Solar Tracker Industry Overview

The global solar tracker market size was valued at USD 4.41 billion in 2022, expanding at a compound annual growth rate (CAGR) of 26.2% from 2023 to 2030. Rising concerns over energy conservation and transition from non-renewable energy to renewable energy is expected to surge demand for solar energy and eventually solar trackers over the forecast period on a global level. Solar tracker utilizes various electrical components including actuators, motors, and sensors to orient the solar cell for concentrating the sunlight in order to maximize the energy captured. The captured solar radiations are further converted into electricity which is utilized by various end-user segments. Rising use of solar power as a potential source of commercial energy generation has gained popularity due to decreasing solar PV panel cost which is excepted to further augment solar tracker market growth.

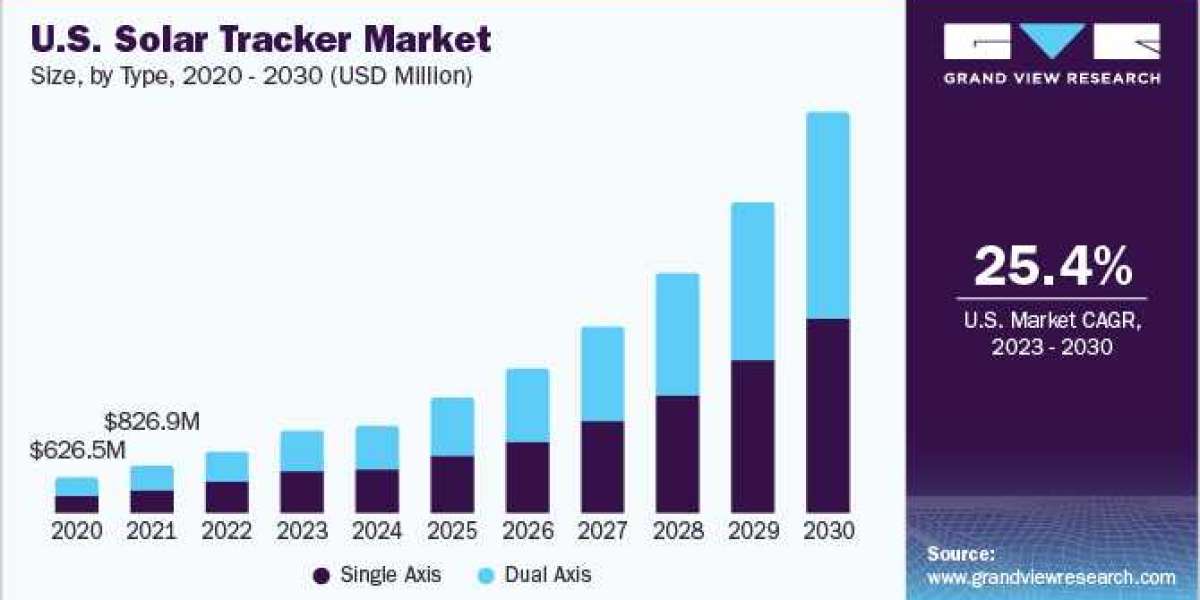

Solar PV technology has been one of the fastest growing renewable sources of energy over the past few years in the U.S. Increasing government focus on renewable energy has resulted in the development of PV cells as a sustainable and continuous source of energy generation. Rising capacity expansions across the U.S. has led to decline the levelized cost of electricity (LCOE). This has made solar PV competitive with other conventional forms of energy in the country. Along with supporting policies by the U.S. government has been one of the significant drivers for high implementation of solar energy in the country.

Gather more insights about the market drivers, restrains and growth of the Solar Tracker Market

Detailed Segmentation:

Type insights

Dual axis tracker accounted for the largest market share of more than 50.83% in 2022 in terms of revenue and is projected to expand at the highest CAGR during the forecast. Dual axis trackers allow maximum absorption of the sun’s rays on account of their ability to follow the sun both horizontally and vertically. Dual axis trackers help in generating 8% to 10% more energy than single axis trackers.

Higher land requirements and more complex technology coupled with high maintain requirement for motors and control systems results in high OM expenditure for dual-axis trackers. This factor acts as a major restraint for wider adoption for dual-axis trackers.

Technology insights

Photovoltaic (PV) technology was the largest technology segment in 2022 and accounted for a revenue share of about 91.52% in 2022. Compatibility of PV cells with standard photovoltaic modules technologies is the major reason for largest market share of PV technology. The rising cost of electricity owing to supply-demand gap will further augment the use of solar PV in utility and non-utility applications.

The use of solar trackers on PV modules requires less design regulations when compared to mirrors, lenses, and Fresnel collectors on the CSP and CPV technology trackers. These features will drive the growth of solar trackers in PV technology over the forecast period. CPV is the emerging technology in the solar industry. CPV system produces low-cost solar power owing to low manufacturing cost and fewer raw material requirements. This technology uses optics such as lenses to concentrate a large amount of sunlight on a small surface of PV materials to generate electricity.

Concentrated Solar Power (CSP) is used to harness the sun’s energy potential and has the capacity to provide consumers globally with reliable renewable energy even in the absence of the sun’s rays. Over the past few years, CSP has been increasingly competing with the less expensive PV solar power and concentrator photovoltaics (CPV), which is also a fast-growing technology.

Application Insights

In terms of revenue, utility was the largest application sector while accounting for over 85.56% of the market share in 2022. Increasing electricity cost coupled with rising demand for renewable source for energy generation is expected to augment the use of solar trackers in utility applications. This trend is projected to continue during the forecast period.

The most widely used solar trackers in utility sector is the single axis tracking system as utility solar installations are ground mounted, and single axis trackers can be used to follow the sun throughout daylight hours; Trackers are being used on a large-scale in utility applications in light of increasing government subsides coupled with feed-in tariff schemes particularly in North American and European region.

The prevalence of various government subsidies in North America and Europe will augment the use of solar panels in non-utility applications over the forecast period. One of the major factors affecting the application of trackers in non-utility projects is high cost associated with them. Implementing solar trackers can be extremely costly, but it consequently helps in generating 25%-30% more solar power as compared to a fixed solar panel. However, high cost and land constraints make it infeasible in most cases for use of solar trackers in commercial and residential applications.

Regional Insights

North America accounts for the major market share in the global market and this trend is expected to continue till 2030. The growth is primarily attributed to rising emphasis on renewable energy and the Paris Agreement on Climate Change that has recommended the usage of renewable energy in the nation’s energy supply.

The government in the U.S. is also targeting to increase the usage of solar power in the economy through various initiatives. In the year 2011, DOE (U.S. Department of Energy) launched the SunShot Initiative with an aim to make the solar industry cost-competitive with conventional energy sources by reducing charges to less than 1 USD/watt by 2020. The initiative has sponsored more than 350 projects which includes companies, private, universities, and national laboratories.

Middle East Africa is anticipated to witness highest growth during the forecast period. The region is expected to witness significant growth over the next ten years on account of high solar potential and increase in investments in the solar projects in the region, particularly in UAE, and Saudi Arabia. Among these, Saudi Arabia held the highest share in 2021, owing to large investments being made by both domestic and foreign parties. The country also witnessed significant growth in light of investments being made by U.S. solar companies, due to the country’s favorable climatic conditions.

Browse through Grand View Research's Category Renewable Energy Industry Research Reports.

- The global wind energy foundation market size was valued at USD 10.64 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2030.

- The global photovoltaic (PV) materials market size was valued at USD 61.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030.

Key Solar Tracker Companies:

- Abengoa Solar S.A.

- AllEarth Renewables

- Array Technologies Inc.

- DEGERenergie GmbH Co. KG

- Nclave

- Powerway Renewable Energy Co. Ltd.

- Soltec Tracker

- SunPower Corporation

- Titan Tracker

- Trina Solar Limited

Solar Tracker Market Segmentation

Grand View Research has segmented the global solar tracker market based on technology, type, application, and region:

Solar Tracker Technology Outlook (Volume, Megawatt; Revenue, USD Million, 2018 - 2030)

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

- Concentrated Photovoltaic (CPV)

Solar Tracker Type Outlook (Volume, Megawatt; Revenue, USD Million; 2018 - 2030)

- Single Axis

- Dual Axis

Solar Tracker Application Outlook (Volume, Megawatt; Revenue, USD Million; 2018 - 2030)

- Utility

- Non-utility

Solar Tracker Regional Outlook (Volume, Megawatt; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- Spain

- Italy

- France

- Asia Pacific

- China

- India

- Japan

- Central South America

- Brazil

- Chile

- Middle East Africa

- UAE

- Saudi Arabia

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.