Vitamins Dietary Supplements Procurement Intelligence

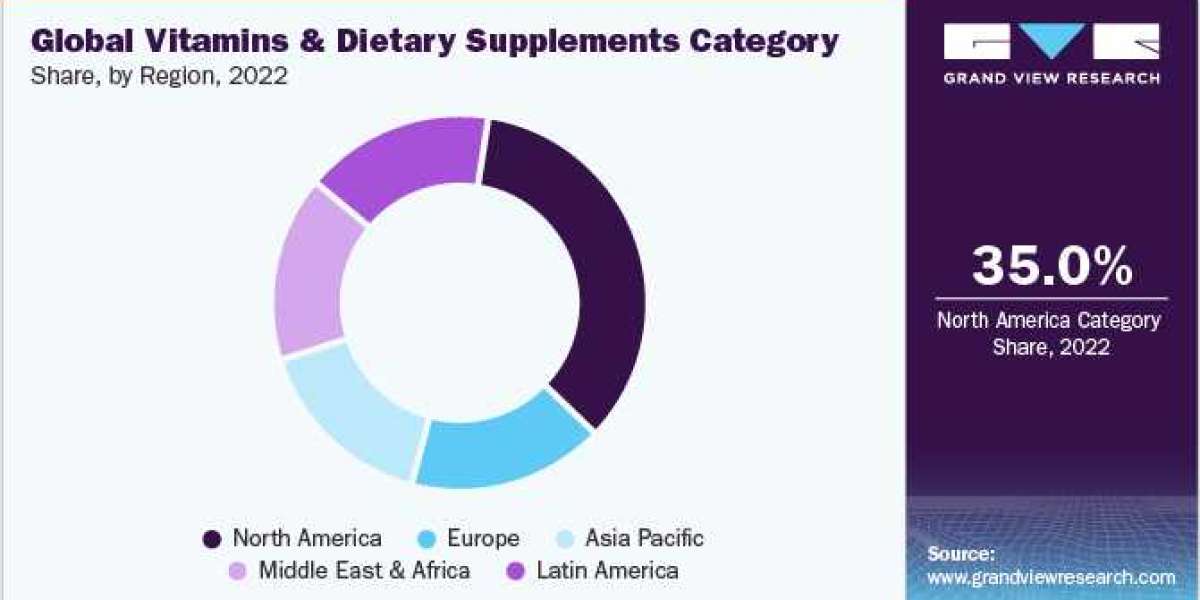

The vitamins dietary supplements category is anticipated to witness growth at a CAGR of 8.5% from 2023 to 2030. In 2022, North America dominated the global category, accounting for 35% of the overall market share, followed by Europe and Asia Pacific. Europe is anticipated to witness growth owing to increased consumer awareness of health and the role of supplements in weight control and physical activity as well as their readiness to pursue a healthier lifestyle. The Asia Pacific region is anticipated to witness the fastest growth rate during the forecasted period. This growth is attributed to increasing consumer awareness purchasing power along with a rise in geriatric population in countries such as Japan and China.

Vitamins dietary supplements are manufactured in several forms such as tablets, capsules, powders, liquids, and gels. By type, the products are segmented into vitamin subtypes (e.g., A, B, C, D, E, and K), minerals, amino acids, enzymes, and probiotics. The products have end-use applications in pharmaceuticals, nutraceuticals, feed products, foods and beverages, and personal care products. A few of the key raw materials used in manufacturing these products include retinol, carotenoids, thiamin, riboflavin, ascorbic acid, cholecalciferol, calcium carbonate, and magnesium aspartate.

Key technologies driving this category’s growth include nanoencapsulation, biohacking and targeted supplementation, nutrigenomics, 3D printing of capsules, and lab-grown nutrients. For instance, nanoencapsulation provides various benefits such as improving the stability and solubility of bioactive compounds used in the manufacturing of vitamins and dietary supplements. It also inhibits the deterioration of products during storage and transportation. It also enhances the bioavailability and potency of the target compounds in the products.

The industry players purchase raw materials and active ingredients from a variety of sources and locations. The profit margins are typically moderate to low due to intense competition. The key players usually compete over pricing strategies, product innovations, packaging, labeling, and advertising. Customers can be selective, as their objective is to purchase the best available options at the lowest feasible cost. This increases the pressure on key players to provide competitive pricing and high-quality products. Besides, regulatory guidelines in several countries require companies to have stringent quality control and safety standards.

Order your copy of the Vitamins Dietary Supplements category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Vitamins dietary supplements may either be manufactured in-house or through contract development manufacturing organizations (CDMOs). They may be distributed via offline or online distribution channels. Offline channels include brick-and-mortar establishments such as direct sellers, pharmacies, hypermarkets, supermarkets, convenience stores, or other tangible shop environments. Online channels comprise e-pharmacies (e.g., Walgreens, CVS, PharmEasy) and e-commerce platforms (e.g., Amazon, eBay, Flipkart).

The COVID-19 pandemic caused significant disruption in the global vitamins and dietary supplements industry. The product demand intensified after the COVID-19 outbreak, due to the surge in demand for immunity-boosting products. Supply disruptions were prevalent due to transportation bottlenecks and labor shortages during government-imposed lockdowns, but the supply stabilized significantly in 2023 to meet the increased global demand.

Vitamins Dietary Supplements Sourcing Intelligence Highlights

- The vitamins dietary supplements category has a fragmented landscape, with intense competition among the service providers.

- Countries such as India and China are the preferred low-cost/ best-cost countries for vitamins and dietary supplements owing to cheap raw material costs, cheap labor costs, competitive pricing, and high return on investment.

- Buyers in the category possess high negotiating power due to the intense competition among the service providers based on the scope of services and prices, enabling the buyers with flexibility to switch to a better alternative.

- Raw materials, labor, technology and equipment, energy and utilities, packaging, labeling, and logistics, and other costs are the major cost components of the vitamins dietary supplements category. Other costs can be further bifurcated into RD, regulatory compliance, rent, general administrative, sales marketing, and finance taxes.

List of Key Suppliers

- Abbott Laboratories

- Amway Corporation

- Archer Daniels Midland Company (ADM)

- BASF SE

- Bayer AG

- DSM Nutritional Products AG

- GSK plc

- Herbalife International, Inc.

- Lonza Group Limited

- Pfizer, Inc.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Artificial Intelligence Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Corrugated Board Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Vitamins Dietary Supplements Procurement Intelligence Report Scope

- Vitamins Dietary Supplements Category Growth Rate: CAGR of 8.5% from 2023 to 2030

- Pricing Growth Outlook: 5% - 10% increase (Annually)

- Pricing Models: Cost-plus pricing, competition-based pricing, demand-based pricing, bundled pricing

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Geographical service provision, revenue generated, key regulatory certifications, years in service, employee strength, clientele, product portfolio, key technologies, distribution channels, application/end-use, customer ratings, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions