Commercial Print Services Category - Procurement Intelligence

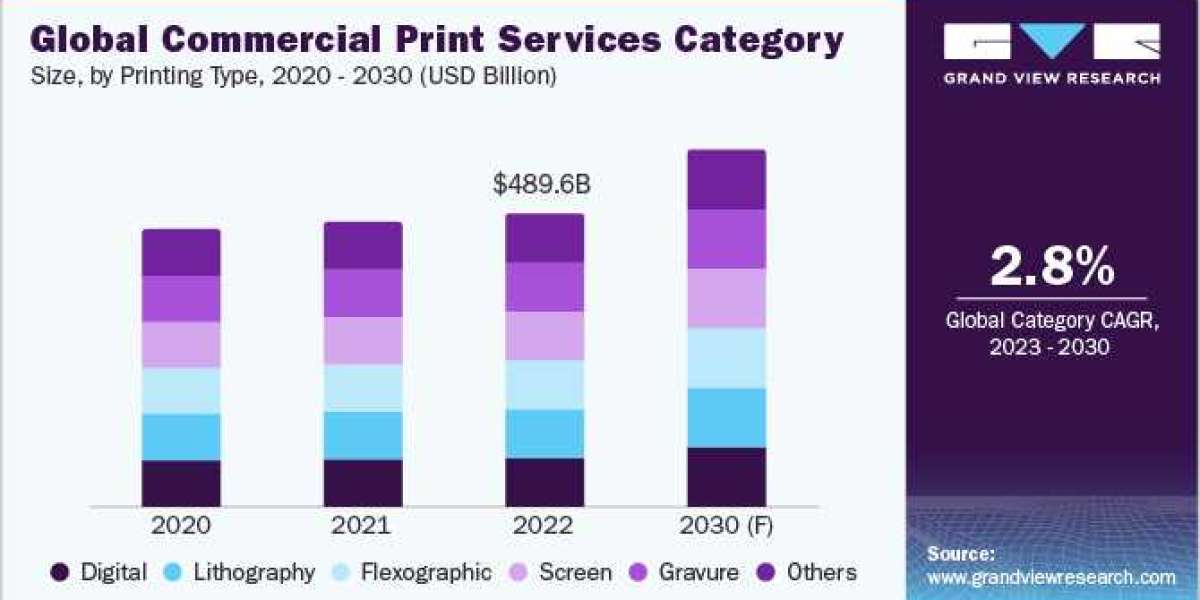

The commercial print services category is expected to grow at a CAGR of 2.8% from 2023 to 2030. APAC accounts for the largest share of the category. The increasing use of printing technology for promotional activities, as well as the growing acceptance of digital printing, are driving category growth. Companies are focusing on adopting various strategies such as investments, partnerships, and mergers acquisitions. For instance, in November 2022, Konica Minolta Business Solutions U.S.A., Inc. (Konica Minolta), a marketer of printing and packaging applications for industrial and commercial use, announced that it had entered into a partnership with Elastic Path to enhance its B2B commerce experience by implementing and optimizing a multi-vendor approach.

Print-on-demand (POD) is a business model that enables product customization and order-by-order sales. It is also an environmentally sustainable model. To lessen its influence on the environment, it employs water-saving printing methods and sends products in cardboard boxes instead of plastic ones.

Order your copy of the Commercial Print Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on partnering or developing their own technology. For instance,

- In September 2022, Westrock Company bought the HP PageWide T1190 inkjet digital press. The digital press would supplement the company’s present offset lithography, flexographic preprint, flexographic direct printing, and sheet-fed digital print processes all over its corrugated box plants and specialty facilities.

- In May 2022, Quad announced it is expanding its In-Store Solutions production offering with the addition of the Landa S10P Nanographic Printing Press. The Landa S10P, with its powerful digital front end, sets a new standard in printing speed, format, efficiency, and data-driven digital applications, expanding digital capabilities for B1-format printing and providing unlimited variable print options at very fast speeds and the highest quality available.

- In May 2022, SICURA Litho Pack ECO, a novel U.V. offset ink for non-food paper and board use, was launched by Siegwerk. It contains over 40% sustainable and plant-based components, according to a news release from Siegwerk. It says that the new UV offset ink series contains a greater proportion of sustainable organic ingredients than standard UV inks.

- In August 2021, Cimpress entered into a deal with Canon, a manufacturer of inkjet printers, digital cameras, and business printers. This agreement sought to supply its numerous enterprises. Cimpress also wishes to increase its position in the expanding online printing industry.

Commercial Print Services Sourcing Intelligence Highlights

- The global commercial print services category is fragmented, with numerous small and large players operating in different regions. The competition between players is intense as they strive to gain a wider customer base by investing in RD to develop new products and improve customer experiences

- The suppliers of this service compete with each other by offering competitive prices for their services, lowering their bargaining power

- Printing equipment, toner supplies, and paper form the most significant cost component in providing commercial print services. The overall cost also depends on factors such as labor, repair, and maintenance

- Service providers in this category offer services from graphic design, printing, fulfillment, marketing services, and others

List of Key Suppliers

- Quad/Graphics Inc.

- Acme Printing

- Cenveo

- RR Donnelley

- Transcontinental Inc.

- LSC Communications US, LLC.

- Gorham Printing, Inc.

- Dai Nippon Printing

- The Magazine Printing Company

- Cimpress plc

- Quebecor World Inc.

- Duncan Print Group

Browse through Grand View Research’s collection of procurement intelligence studies:

- 3PL Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Household Cleaners Contract Manufacturing Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Commercial Print Services Procurement Intelligence Report Scope

- Commercial Print Services Category Growth Rate: CAGR of 2.8% from 2023 to 2030

- Pricing Growth Outlook: 3% - 5% (Annually)

- Pricing Models: Volume-based pricing model, Performance-based pricing model

- Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

- Supplier Selection Criteria: Printing methods, print size, print quality, price, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions