Contact Center As A Service Industry Overview

The global contact center as a service (CCaaS) market size was valued at USD 4.43 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.1% from 2023 to 2030. The increasing remote and distributed workforce is a significant driver for the growing demand for Contact Center As A Service (CCaaS). With the rise of remote work and the need for virtual contact centers, organizations are realizing the benefits of CCaaS solutions in enabling their agents to work from anywhere. CCaaS solutions offer the necessary infrastructure and tools for agents to deliver quality customer service regardless of their location. Agents can access the contact center platform remotely, using their own devices, and connect with customers through various channels such as phone calls, emails, chats, and social media.

Advancements in Artificial Intelligence (AI) and automation technologies are pivotal in driving the CCaaS market's growth. Integrating AI-powered features and automation capabilities in CCaaS solutions allows organizations to streamline their contact center operations, enhance customer experiences, and improve overall efficiency. Virtual assistants and AI-powered chatbots are becoming increasingly popular in contact centers. These intelligent bots can handle routine customer inquiries, respond instantly, and assist with self-service options.

Gather more insights about the market drivers, restrains and growth of the Contact Center As A Service Market

Detailed Segmentation:

Solution Insights

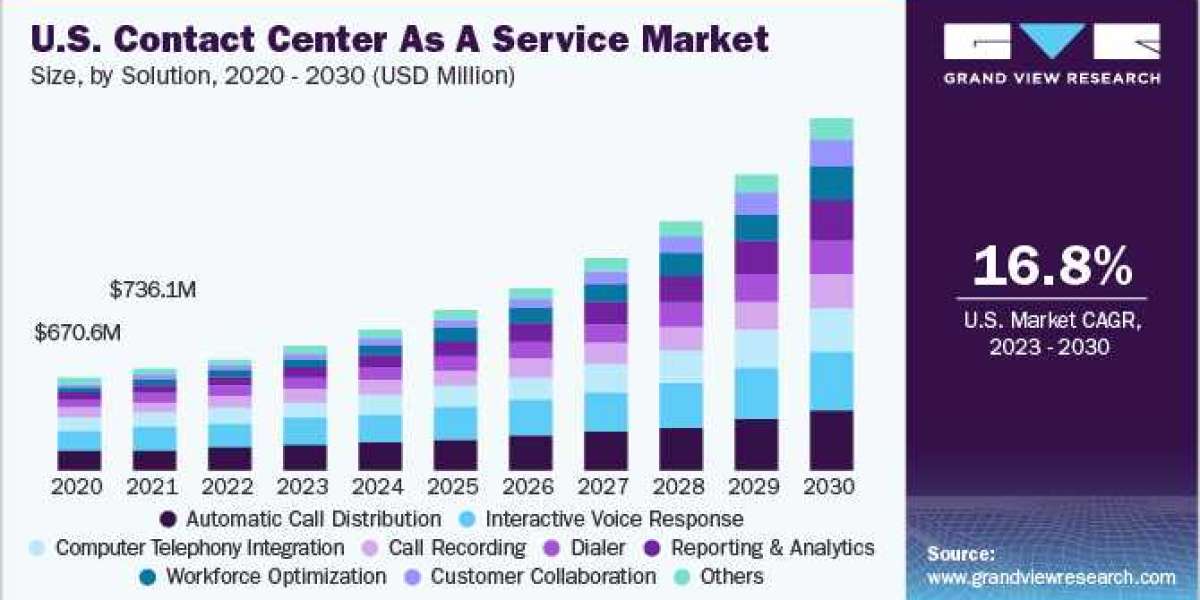

The automatic call distribution segment dominated the market in 2022 and accounted for more than 22.0% share of the global revenue. The automatic call distribution solution is widely adopted in contact centers as it helps them to handle a large volume of inbound calls. This solution routes the incoming calls to specific agents or departments within an organization based on the pre-set distribution rules. It also assists the callers when the call volume is too high, or the call center agents are busy, thus providing a better customer experience.

