Data Center Hosting Storage Services Procurement Intelligence

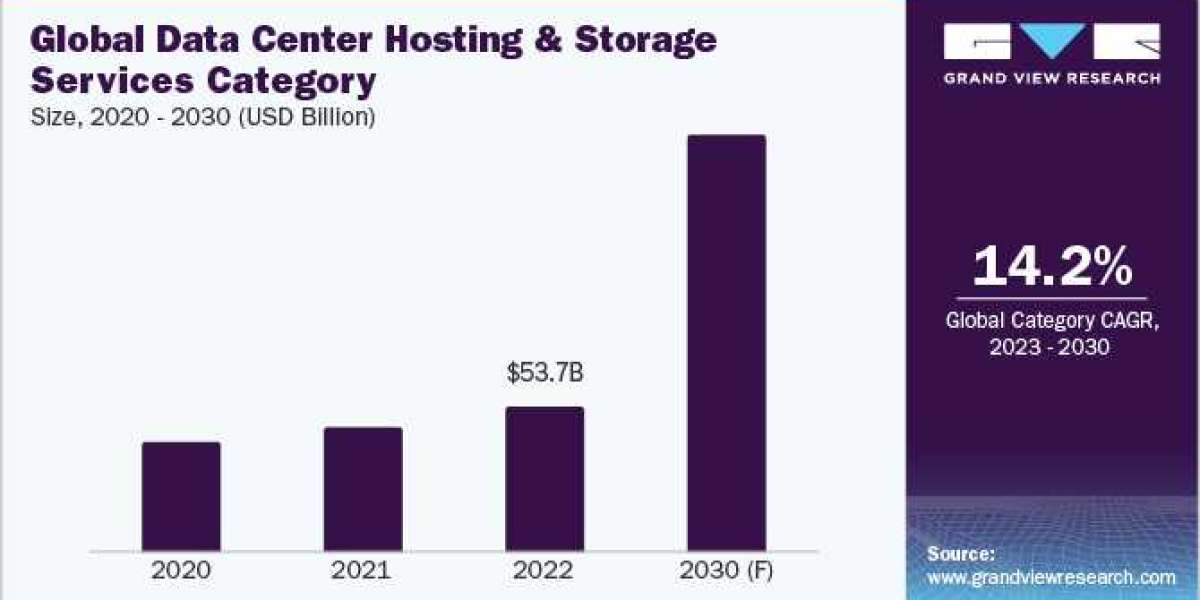

The data center hosting storage services category is expected to grow at a CAGR of 14.2% from 2023 to 2030.

The United States has the most data centers in the world, a total of 2701, followed by Germany and the United Kingdom. Growth is being fueled by the growing digital transformation of businesses, increased internet usage, and the proliferation of connected devices. Service upgradation such as cloud computing has become integral to modern business operations providing access to scalable and flexible resources. Technological advancements and big data analytics contribute to the increasing demand for the category. Remote working environments are growing and becoming mainstream, making data centers more relevant than ever. Data center demand varies with the country as a result of various market forces and regulations. Higher density in particular jurisdictions may be an outcome of industry sector demand.

Order your copy of the Data Center Hosting Storage Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are constantly concentrating on alliance formation and acquisition to expand their reach. For instance,

- In April 2023, Hitachi, Ltd. penned down a Memorandum of Understanding (MOU) with Equinix Inc. for addressing social issues through digital solutions. Equinix will support Hitachi in delivering sustainable hybrid cloud solutions globally, and Hitachi will validate its storage solution on Platform Equinix in various cloud environments. The partnership aims to accelerate sustainability and digital transformation efforts.

- In April 2023, for USD 3.8 billion, Brookfield agreed to purchase Data4, one of Europe’s largest data center platforms, from AXA IM. The transaction is expected to be completed in Q3 2023. Brookfield enters the European data center industry through this transaction with a view toward expansion

- In March 2022, CyrusOne Inc., a pioneer in hybrid-cloud and multi-cloud deployments, announced the completion of its acquisition by funds managed by KKR, a top global investment firm, and Global Infrastructure Partners (“GIP”), a top infrastructure investor, in an all-cash deal valued at roughly USD 15 billion.

- In December 2021, after the purchase of CoreSite Realty Corporation for USD 10.1 billion, American Tower Corporation announced an expansion of its data center ambitions. The tower real estate will benefit from new edge compute opportunities enabled by CoreSite's highly interconnected data center infrastructure and crucial cloud on-ramps to deliver robust, steady, recurring growth.

As more people and organizations enter the digital world, the demand for efficient information processing is increasing. End users can obtain information quickly even when they are working remotely due to data centers’ function as communication network connectors. There are more than 8,000 centers in the world. A significant increase in private equity is noticed since the sector is seen as a long-term haven for investments, even during turbulent times. In ten of the twelve biggest purchases over the past twelve months, private buyers were engaged.

Data Center Hosting Storage Services Sourcing Intelligence Highlights

- The category is highly fragmented and competitive, with suppliers competing to increase their market share. Vendors are expanding their geographical presence and signing long-term collaboration agreements with end users to provide data centers.

- More than USD 48 billion was spent on 209 data center deals in 2021, an increase of over 40% from USD 34 billion in 2020. In 2022, 187 agreements totaling USD 48 billion were completed. Private equity buyers' shares climbed by more than 90% in 2022.

- A large data center typically costs between USD 10 million and USD 25 million per year to operate. Less than half of the budget goes into networking, continuous power supplies, disaster recovery, software, and hardware. Another significant portion goes towards continuing infrastructure and application maintenance.

- An estimated 5% to 9% of the world's electricity usage is attributed to digital technologies. Green data centers are a new approach with highly energy-efficient architecture that has minimum to no environmental impact. These facilities have been upgraded using a variety of technology, including cooling systems, clean and green energy, and sustainable computer processing software.

List of Key Suppliers

- Equinix

- Digital Realty

- Microsoft Azure

- NTT Global Data Centers

- Telehouse/KDDI

- CoreSite (American Tower)

- Google Cloud Platform

- CyrusOne

- GDS Holdings

- Amazon Web Services

- 365 Data Centers

Browse through Grand View Research’s collection of procurement intelligence studies:

- Business Intelligence Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Customs Brokerage Service Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Clinical Research Organizations Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Data Center Hosting Storage Services Procurement Intelligence Report Scope

- Data Center Hosting Storage Services Category Growth Rate : CAGR of 14.2% from 2023 to 2030

- Pricing Growth Outlook : 10% - 12% (Annually)

- Pricing Models : Value-based pricing model, performance-based model, dynamic pricing model, subscription-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, setup geographical presence

- Supplier Selection Criteria : Type, scalability, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions