Nitric Acid Industry Overview

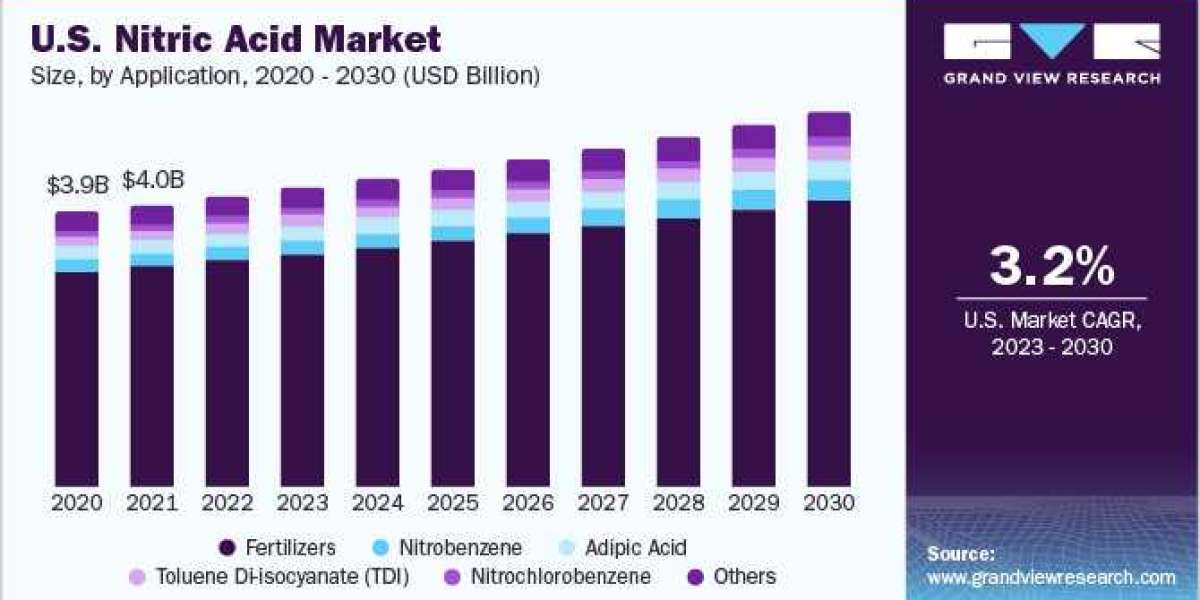

The global nitric acid market size was valued at USD 29.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.4% from 2023 to 2030. The growth for the product is expected to be driven by increasing demand for the product from fertilizers formulators and by rising consumption of fertilizers in agrarian economies of the world. Growing demand for food has propelled the expansion of various fertilizers and agricultural units globally to optimize crop yield, lower cultivation time, attain healthy crop growth, and more. Nitric acid is one of the key components of producing nitrogen fertilizers which are highly demanded by the agricultural world.

The global product market is highly competitive, especially in the presence of multinationals that are constantly innovating to capture a broader share of the market. Companies like BASF SE, Dow Chemicals, Nutrient, CF Industries are the major players and dominate the market with a wide range of products for each application and a strong global presence.

Gather more insights about the market drivers, restrains and growth of the Nitric Acid Market

Detailed Segmentation:

Applications Insights

Fertilizer manufacturing dominated the nitric acid application with a share of 80.53% in 2022. Its high share is attributable to the increasing demand for food which has led to the development of fertilizers units globally. Farmers are adopting techniques that maximize the crop yield in minimum time with the help of fertilizers.

Adipic acid is produced by the use of the product as an important raw material. It is considered one of the key components for the production of Nylon 6, 6 which is used widely in the development of plastics and industrial carpets. Nylon 6, 6 is expected to stagnate over the forecast period resulting in a reduced margin in Adipic acid manufacturing owing to which the consumption of nitric acid for the production of Adipic is anticipated to be on the lower side.

Nitrobenzene is one of the key applications of nitric acid and is used in the construction industry. The future scenario of nitrobenzene totally depends on how the construction industry grows after the industry was slowed down in emerging economies due to an unexpected strike of coronavirus which has affected the demand for nitrobenzene. However, the demand is expected to pick up over the forecast period.

Toluene di-isocyanate is widely used in the production of soft foam that is used in mattresses, and automotive seats. The demand for TDI was disrupted due to the unforeseeable situation of the pandemic. The margin in TDI is also facing a downfall and is expected to grow at a slower rate which is putting pressure on the TDI value chain.

Other applications of the product include its use as a rocket propellant, analytical reagent in metalworking, cleaning agent, and in woodworking applications. Among these aforementioned application sectors of the product, its utility in cleaning products is substantial. However, as per the assessments made in the cleaning hygiene sector, the use of nitric acid in cleaning products is deemed harmful to humans. Multiple household cleaning products used across various Latin American countries contain nitric acid in their formulations, excessive use of which can lead to serious consequences on the health of humans.

Regional Insights

Europe dominated the market with a share of 65.40% in 2022. This is attributed to the presence of a robust value chain and significant domestic consumption in the region. The growth in Central Europe is steady and moderate. However, the majority of the demand comes from Eastern Europe which shows huge potential for expansion. The automotive and chemical industries are the major pillars and driving forces for the product in the region.

France which has a highly specialized chemical industry provides adequate opportunities for the market growth of nitric acid. Nitric acid consumption is expected to take a leap due to the presence of specialty chemical manufacturers such as Arkema, Air Liquide, Solvay, SEQENS, L’Oréal, BASF, DowDuPont, Henkel, Bayer. With the government initiation in developing a sustainable economy for the chemical industry, the demand is expected to witness steady growth.

North America accounted for the second largest revenue contributor globally in 2022. This is attributed to the fact that fertilizers are the major application segment in the region owing to the high demand for nitrogenous fertilizers and the presence of a favorable industrial environment. The growing population and rising income are expected to continue accelerating the demand for agricultural commodities.

Browse through Grand View Research's Category Agrochemicals Fertilizers Industry Research Reports.

- The global wood vinegar market size was valued at USD 5,206.86 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030.

- The global glufosinate ammonium market size was estimated at USD 481.4 million in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030.

Key Nitric Acid Companies:

The presence of multinationals has increased the competition in the global nitric acid market. Multinationals conduct constant research and development activities to formulate new innovations and increase their market.

Some prominent players in the global nitric acid market include:

- BASF SE

- Dupont

- Nutrien Ltd.

- Omnia Holding Limited

- Apache Nitrogen Products Inc.

- CF Industry Holdings, Inc

- Rashtriya Chemicals Fertilizers Ltd.

- Dyno Nobel

- Sasol

- Angus Chemical Company

- Enaex S.A.

- LSB Industries

- Thyssenkrupp AG

- Yara International ASA

- Ixom

Nitric Acid Market Segmentation

Grand View Research has segmented the global nitric acid market report based on application and region:

Nitric Acid Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- Fertilizers

- Ammonium Nitrate

- Calcium Ammonium Nitrate

- Others

- Nitrobenzene

- Adipic Acid

- Toluene Di-isocyanate (TDI)

- Nitrochlorobenzene

Nitric Acid Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Russia

- France

- Poland

- Ukraine

- Asia Pacific

- China

- Uzbekistan

- Kazakhstan

- Thailand

- Central South America

- Brazil

- Middle East Africa

- Egypt

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.