Fleet Management Procurement Intelligence

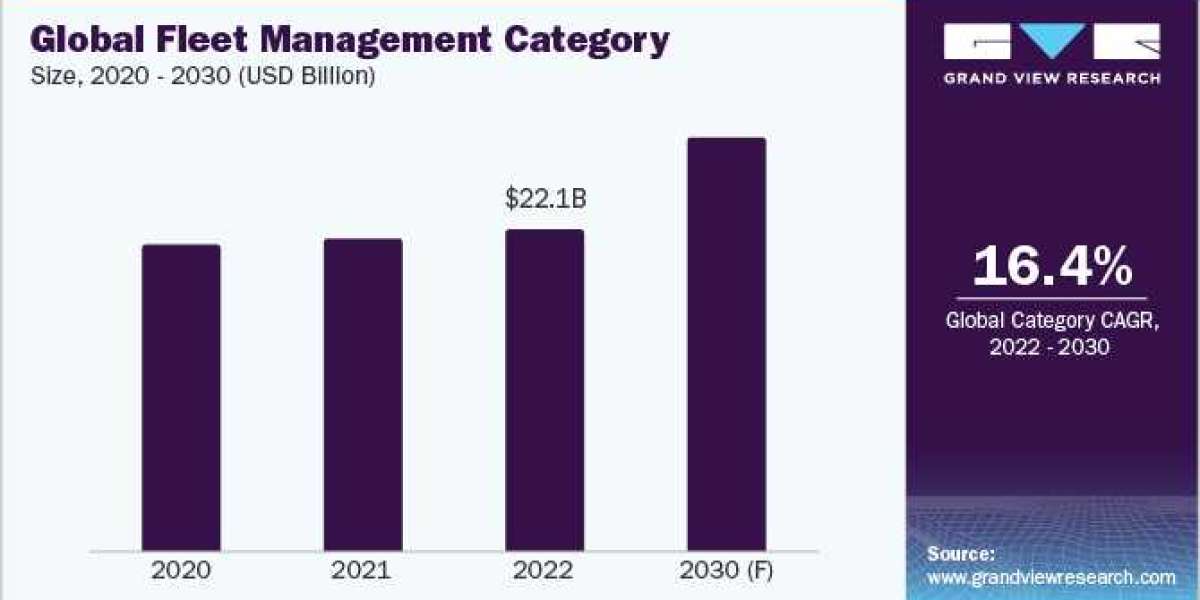

The fleet management category is anticipated to witness growth at a CAGR of 16.4% from 2023 to 2030. In 2022, North America accounted for 39% of the market share followed by Asia-Pacific and Europe. North America currently holds a dominant position in the global industry with the U.S. being a dominant nation in the region as it is home to several enormous market participants. Industry players support businesses working in different sectors by streamlining their fleet operations to reduce their operating expenses and offer various services such as fuel management, driver management performance monitoring, vehicle maintenance, vehicle purchase/lease, funding, offering consultation, etc.

Technologies such as advanced driver assistance system (ADAS), electronic logging device (ELD) compliance system, artificial intelligence (AI), Internet of Things (IoT), machine learning (ML), and global positioning system (GPS) are playing a vital role in the development of fleet management category. Technological advancements in the industry have turned the optimization of operations fluidic and flexible, helping organizations save time and money. Through the use of fleet management systems (FMS), fleet managers may more effectively react to the changing conditions of the market.

Order your copy of the Fleet Management category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The COVID-19 pandemic significantly affected industrial activities. Even though sectors such as field services, utility, logistics, and transportation opted for remote working policies, they operated at the fullest capacity to meet the need for essential services. The logistics and transportation sectors encountered enormous challenges as a result of this crisis and the ensuing disruptions in the supply chain. Key players witnessed a significant decline in their revenue during this period. Consequently, there was less of a need for fleets, drivers, dispatchers, planners, and other fleet operators.

Fleet Management Sourcing Intelligence Highlights

- The global fleet management category is highly fragmented, with top players in the market being based out of North America, Europe, and Asia Pacific, and are continuously expanding their service portfolio and scale to stay competitive by getting an edge over the others across the globe.

- The U.S. is the largest nation in Fleet Management Services due to the presence of a large number of global players.

- Despite being a competitive industry, fleet management companies (FMCs) in the industry have low negotiating capability as there is high competition and the buyers can easily switch to a different supplier.

- Vehicle acquisition cost, financing, insurance, telematics, fuel costs, and repair maintenance are the key cost components of Fleet Management. Other costs include management fees taxes, interest rates, depreciation, labor costs, toll parking costs, and disposal costs.

List of Key Suppliers

- Air Products and Chemicals, Inc.

- BOC Limited

- Coregas Pty Ltd

- Iwatani Corporation

- L’Air Liquide S.A.

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer SE Co. KGaA

- Strandmøllen A/S

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

- Yingde Gases Group Company Limited

Browse through Grand View Research’s collection of procurement intelligence studies:

- Corn Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Fleet Management Procurement Intelligence Report Scope

- Fleet Management Category Growth Rate : CAGR of 16.4% from 2023 to 2030

- Pricing Growth Outlook : 5% - 10% (Annually)

- Pricing Models : Cost plus pricing model, fixed price pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Years of experience, geographical service provision, industries served, fleet acquisition/leasing, outsourced driver management, fleet management, sale leaseback, technology, consulting, and other factors

- Report Coverage : Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions