Dental Implant Industry Overview

The global dental implants market size was valued at USD 4.99 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. Increasing applications of dental implants in various therapeutic areas along with rising demand for prosthetics are some of the key factors expected to boost the industry growth. Prosthetics play a major role in propelling the demand for these implants through oral rehabilitation, which helps in restoring the oral function and facial form of a patient. Acceptance level for dental implants is increasing among patients and dental surgeons due to limitations of removable prosthetics, such as discomfort, lack of natural appearance, and need for maintenance.

Prosthetics mounted on dental implants do not encroach on soft tissues and enhance aesthetics, which is further expected to drive the industry. The industry witnessed a minor setback due to the COVID-19 pandemic in the second and third quarters of 2020 due to supply chain bottlenecks and the closure of dental clinics. However, after the second quarter of 2020, dental procedures started to resume leading to a full market recovery by 2021. Companies like Straumann, which has a comprehensive portfolio of implants and implant solutions namely Neodent, Medentika, and Anthogyr, reported that their industry share increased from 27% to 29% from 2020 to 2021. This implies that the company expanded its customer base and geographical presence considerably post-pandemic.

Gather more insights about the market drivers, restrains and growth of the Dental Implant Market

Detailed Segmentation:

Implant Type Insights

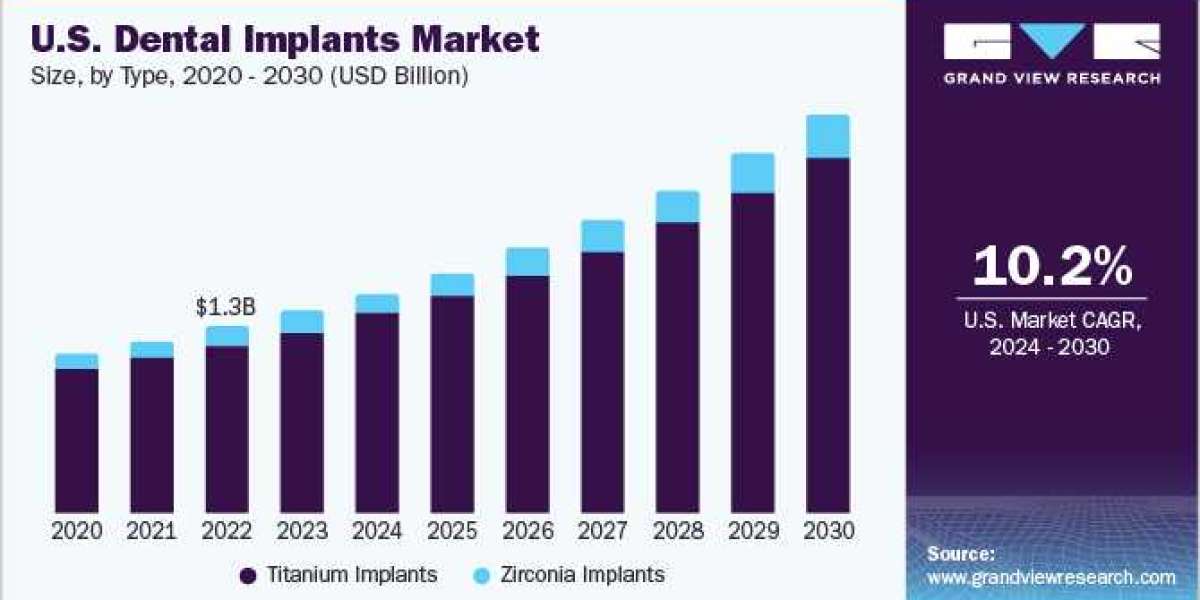

On the basis of types, the global industry is segmented into titanium implants and zirconium implants. The titanium segment held the largest share of more than 91.55% of the overall revenue in 2022 owing to the wide use of dental implants made up of titanium. The biocompatible nature of the pure form of titanium is the main benefit of its use. The crude form of titanium consists of other metals, such as ilmenite, iron, vanadium, zirconium, silicon, and magnesium. The chemical synthesis procedure entails the conversion of crude titanium intermediates through a sequence of extraction and purification reactions into pure titanium ingot.

Titanium dioxide is very toxic to the human body and needs to be removed from the titanium implant. The zirconium segment is anticipated to be the fastest-growing product segment over the forecast period. The material called zirconium functions with nearly the same features as titanium. Titanium implants can be made as one-piece or two-piece systems, whereas, zirconium implants are made as one-piece systems. Two-piece implants offer better features, such as they can be used to support overdentures. Implants are manufactured in different sizes (length and width), which enables the choice of implants as per patients’ bone size.

Regional Insights

In 2022, North America dominated the global industry and accounted for the maximum share of more than 35.50% of the overall revenue. The prominent drivers of the region include the growing geriatric population with a high incidence of dental conditions and high awareness among the population regarding oral preventive restorative treatments in this region. According to the American Academy of Implant Dentistry, 3 million people already have dental implants, and this number is usually higher in developed countries than in developing countries due to the wide availability of resources, higher per capita income of the population, more concern about aesthetics, and higher awareness.

Asia Pacific is anticipated to be the fastest-growing region over the forecast period owing to increasing economic stability and disposable income. Asian countries have dense populations, with a growing burden of geriatric population. These countries are also popular for their low-cost treatment, which makes them a preferred market for medical tourism. The growing adoption of cosmetic dental implants is one of the significant factors driving the market. Furthermore, the introduction of novel technologies, such as CAD/CAM-based dental restorations, and high awareness about dental procedures are expected to impel growth over the forecast period.

Browse through Grand View Research's Category Medical Devices Industry Research Reports

- The 3D printed brain model market size was valued at USD 44.3 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 17.9% from 2024 to 2030.

- The global pulse electromagnetic field (PEMF) therapy devices market size was valued at USD 523.4 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030.

Key Dental Implants Companies:

- BioHorizons IPH, Inc.

- Nobel Biocare Services AG

- Zimmer Biomet Holdings, Inc.

- OSSTEM IMPLANT

- Institut Straumann AG

- Bicon, LLC

- Leader Italy

- Anthogyr SAS

- DENTIS

- DENTSPLY Sirona

- DENTIUM Co., Ltd.

- T-Plus Implant Tech. Co.

- KYOCERA Medical Corp.

Dental Implants Market Segmentation

Grand View Research has segmented the dental implants market on the basis of on implant type and region:

Dental Implants Implant Type Outlook (Revenue, USD Million, 2018 - 2030)

- Titanium Implants

- Zirconia Implants

Dental Implants Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Austria

- The Netherlands

- