Patient Engagement Solutions Procurement Intelligence

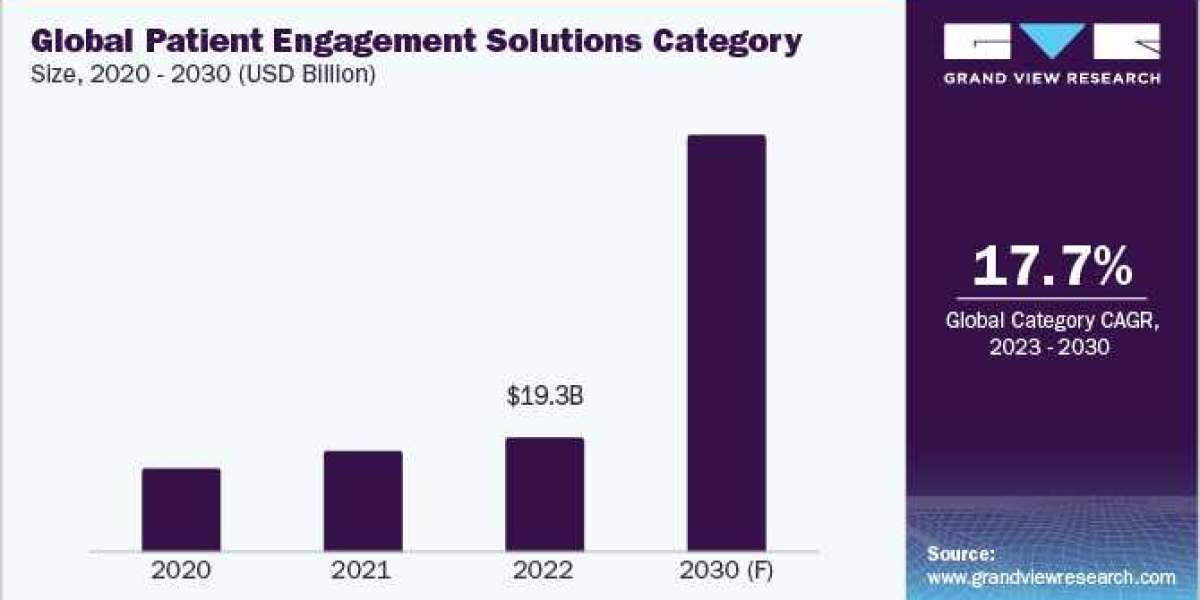

The Patient Engagement Solutions category is anticipated to witness growth at a CAGR of 17.7% from 2023 to 2030. In 2022, North America held a substantial share in the global category, followed by Europe and Asia Pacific. North America’s dominance is mainly due to the increased incidences of chronic diseases, the need to reduce healthcare costs, and favorable government efforts and regulations. The region is led by the U.S. whichhas a complicated healthcare system with a ton of paperwork and a set of procedures for the commercialization of medical devices and treatments.Europe holds the second-largest share due to publicly supported programs like the National Health Service (NHS) in the United Kingdom. The Asia Pacific region is anticipated to witness a decent growth rate with the presence ofprofitable growth prospects for the healthcare sector, such as improved care quality and healthcare infrastructure.

Based on end-usage, the healthcare providers segment holds the largest share of revenue. Healthcare providers are the first choice for consultation on anything from general to specialized medical issues in addition to treating the greatest number of patients. Therefore, these end-users are the ones who use patient engagement solutions the most. Based on mode of delivery, the web / cloud-based segment holds the largest share. Increased usage of these solutions is fueled by their integrated features, convenience of use, low cost of handling, simple data backup, and remote access to real-time data tracking. Healthcare businesses are investing more in web and cloud-based patient engagement solutions for the reasons outlined above. For instance, Microsoft released Cloud for Healthcare, in 2020, which seeks to improve patient involvement and teamwork inside healthcare organizations with the use of data analytics and telemedicine capabilities.

Order your copy of the Patient Engagement Solutions category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Technologies such as wearables and optimized online touchpoints are gaining significant popularity in the industry. Despite having few concerns attached with it pertaining to legal and privacy, wearables offer significant potential for the healthcare sector. The technology can track vital signs like heart rate and blood pressure, and some of them can even make predictions. It gives doctors a useful point of reference when talking with patients about particular physiological and biochemical data and their meanings. In addition, the technology motivate patients to take charge of their health and participate in it. A hospital or clinic is seen as the patient's informed healthcare provider when it provides a smooth, tailored experience that helps patients recognize and trust its brand. This will enable patients to regularly interact with them (hospital / clinic) as their go-to source for trustworthy information and treatment, which will increase patient retention.

The importance of virtual patient participation has been emphasized after the outbreak of the COVID-19 pandemic, prompting a change in strategy from traditional methods to the use of virtual modes for patient involvement in clinical trials and healthcare delivery. Patient engagement software has been implemented by several healthcare facilities to improve communication and promote a positive relationship between patients and clinicians. At the same time, several chronic diseases that affect a large section of the population, such as cardiovascular disorders and diabetes have become much more common. Hence, the patients suffering from these diseases need to be constantly in touch with their respective healthcare service providers to report issues or seek help in case of any emergency which is fulfilled by the solutions offered in the category.

Patient Engagement Solutions Sourcing Intelligence Highlights

- The patient engagement solutions category exhibits a fragmented landscape with intense competition among the industry players.

- Buyers in the category possess high negotiating capability due to the intense competition among the suppliers, enabling the buyers with the flexibility to switch to a better alternative.

- India is the preferred low-cost/best-cost country for sourcing patient engagement solutions suppliers. The nation is one of the most well-known for its affordable software development costs for healthcare.

- License cost/subscription fee, personnel, maintenance upgradation, training certification costs, and support constitute the total cost of ownership for patient engagement solutions category. Other costs can be further bifurcated into utility costs, administrative expenses, renewal costs, data migration costs, and security.

List of Key Suppliers

- Athenahealth, Inc.

- GetWellNetwork, Inc.

- Infomedia Group, Inc. (d.b.a Carenet Healthcare Services)

- Innovaccer Inc.

- International Business Machines Corp. (IBM Phytel)

- IQVIA Inc.

- Lincor, Inc.

- McKesson Corporation

- Medisys, Inc.

- Oracle Corporation (Oracle Cerner)

- Orion Health Group Limited

- PatientPoint Network Solutions, LLC

- Veradigm LLC

- Vivify Health, Inc.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Blockchain Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Blow Molding Plastic Packaging Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Patient Engagement Solutions Procurement Intelligence Report Scope

- Patient Engagement Solutions Category Growth Rate: CAGR of 17.7% from 2023 to 2030

- Pricing Growth Outlook: 5% - 10% increase (Annually)

- Pricing Models: Subscription-based pricing, perpetual pricing, usage-based pricing, and freemium pricing

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Years in service, industries served, employee strength, revenue generated, geographical service provision, key clientele, certifications, software type, hardware type, services offered, deployment mode, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions