Connected Devices and Wearables Procurement Intelligence

In this connected devices and wearables procurement intelligence report, we have estimated the pricing of the key cost components. Hardware, software, and connectivity form the largest cost component of the connected devices and wearables businesses. Together, they account for about 80% of the total cost. The cost also depends on the type of manufacturing process undertaken, marketing, and support provided for the product.

For example, in developing an IoT-based wearable connected device, the connectivity costs of a system of connected devices that communicate over a cellular network are typically around USD 0.04 per megabyte. Some telecom carriers offer narrowband pricing options for businesses, charging USD 6 per device per year. Ranging in form and complexity from bare-metal firmware to customized Android, software may add up to USD 20,000 to the overall cost estimate. If a third-party gadget is incorporated into the device network, it might also need middleware - i.e., drivers, APIs, and SDKs that are required by the connecting devices and applications to communicate. Custom firmware for an IoT-based solution may cost USD 10,000 to USD 30,000.

Order your copy of the Connected Devices and Wearables category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Operational Capabilities - Connected Devices and Wearables

- Years in Service - 25%

- Geographic Service Presence - 15%

- Key Clients - 15%

- Revenue Generated - 15%

- Employee Strength - 15%

- Industries Served - 15%

Functional Capabilities - Connected Devices and Wearables

- Data Analytics Integration - 16%

- UX Design - 16%

- Security Privacy - 16%

- Device Management - 16%

- Power Management - 16%

- Customer Support - 16%

- Others - 4%

Rate Benchmarking

The geographical location and nature of the firm are important factors in analyzing rate benchmarking in the connected devices and wearables category. Smart devices are generally costlier in the US compared to China. For example, considering Samsung’s smart watch prices in the US, Japan, South Korea, Taiwan, and China, the cost of a smart watch in South Korea is about USD 400, the lowest among the countries listed. China comes in second with cost of a smart watch around USD 470. This is due to factors such as low labor costs, low materials costs, and high market competition. Taiwan, along with Japan has the second highest cost, with USD 480, due to high labor and material costs. The United States has the highest cost of a smart watch, with USD 500, attributed to factors such as labor costs, materials costs, and low market competition.

Supplier Newsletter

In September 2022, Fitbit upgraded its smartwatch range which have latest aesthetics and functionality.

In September 2022, Apple has launched latest version of Apple Watch SE and Apple Watch Series 8. These two products help users in knowing their health condition in real time which is synced to their smartphones and they access that data at any time.

In June 2022, to enter the smart wearable industry, Mensa Brands, an e-commerce company, acquired the wearables manufacturer, Pebble. Pebble offers an offline distribution network for music, fitness trackers, and charging solutions. The company intends to expand Pebble's internet presence and capitalize on the growing consumer popularity of wearables.

In April 2022, Apple introduced the HidrateSpark smart water bottle. It can monitor the user’s daily intake of water while syncing it with their Apple Health

In August 2021, The RS60 Ring Scanner launched by Handheld Group is a convenient independently scanning option for use in distribution facilities, retail stores, as well as other environments requiring highly mobile scanning.

List of Key Suppliers

- Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Sony Corp.

- Huawei Technologies Group Co., Ltd.

- Apple Inc.

- Xiaomi Corp.

- Adidas AG

- Nike, Inc.

- Fitbit, Inc.

- Garmin Ltd.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Cyber Security Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Lab Equipment Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Connected Devices and Wearables Procurement Intelligence Report Scope

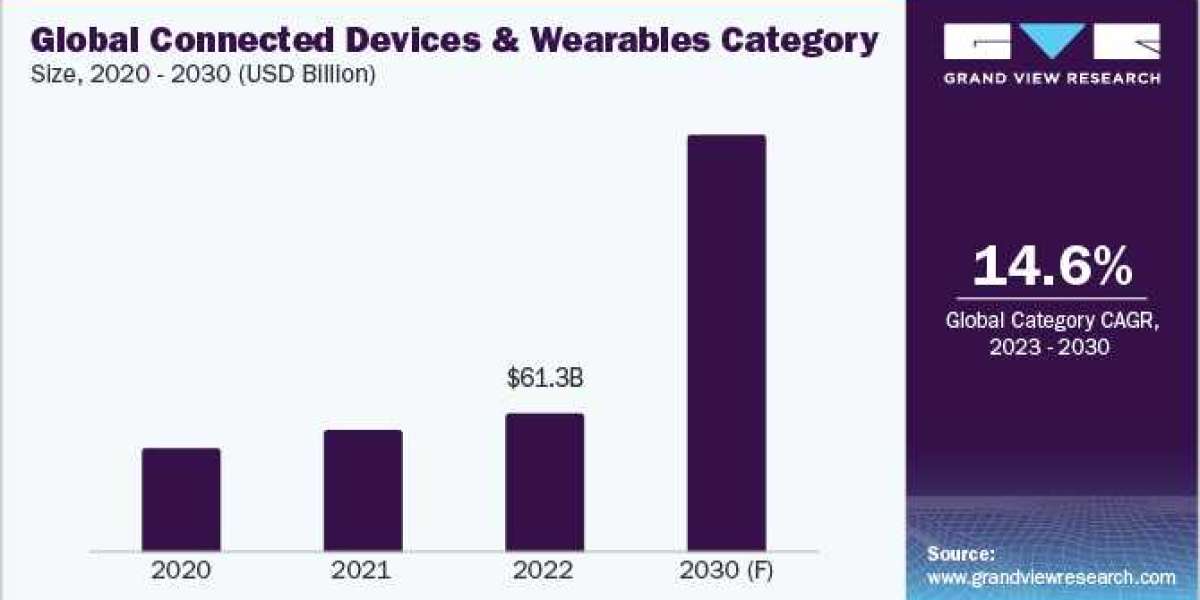

- Connected Devices and Wearables Category Growth Rate : CAGR of 14.6% from 2023 to 2030

- Pricing Growth Outlook : 10% - 15% (annual)

- Pricing Models : Subscription-based pricing model, tier-based pricing model, fixed-fee pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Technology, service, quality, service, reliability, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions