Health and Wellness Management Services Procurement Intelligence

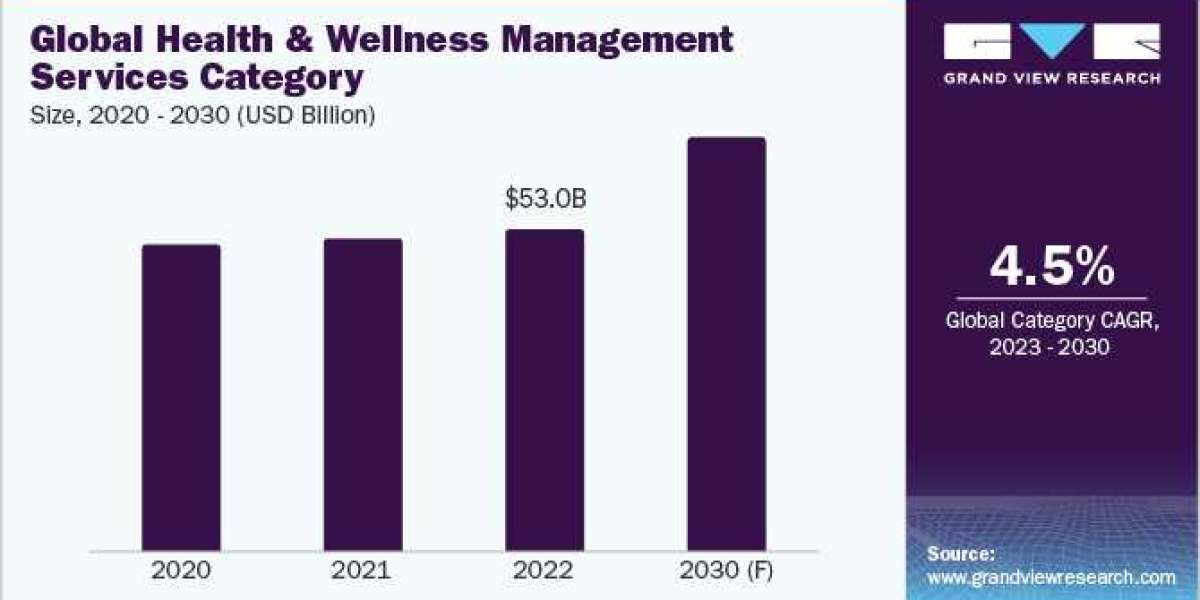

The health and wellness management services category is expected to grow at a CAGR of 4.47% from 2023 to 2030. A McKinsey survey report conducted in 2021 found that 79% of consumers considered well-being to be of prime importance. Over the last two to three years, almost 48.2% of Americans have increased prioritizing health and wellness. In the U.K., the study found, following the pandemic, since 2021, many customers did not resume their pre-lockdown exercise routines; however, their fitness objectives remained the same. Hence, the industry has witnessed a significant increase in creative applications such as Mirror, Peloton, and Tonal. Some of the major trends in this category include the growing use of fitness and healthcare applications and devices, telehealth solutions for work-related illnesses, and employee engagement software.

Companies increasingly want workers to live healthy lives, manage risks, and save money on medical care. Health and wellness management also makes it possible for businesses to establish healthy lifestyle initiatives for their employees, educating them about various illnesses, providing hints for staying well, and emphasizing the value of leading a healthy lifestyle. Some examples of program offerings may include biometric screenings, health assessments, medical care programs, and stress management programs. Service adoption in APAC and Latin America is rising as a result of major international buyers' attempts to combine their supply bases. Growing working age population and greater employee awareness are driving the growth of corporate well-being in Asia Pacific, particularly in Singapore, Australia, and New Zealand.

By offering programs for managing diseases, lifestyles, and health screenings, suppliers are also enhancing their ability to supply. 2022 and 2023 saw an increase in the average amount spent on welfare benefits. For instance, compared to 2019, eight out of ten Indian companies have increased their expenditures on employee well-being in 2023. As per the Aon study in 2023, a growing number of companies are broadening their primary care well-being benefits. Among them, 80% offer mental health support and employee assistance programs, while 37% provide telemedicine.

Order your copy of the Health and Wellness Management Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Health and Wellness Management Services Sourcing Intelligence Highlights

- The global health and wellness management services category is highly fragmented. In many emerging economies such as India, this category is disorganized and fragmented.

- The bargaining power of suppliers globally is moderate owing to the presence of multiple players and high fragmentation. Barriers as such longer sales cycles for products or services, difficulty in gauging the local demand, dynamic regulatory landscape, pricing disparities, etc. can sometimes make it slightly difficult for new suppliers to enter this industry.

- Some of the major cost components include salaries of health and wellness consultants, tools, technology, and software, marketing and advertising, and facilities/office space.

- More than 65% - 70% of employees in North America receive some kind of well-being initiative or program. More than 40% - 45% of employees in Europe receive well-being benefits or programs.

- In terms of operating model, companies mostly prefer engaging with approved service providers adhering to different health regulations and standards.

List of Key Suppliers

- ComPsych Corporation

- Wellness Corporate Solutions (Laboratory Corporation of America)

- Virgin Pulse, Inc.

- EXOS

- Marino Wellness LLC

- Privia Health

- Vitality Group International, Inc.

- Wellsource, Inc.

- Central Corporate Wellness

- Truworth Wellness

- Healthfirst, Inc.

- FitMind LLC

- Limeade, Inc.

- TotalWellness

Browse through Grand View Research’s collection of procurement intelligence studies:

- Packaging Design Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Medical Coveralls Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Health and Wellness Management Services Procurement Intelligence Report Scope

- Health and Wellness Management Services Category Growth Rate : CAGR of 4.47% from 2023 to 2030

- Pricing Growth Outlook : 8% - 12% (Annually)

- Pricing Models : Cost plus, value-based, and tiered pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Employee assistance programs, workplace wellness programs, health assessments, tools, technology, and tracking, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions