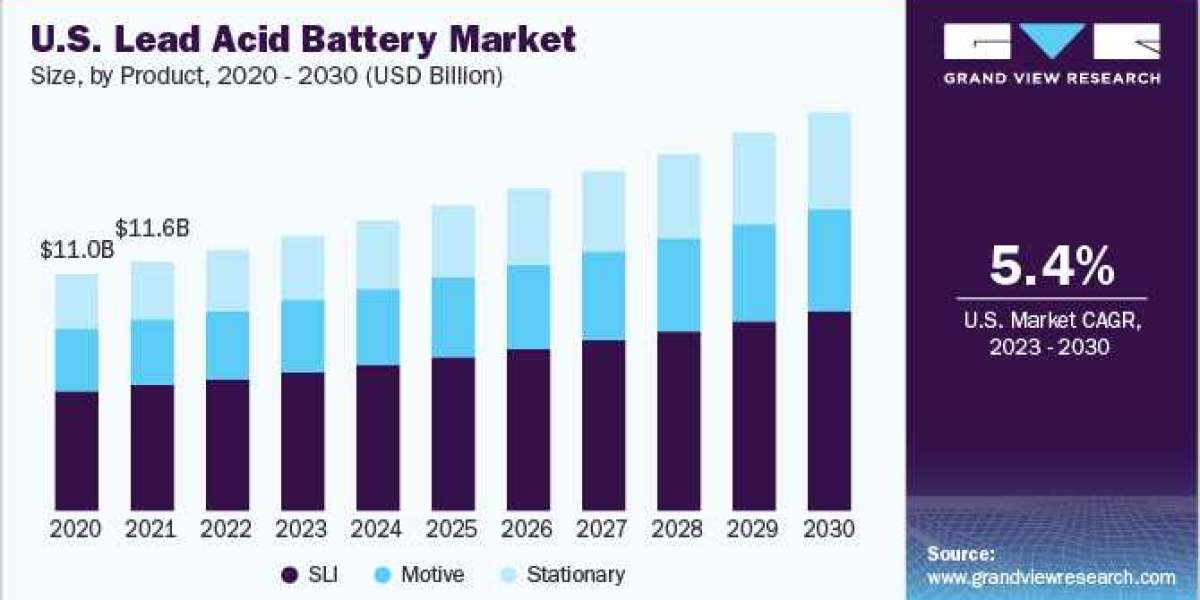

Lead Acid Battery Industry Overview

The global lead acid battery market size was valued at USD 37.98 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. The market is estimated to witness growth owing to the growing adoption of lead acid batteries in automobiles and Uninterruptible Power Source (UPS) along with some developments in the manufacturing methods. The increasing demand for lead acid batteries in off-grid power generation is expected to boost the market size. The development in the transportation industry, along with an increase in energy storage applications is projected to drive industry demand in the upcoming future. Growing demand for UPS in various sectors which includes banking, oil gas, healthcare, and chemicals has propelled industry demand further.

The adverse effects of lead batteries on the environment remain key restraining factors to growth. Also, the declining cost of lithium batteries has stalled the demand for lead-acid batteries, primarily owing to the former’s technological advancement. Continuous reduction in costs is likely to reinforce demand for the lithium-ion technology in various energy storage markets, which is also expected to restrain the market.

Gather more insights about the market drivers, restrains and growth of the Lead Acid Battery Market

Advancement of the auto industry in India, Brazil, Mexico, South Korea, Indonesia, Thailand, and Vietnam is anticipated to expand the global industry size. Increasing demand for pollution-free electric automobiles coupled with technological developments is projected to fuel product demand over the upcoming years.

Detailed Segmentation:

Product Insights

In terms of value, Starting, Lighting, and Ignition (SLI) batteries emerged as the largest product segment and accounted for more than 53.0% of the market in 2022. These are projected to witness sluggish growth due to higher demand for other types of products including stationary and motive. However, the segment is likely to expand due to increasing demand in applications requiring high power including automotive.

Increasing vehicle manufacturing, particularly in China, Japan, India, Brazil, Mexico, South Korea, and the U.S. is expected to promote expansion over the upcoming years. For instance, In October 2018, Amara Raja Batteries signed an agreement with Johnson Controls to launch a new battery technology in India which provides sophisticated consumer features and strict emission standards for the automotive industry. Such initiatives are anticipated to drive the demand for lead-acid batteries during the forecast period.

Construction Method Insights

In terms of value, the flooded lead acid battery segment emerged as the largest construction method segment and accounted for more than 65.0% of the market share in 2022. The segment is expected to lose market share owing to high maintenance costs along with complex construction. However, increasing demand for stationary applications will fuel industry growth over the forecast period.

VRLA batteries are anticipated to witness the highest gains and are alone expected to contribute to over 34.0% of the revenue market share by 2022. Rising demand for VRLA in automotive applications owing to its high output and low maintenance will fuel market growth over the forecast period. In addition, VRLA lead acid batteries including AGM offer high resistance to vibration, minimize terminal corrosion, extend shelf life, and offer a low self-discharge rate. The widespread availability of various sizes of AGM lead acid batteries will fuel its demand over the next nine years.

Application Insights

In terms of value, automotive emerged as the largest application segment and accounted for more than 58.0% of the market in 2022. The extensive usage of lead acid batteries in the automotive sector is expected to grow as a result of the rising automotive sector globally. The presence of big automotive players such as TATA, Maruti Suzuki, Infinium Toyota, Mahindra, Mitsubishi, Hyundai, Honda, and Nissan have fuelled the growth of the automotive sector in the Asia Pacific due to their strong distribution channels and easy availability of their products at a cheaper price.

UPS accounted for more than 9.0% of global revenue in 2022 and is expected to witness the highest CAGR of 7.4% from 2023 to 2030. The growing demand in various industries including the medical industry, educational institutes, corporate offices, research institutions, and houses promises further growth during the forecast period.

Regional Insights

Asia Pacific dominated the lead acid batteries industry and accounted for more than 55.0% share of the global revenue in 2022. The growing construction industry in emerging countries including China, India, Japan, Malaysia, South Korea, Vietnam, and Indonesia is projected to drive the utilization of lead-acid batteries. According to the Society of Indian Automobiles Manufacturers, total automotive sales grew by 24.0 percent in 2020-2021 over 2021-2022. Expansion in the automobile sector will lead to significant growth in sales of SLI lead acid batteries.

Asia Pacific is anticipated to be the most lucrative market during the forecast period on account of the increasing demand for energy storage batteries in China and India. Furthermore, favorable government regulations which are designed to generate investments from public-private partnerships and foreign direct investments (FDI) are estimated to fuel lead acid battery demand till 2030.

Browse through Grand View Research's Category Power Generation Storage Industry Research Reports.

- The global electrolytic manganese dioxide (EMD) market size was valued at USD 1.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030.

- The global power plant boiler market size was valued at USD 22.38 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030.

Key Lead Acid Battery Companies:

The market is fragmented in nature due to the presence of many manufacturers. The market is categorized with a large number of market players in the U.S., China, and Japan. Mergers acquisitions and joint ventures are key characteristics of the market players, to increase their market presence. The industry is highly competitive with participants involved in continuous product innovation and RD.

Some prominent players in the global lead acid battery market include:

- East Penn Manufacturing Co.

- Exide Technologies

- Johnson Controls

- ATLASBX Co. Ltd.

- NorthStar

- CD Technologies, Inc.

- Narada Power Source Co., Ltd.

- Amara Raja Corporation

- GS Yuasa Corp

- Crown Battery Manufacturing

- Leoch International Technology Ltd.

Lead Acid Battery Market Segmentation

Grand View Research has segmented the global lead acid battery market based on product, construction method, application, and region:

Lead Acid Battery Product Outlook (Revenue, USD Million, 2018 - 2030)

- SLI

- Stationary

- Motive

Lead Acid Battery Construction Method Outlook (Revenue, USD Million, 2018 - 2030)

- Flooded

- VRLA

Lead Acid Battery Application Outlook (Revenue, USD Million, 2018 - 2030)

- Automotive

- UPS

- Telecom

- Electric bikes

- Transport vehicles

- Others

Lead Acid Battery Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Europe

- UK

- Germany

- Italy

- Russia

- Asia Pacific

- China

- India

- Central and South America

- Brazil

- Middle East and Africa

- South Africa

- UAE

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.