Clinical Research Organization Procurement Intelligence

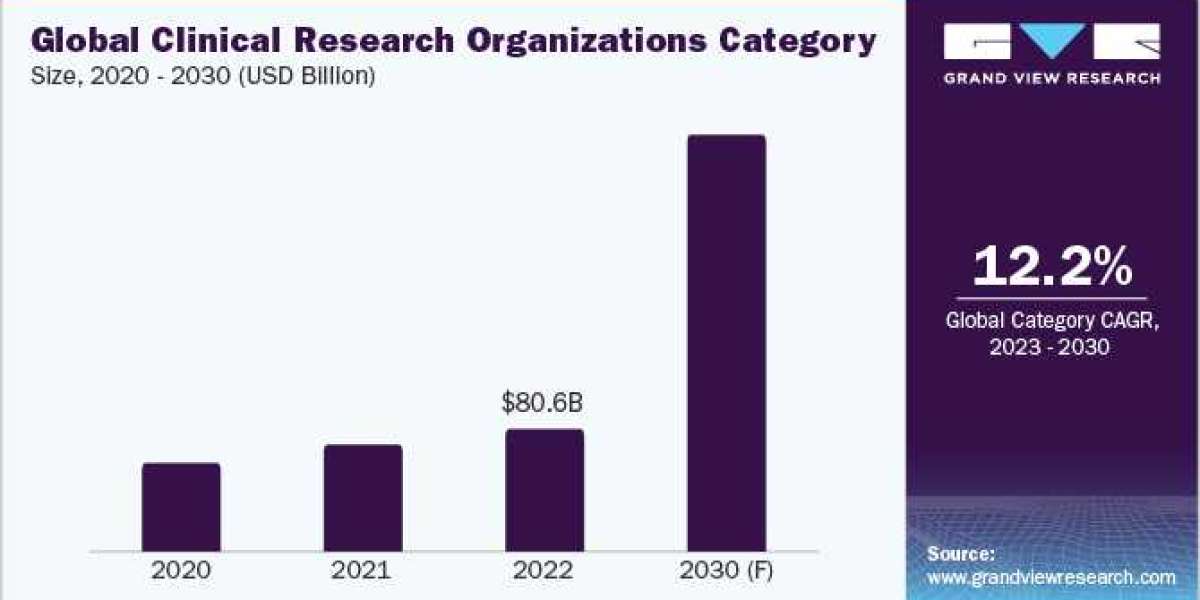

The clinical research organization category is expected to grow at a CAGR of 12.2% from 2023 to 2030. In 2022, North America held a 40% share of the market. This is linked to the region's concentration of large pharmaceutical corporations, which are also known for their extensive drug development efforts and first-rate healthcare systems. In addition, due to changes in the market and reimbursement from generic pharmaceuticals, a number of significant pharmaceutical businesses in this region are outsourcing RD and clinical trials.

Clinical trials are complex and require many resources. Outsourcing clinical trials to CROs can help pharmaceutical and biotech companies reduce costs, streamline business operations, and increase productivity. As more pharmaceutical companies outsource their clinical studies, the demand for CROs is growing.

Companies are continuously focusing on collaborating or developing their own technology. For instance,

- In January 2023, a partnership between ICON plc and Google Cloud was announced in order to expedite the creation and distribution of clinical studies. Through the cooperation, ICON will be able to increase the effectiveness and efficiency of clinical trials by utilizing Google Cloud's artificial intelligence (AI) and machine learning (ML) capabilities.

- In 2021, Charles River Laboratories agreed to purchase Cognate BioServices Inc., a contract development and manufacturing organization (CDMO) that specializes in cell and gene therapy. This acquisition is intended to help Charles River expand its scientific capabilities in the rapidly growing cell and gene therapy sector.

Category growth is expected to be fueled by the globalization of clinical trials and the demand for specialized services. The demand for specialized services is also being driven by the increasing number of rare diseases. These diseases affect a small number of patients, making it difficult to conduct clinical trials in traditional settings. CROs that can provide specialized services for rare diseases are well-positioned to capitalize on this growing market.

Order your copy of the Clinical Research Organization Procurement Intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Clinical Research Organization Sourcing Intelligence Highlights

- The global clinical research organization category is fragmented, with the presence of several players in the market. To grow their market share, firms in the industry are adopting crucial strategies like research and development, acquisitions, partnerships, and regional expansion.

- The cost of hiring staff, purchasing equipment, developing software, cost of data management, site monitoring, and regulatory compliance are the major cost component in clinical research organizations.

- Most of the service providers offer study design and planning, clinical monitoring, biostatistics, and others.

Clinical Research Organizations Procurement Intelligence Report Scope

- Clinical Research Organizations Category Growth Rate: CAGR of 12.2% from 2023 to 2030

- Pricing Growth Outlook: 3% - 4% (Annually)

- Pricing Models: Cost Plus Pricing

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Technical expertise, experience, cost and quality of service, capabilities, and reliability, research and development, customer service

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

List of Key Suppliers

- Asymchem Laboratories (Tianjin) Co Ltd

- Charles River Laboratories

- Dalton Pharma Services

- ICON plc

- IQVIA Inc

- Pharmaron Beijing Co Ltd

- Piramal Enterprises Ltd

- Sun Pharmaceutical Industries Ltd

- Syneos Health

- Thermo Fisher Scientific Inc

Browse through Grand View Research’s collection of procurement intelligence studies:

- Nitrogen Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Mobility - Voice and Data Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions