Big Data Procurement Intelligence

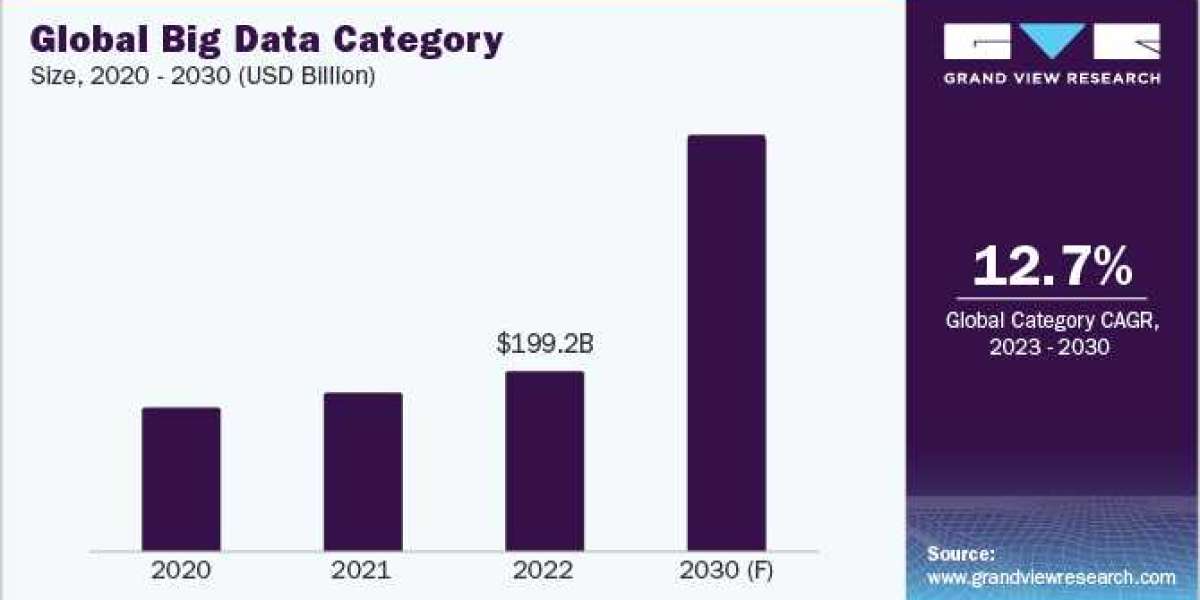

The big data category is expected to grow at a CAGR of 12.7% from 2023 to 2030. North America accounts for the largest share of the category. The increasing demand for advancement in technology and increasing data generation in the business are boosting growth. Companies are focusing on adopting technology for boosting revenue and consumer base. For instance, in March 2022, Microsoft launched Azure Health Data Services, a cloud-based platform that combines health data and supports transactional and analytical workloads. It also powers artificial intelligence applications and protects protected health information (PHI).

Apache Hadoop is an open-source software framework that allows for the distributed storage and processing of large datasets. Hadoop breaks down large datasets into smaller chunks that can be stored and processed on multiple computers in parallel. This allows Hadoop to efficiently store and process large datasets that would be too large for a single computer to handle.

Order your copy of the Big Data category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on partnering or developing their own technology. For instance,

- In April 2022, Wipro and DataRobot partnered to help businesses adopt Artificial Intelligence (AI) at a larger scale. The partnership will provide businesses with augmented intelligence solutions that can be used to improve decision-making, optimize operations, and deliver better customer experiences. The partnership will also help businesses to get more value from their data more quickly.

- Oracle updated Oracle Analytics Cloud in January 2022 with a new design experience that makes it easier for users to identify, display, and act on critical insights. The new design features a fresh new look, more whitespace, and fonts that are optimized for dense data.

- In May 2021, Telefonica Tech collaborated with Microsoft on Azure Edge Zone. Telefonica united its 5G connectivity with Microsoft Edge computing competencies, allowing industry procedures to strengthen digital transformation.

- In December 2021, Microsoft added a soft delete feature to Azure Data Lake Storage. This feature allows users to recover accidentally deleted files and folders for a specified period of time. After the retention period has expired, the deleted items are permanently deleted.

- In December 2021, Microsoft announced that Snowflake would be supported as a data source in Azure Purview. This means that users can now use automated data discovery to build a detailed map of their data environment, including Snowflake databases. Users can also quickly import information from Snowflake databases into the Azure Purview data map, and then manage and control the Snowflake data in Azure.

Category growth is expected to be fueled by the implementation of IOT, social media and user-generated content and decreasing cloud storage cost. The utilization of big data technology in social media like Facebook AI Research Lab and Amazon Kinesis is a key factor driving this trend.

Big Data Sourcing Intelligence Highlights

- The global big data category is fragmented, with numerous small and large players operating in different regions. The competition between players is intense as they strive to gain a wider customer base and improve customer experiences

- The growing number of suppliers of this technology, such as developers and programmers, has somewhat reduced the bargaining power of suppliers.

- Project scope, data volume, technology stack, and other factors form the most significant cost component in big data implementation. The overall cost also depends on the infrastructure, hardware and software, data acquisition, and integration.

- Most of the service providers offer complete services from data collection, development of technology, maintenance, and others.

List of Key Suppliers

- Accenture

- Cloudera

- Hewlett-Packard Company

- IBM

- Mu Sigma Inc.

- Amazon

- Oracle Corporation

- Splunk Inc

- Teradata Corporation

Browse through Grand View Research’s collection of procurement intelligence studies:

- Advertising Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Graphite Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Heat Exchanger Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Big Data Procurement Intelligence Report Scope

- Big Data Category Growth Rate : CAGR of 12.7% from 2023 to 2030

- Pricing Growth Outlook : 3% - 4% (Annually)

- Pricing Models : Subscription-based

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Type, technical expertise, security measures, support and maintenance, cost-effectiveness, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions