IT Services Outsourcing Category - Procurement Intelligence

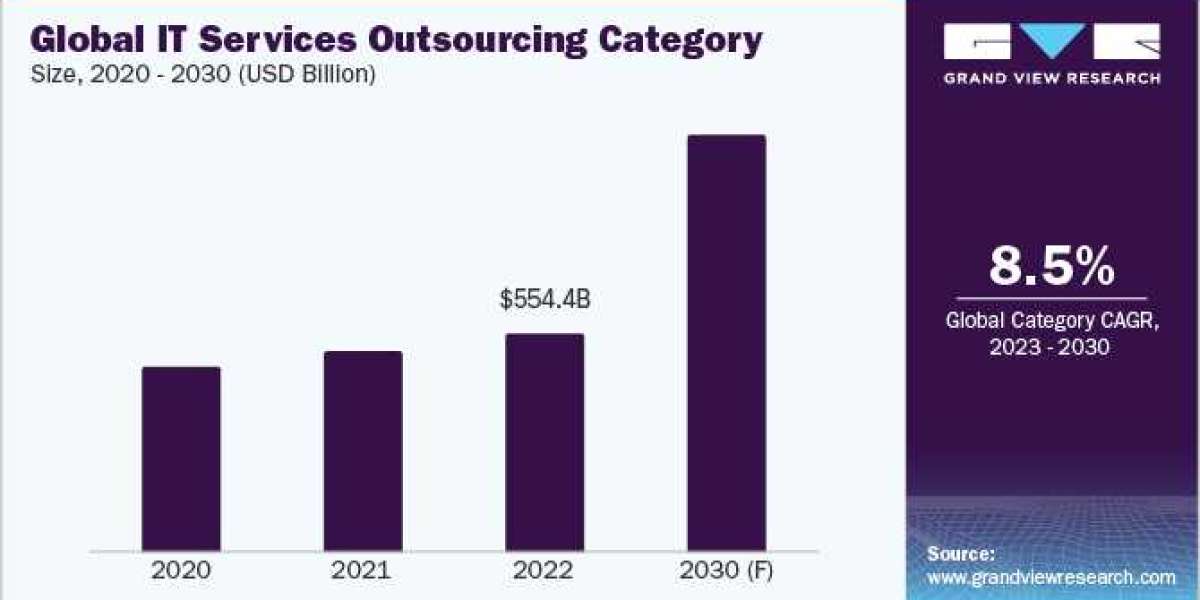

The IT Services Outsourcing category is anticipated to witness growth at a CAGR of 8.52% from 2023 to 2030. In 2022, Asia Pacific accounted for 35% of the market share followed by North America and Europe. North America has a thriving technological environment with the presence of a large number of IT firms, startups, and research institutes. IT outsourcing firms can benefit greatly from the region's emphasis on cutting-edge technologies like blockchain, AI, and IoT. A large number of American businesses are becoming more global in scope. They frequently look for IT outsourcing partners that can assist them in setting up and managing IT infrastructure in new areas to accomplish this expansion effectively. In addition, the Europe market is also witnessing steady growth. As compared to Italy and France, the UK and Germany exhibit higher revenue. The focus of players in this region is shifting from cost reduction to innovation and value-added services.

Besides BFSI and aerospace, the healthcare end-use segment is also witnessing continued growth owing to the surge in the development of software platforms that are specifically designed to meet the needs of healthcare professionals and the growing use of big data in the medical industry. For the healthcare industry, managing health information across computerized systems is essential. In order to guarantee a secure information interchange between suppliers, customers, and quality inspectors, companies outsource their information technology solutions. By utilizing information technology, healthcare institutions can reduce expenses incurred in the maintenance of patient records while also minimizing human error, and improving patient safety and dependability. Furthermore, a large number of telecommunication businesses are also contracting out their value-added services, such as next-generation communication, content, and commerce services, to IT service providers.

Order your copy of the IT Services Outsourcing category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The category is witnessing higher adoption of blockchain technology. This technology enables programmers to build safe cross-decentralized computer data storage applications. It is gaining popularity due to the growing need for the decentralized web to facilitate anonymous transactions. It offers increased transparency in addition to increased security and defense against cyberattacks. Blockchain technology combined with AI/ML technologies will reduce financial risks and immune the business enterprise against financial fraud. Most companies are eager to work with the best IT services outsourcing providers in order to stay updated with current state of the digital industry. It will provide increased performance, competitiveness, and scalability for their company. The application of AI in the IT sector has been around for a while, and it has a promising future. IT outsourcing service providers may lower human mistake rates, save time and money, and free up staff members to work on more intricate and imaginative projects by utilizing AI tools like natural language processing (NLP), robotic process automation (RPA), and chatbots.

The demand for the services offered in this category intensified post the outbreak of COVID-19 pandemic. It forced every industry to move to digital solutions to maintain corporate operations. At the start of the pandemic, businesses all over the world abruptly changed to remote working modes, which greatly increased the need for cloud-based management tools. They are fully converting to cloud services after realizing about its various advantages. In addition, numerous businesses are opting to outsource IT services in order to stay relevant, driven by the acceleration of digitalization, the ongoing shortage of tech talent, and the emergence of cutting-edge technologies like artificial intelligence (AI) and robotic process automation (RPA). Due to the lack of competent IT staff and superior software, more businesses started choosing to outsource their digital transformation initiatives. The pandemic has led to a variety of new consumer demands, pushing companies to provide quick, cutting-edge solutions.

IT Services Outsourcing Intelligence Highlights

- The IT Services Outsourcing category exhibits a fragmented landscape, with intense competition among the service providers.

- India is the preferred low-cost/best cost country for sourcing IT Services Outsourcing owing to the presence of robust IT sector, offering access to a sizable talent pool of intelligent people with a background in technology, including engineers, data analysts, and software developers.

- Buyers in the category possess high negotiating capability owing to the intense competition among the service providers based on number of services and prices, enabling the buyers with flexibility to switch to a better alternative.

- Setup costs (infrastructure, transition, and migration), labor, software licensing fee for service provider, rent utilities, and maintenance upgradation are the major cost components of IT Services Outsourcing category.

List of Key Suppliers

- Accenture plc

- Atos SE

- Capgemini Services SAS

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- HCL Technologies Limited

- Infosys Limited

- International Business Machines (IBM) Corporation

- NTT DATA Group Corporation

- TATA Consultancy Services Limited

- Wipro Limited

- WNS (Holdings) Ltd.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

IT Services Outsourcing Procurement Intelligence Report Scope

- IT Services Outsourcing Category Growth Rate : CAGR of 8.52% from 2023 to 2030

- Pricing Growth Outlook : 5% - 10% increase (Annually)

- Pricing Models : Fixed pricing, time materials pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Geographic service provision, industries served, years in service, certifications, custom software development, infrastructure management, cloud services, cybersecurity, quality assurance testing, technical support, and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions