Managed Services Industry Overview

The global managed services market size was estimated at USD 299.01 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. Managed services reduce downtime redundancy and provide customized value-added services such as application testing, service catalog building, and expert consultancy. Multiple monitoring tools and several layers of infrastructure managed by isolated teams contribute to market growth. Furthermore, to streamline infrastructure and reduce costs, enterprises globally are migrating to the cloud platform and adopting managed IT services to optimize their infrastructure costs. Professional and managed services help enterprises compete with this digital transformation faster and more efficiently. Market players are focusing on unveiling innovative managed services for enterprise businesses to acquire a significant share of this potential market.

The companies operating in the managed services market are establishing strategic partnerships to provide their cloud infrastructure managed services to the client for increased security compliance and enhanced business performance. For instance, in April 2023, Sinch, a Microsoft Operator Connect partner, announced a partnership with Synoptek to provide managed and professional services for the Microsoft Teams Phone System, which is integrated with direct routing or operator connect. Factors such as improving operational efficiency by focusing more effectively on core competencies, cutting operating expenses, and increasing use of cloud-based technologies such as automation, IoT, blockchain, and cloud computing are driving market growth.

Gather more insights about the market drivers, restrains and growth of the Managed Services Market

Detailed Segmentation:

Solution Insights

In terms of solutions, the managed data center segment held the largest market share in 2022 of over 15% The managed data center segment is expected to expand due to the continued integration of cutting-edge technology into existing and new corporate infrastructures. Managed data center services might help optimize corporate operations by boosting business automation and strengthening business management in a hybrid IT architecture.

Managed Information Service (MIS) Insights

In terms of MIS, the business process outsourcing (BPO) segment held the largest market share exceeding 40% in 2022. Utilizing BPO as part of a business strategy to focus on core strengths and boost profitability is expected to fuel the growth of the BPO segment. Growth of BPO services is projected to be driven by several factors, including a focus on process automation, social media management tools, and investments in cloud computing.

Deployment Insights

In terms of deployment, the on-premise segment held the largest market share of over 64% in 2022. Numerous organizations have adopted on-premise mode of deployment as it does not require an internet connection and allows easy customization of software to suit the business process requirements of clients. The on-premise implementation also aids in increasing operational efficiency and establishing a control center within an organization for efficiently coordinating and controlling various project management duties and business operations.

Enterprise Size Insights

In terms of enterprise size, the large enterprises segment held the largest market share of over 60% in 2022. Large businesses deal with large amounts of data that must be successfully maintained and accessible locally and remotely. Furthermore, large organizations are increasingly turning to managed security services to maintain and monitor their corporate data security. Due to increasing cyberattacks and less developed infrastructures to detect breaches, managed security services are the most requested service by businesses across the region. A cyberattack or data breach at a large corporation in APAC might result in a considerable loss. The key verticals contributing to the market are retail and consumer goods, healthcare, manufacturing, and telecom IT.

End-use Insights

In terms of end-use, the BFSI segment accounted for the largest market share of over 15% in 2022. Financial institutions are turning to managed services to address various issues, including keeping abreast with technological advancements, market and regulatory changes, and a looming shortage of employees with experience in cutting-edge technologies, among others. The managed services model often aids in the management of company processes and operations while boosting operational efficiency and product quality. Managed services are becoming increasingly popular as businesses seek a more strategic approach to operate, organize, and protect their operations effectively. A managed services partnership's long-term, tightly integrated structure provides significant strategic benefits in addition to cost savings. The bank can expand its domicile and investment coverage and volume without investing more money using a scalable, worldwide third-party delivery infrastructure on a pay-per-use basis

Regional Insights

North America Managed Services Market Trends

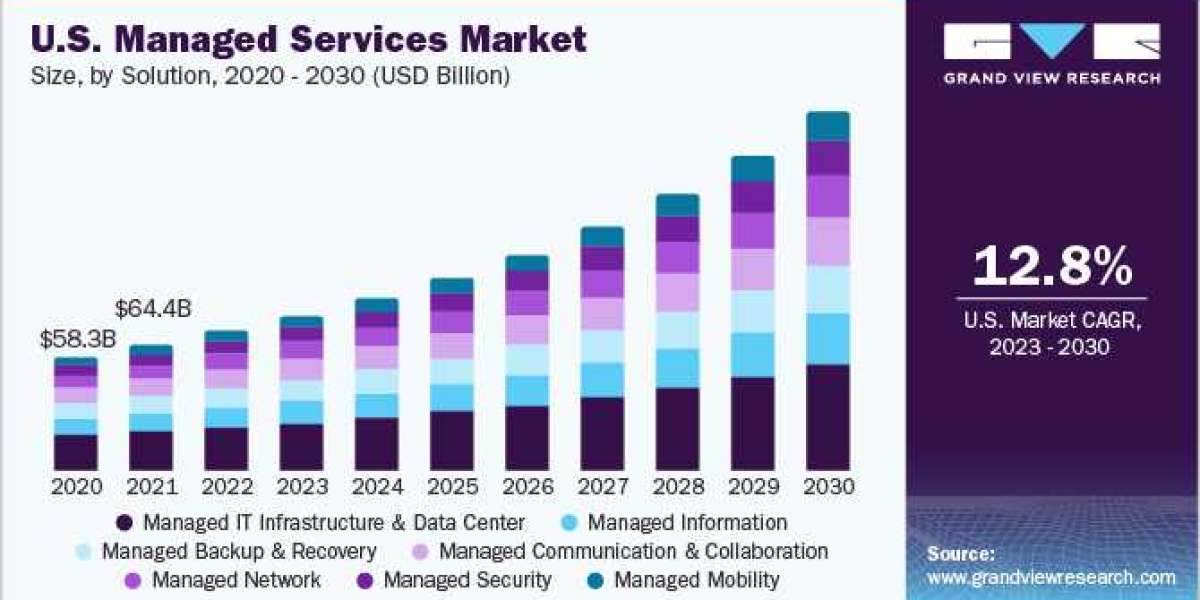

North America dominated the global market in 2022 with a market share of over 32.0%. The growing number of technology start-ups and the continued adoption of ERP, CRM, and cloud services in North America are expected to drive the demand for North America managed services market from 2023 to 2030.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

· The global neural processor market size was estimated at USD 237.6 million in 2023 and is projected to grow at a CAGR of 19.3% from 2024 to 2030.

· The global edge AI accelerators market size was estimated at USD 5,942.4 million in 2023 and is projected to grow at a CAGR of 30.7% from 2024 to 2030.

Key Companies Market Share Insights

Some of the key players operating in the market include Accenture, International Business Machines Corporation, and Cisco Systems, Inc.

- Accenture provides various infrastructure-managed services that include hosting, migrating, and managing the client’s infrastructure. It also helps clients streamline the human-centric experiences to optimize the physical workspace and support workforce collaboration.

- Cisco Systems, Inc. offers managed services to protect the clients’ end-point devices and provides actionable insights to the clients to assist them in making data-driven decisions to maximize business profitability.

ScalePad Software Inc., Atera Networks Ltd., and ARYAKA NETWORKS, INC. are some of the emerging market participants in the managed services market.

- ARYAKA NETWORKS, INC. offers managed services for secure remote access, cloud migration, last mile connectivity, and to improve the performance of dynamic IP applications.

- ScalePad Software Inc. specializes in managing the client’s IT assets and improving the performance of the endpoint devices. It also assists clients in adhering to security compliance and strengthening the cybersecurity of the IT infrastructure.

Key Managed Services Companies:

- Accenture

- Atera Networks Ltd.

- ARYAKA NETWORKS, INC.

- ATT Inc.

- BMC Software, Inc.

- Broadcom

- Cisco Systems, Inc.

- DXC Technology Company

- Fujitsu

- HCL Technologies Limited

- HP Development Company, L.P.

- International Business Machines Corporation

- Lenovo

- ScalePad Software Inc.

- Telefonaktiebolaget LM Ericsson

Managed Services Market Segmentation

Grand View Research has segmented the global managed services market report based on solution, managed information service (MIS), deployment, enterprise size, end use, and region:

Managed Services Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Managed IT Infrastructure Data Center

- Server Management

- Storage Management

- Managed Print Services

- Others

- Managed Network

- Managed Wi-Fi

- Managed LAN

- Managed VPN

- Managed WAN

- Network Monitoring

- Others

- Managed Mobility

- Application Management

- Device Life Cycle Management

- Managed Communication Collaboration

- Managed Voice over Internet Protocol (VoIP)

- Managed Unified Communications as a Service (UCaaS)

- Others

- Managed Information

- Managed Operational Support Systems/Business Support Systems (OSS/BSS)

- Business Process Management

- Managed Security

- Managed Firewall

- Managed Vulnerability Management

- Managed Risk Compliance Management

- Managed Antivirus/Antimalware

- Managed Encryption

- Managed Unified Threat Management

- Managed Security Information Event Management (SIEM)

- Managed Intrusion Detection Systems/Intrusion Prevention Systems (IDS/IPS)

- Others

- Managed Backup and Recovery

Managed Services Managed Information Service (MIS) Outlook (Revenue, USD Billion, 2018 - 2030)

- Business Process Outsourcing (BPO)

- Business Support Systems

- Project Portfolio Management

- Others

Managed Services Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On-premise

- Hosted

Managed Services Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Small Medium Enterprises (SMEs)

- Large Enterprises

Managed Services End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Government

- Healthcare

- IT Telecom

- Manufacturing

- Media Entertainment

- Retail

- Others

Managed Services Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East Africa (MEA)

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2023, technology services provider Logicalis launched an Intelligent Connectivity suite that includes solutions such as SASE, SSE, SD-WAN, and Private 5G powered by Cisco Systems, Inc. This will enable Logicalis customers to access digitally managed services developed using Cisco technology and supported by the Logicalis Digital Fabric Platform.

- In September 2023, communications technology solution provider Cloud5 Communications launched its new managed services division. The division is designed to support the IT-related requirements challenges in various markets, such as the hospitality industry, student housing, and senior living, among others. This division will assist consumers in efficiently managing IT operations, technology infrastructures, and security.

- In May 2023, Alfar Capital and Walter Capital Partners completed the acquisition of MSP Corp, a managed IT service provider in Canada. The MSP Corp would merge with Groupe Access, an MSP of IT and cybersecurity solutions. The acquisition would help company to deliver cutting-edge solutions and strengthen its position in Canada.

- In January 2023, Rackspace Technology, a multi-cloud technology solutions provider, launched Rackspace Technology Modern Operations, a managed service for public cloud for customers across Azure, AWS, and GCP. The service will provide benefits including 24x7x365 managed support, cloud expertise, cloud resiliency, and innovation with cloud services which help the company’s customers manage complex cloud environments.