Service Insights

The integration and deployment segment dominated the market in 2022 and accounted for more than 40.0% of the global revenue. Growing adoption of the cloud-based CCaaS to provide better flexibility and customer experience is expected to drive the segment growth over the forecast period. The rapid pace of digitalization across industries is compelling businesses to focus on constant transformation and upgradation of their IT infrastructure. This trend is creating promising growth opportunities for the integration deployment segment in the contact center industry. Moreover, contact center businesses have to manage a diverse user base across various channels. This is anticipated to drive the adoption of integration deployment services to deploy various contact center solutions in their IT infrastructure.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for over 54.0% of the global revenue. Large enterprises have a customer base spread widely across the globe, and hence to maintain business continuity efficiently, large enterprises are aggressively investing in advanced Contact Center as a Service (CCaaS) technology. These services assist large enterprises in offering a better customer experience and reducing operational costs. As large enterprises deal with high call volumes, they adopt CCaaS solutions to provide an excellent customer experience.

End-use Insights

The BFSI segment dominated the market in 2022 and accounted for over 25.0% of the global revenue. The BFSI industry relies heavily on efficient and effective customer service to build trust and maintain customer satisfaction. Customers often require personalized assistance and timely support with the increasing complexity of financial products and services. CCaaS solutions offer the necessary tools and functionalities to handle a wide range of customer inquiries, manage complex transactions, and provide real-time support, ensuring a seamless customer experience.

Regional Insights

North America dominated the Contact Center as a Service (CCaaS) market in 2022 and accounted for over 35.0% of the global revenue. Numerous players across this region are focusing on developing the CCaaS aimed to provide better customer service. For instance, in January 2023, Sprinklr, a U.S.-based unified customer experience management platform, and Sitel Group, a provider of customer experience solutions based in the U.S., joined forces in a partnership to empower companies to elevate their contact center operations with social customer service. This collaboration offers a comprehensive suite of digital services for businesses across various industries, encompassing social listening, engagement, social media strategy, and design. By leveraging the combined expertise of Sprinklr and Sitel Group, organizations can unlock a range of benefits, including operational excellence, end-to-end social and digital capabilities, access to global services, and a strategic advantage in the competitive market.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global centralized refrigeration systems market size was estimated at USD 29.87 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030.

- The global accelerated processing unit market size was estimated at USD 13.85 billion in 2023 and is projected to grow at a CAGR of 17.5% from 2024 to 2030.

Key Contact Center As A Service Companies:

The vendors are investing in the development of omnichannel solutions for various end-use industries, such as BFSI, government, healthcare, and IT telecom. Market players are also engaging in partnerships and collaborations to strengthen their market positions.

Some of the prominent players in the global contact center as a service market include:

- Alcatel Lucent Enterprise

- Avaya, Inc.

- Cisco Systems, Inc.

- Enghouse Interactive Inc.

- Five9, Inc.

- Genesys

- Microsoft Corporation

- NICE inContact

- SAP SE

- Unify Inc.

Contact Center As A Service Market Segmentation

Grand View Research has segmented the global contact center as a service market report on the basis of solution, service, enterprise size, end-use, and region:

Contact Center As A Service (CCaaS) Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Automatic Call Distribution

- Call Recording

- Computer Telephony Integration

- Customer Collaboration

- Dialer

- Interactive Voice Response

- Reporting Analytics

- Workforce Optimization

- Others

Contact Center As A Service (CCaaS) Outlook (Revenue, USD Billion, 2017 - 2030)

- Integration Deployment

- Support Maintenance

- Training Consulting

- Managed Services

Contact Center As A Service (CCaaS) Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

- Large Enterprises

- Small Medium Enterprises

Contact Center As A Service (CCaaS) End-use Outlook (Revenue, USD Billion, 2017 - 2030)

- BFSI

- Consumer Goods Retail

- Government

- Healthcare

- IT Telecom

- Travel Hospitality

- Others

Contact Center As A Service (CCaaS) Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East Africa

- Kingdom of Saudi Arabia (KSA)

- UAE

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.