Influencer Marketing Platform Procurement Intelligence

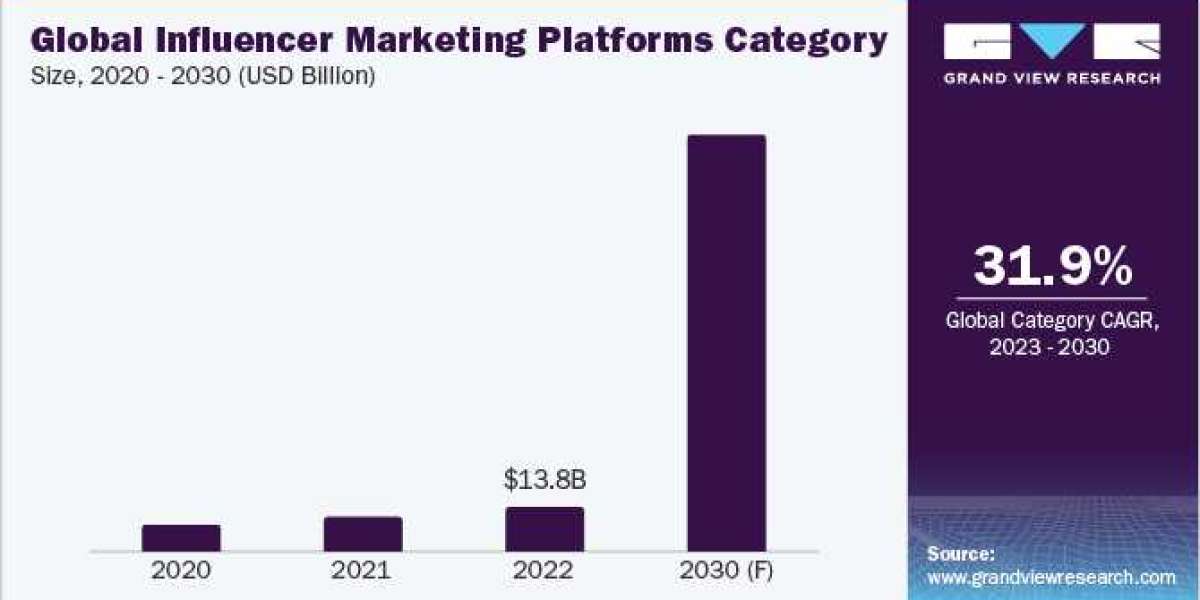

The influencer marketing platform category is anticipated to witness growth at a CAGR of 31.9% from 2023 to 2030. In 2022, North America accounted for 30% of the market share followed by Europe and Asia-Pacific. Europe witnesses the fastest growth rate owing to wider adoption of branding practices and concentrating on expanding their market penetration and gaining a sizable consumer base through micro nano-influencers.

In 2022, the fashion and lifestyle segment held substantial industry share in terms of end-usage owing to the growing number of high-end lifestyle and fashion brands trying to be more approachable to consumers. Influencers are used by a number of fashion brands to promote new apparel and accessories, keeping the public up to date on the newest trends. The potential of influencer marketing to build brand awareness in the fashion sector is one of its greatest benefits. Due to the proliferation of social media, it is difficult for companies to differentiate themselves from the competition because consumers are continually exposed to marketing from multiple brands. However, influencers have the ability to break through the clutter and connect with a niche audience.

Technologies such as virtual influencers, artifical intelligence, and data analytics are expected to strengthen influencer marketing platforms. In order to target the ideal customers, a virtual influencer gives more creative freedom and cost-effective customization. Several brands and businesses are having trouble evaluating the platform's outcomes even after it has been widely adopted. As a result, rising smartphone adoption, increased use of high-speed internet, rising numbers of social media accounts, falling data streaming costs, and the incorporation of cutting-edge technologies like artificial intelligence (AI) are all contributing to the growing demand for video content and live interactive sessions.

Influencer marketing platforms saw a huge increase in popularity after the outbreak of COVID-19 pandemic. The advertising agencies and production companies were compelled to postpone the planned commercial shoots due to the government-mandated lockdown limitations, which prompted the businesses to turn towards alternative promotion strategies such as influencer marketing. Influencer marketing was also made more prevalent by the increased social media activities during the lockdown. This trend is being continued even after there are no further lockdowns and the pandemic is in control. As a result, the outbreak of pandemic supported the global category in several ways such as increased number of live streams, bringing platforms like TikTok and Instagram Reels into popular culture, fueling emergence of micro influencers, creation of authentic content in an unusual timeframe, discovering other paths to purchase, redistribution of media advertising budgets, and higher consumption of content.

Order your copy of the Influencer Marketing Platform category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Influencer Marketing Platform Sourcing Intelligence Highlights

- The global influencer marketing platform category is moderately fragmented, with majority of the key market players offering comprehensive solutions with a wide variety of features.

- India is the preferred low-cost/best cost country for sourcing influencer marketing. As the nation's digital infrastructure is getting better and more Indians have access to the internet, numerous opportunities are opening up for both businesses and marketers.

- The threat of new entrants is anticipated to stay low and it is relatively easy for new companies to start up and compete with established players.

- License cost / subscription fee, personnel, maintenance upgradation, training certification costs, and support are the major cost components of Influencer Marketing Platforms. Other costs include utility costs, administrative expenses, renewal costs, data migration costs, and security.

List of Key Suppliers

- AspireIQ, Inc.

- CreatorIQ

- Grin Technologies Inc.

- JuliusWorks, LLC

- com Ltd.

- Kolsquare

- Mavrck LLC

- NeoReach

- Onalytica Ltd

- Traackr, Inc.

- Upfluence

- Webfluential Global Limited

Browse through Grand View Research’s collection of procurement intelligence studies:

- Advertising Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Cyber Security Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Influencer Marketing Platform Procurement Intelligence Report Scope

- Influencer Marketing Platform Category Growth Rate : CAGR of 31.9% from 2023 to 2030

- Pricing Growth Outlook : 5% - 10% Increase (Annually)

- Pricing Models : Subscription-pricing, Competition-based pricing

- Supplier Selection Scope : Cost and pricing, Past engagements, Productivity, Geographical presence

- Supplier Selection Criteria : Years in service, geographic service provision, certifications, influencer search discovery, free trials / demos, performance tracking, creator marketplace, content management, campaign analytics, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions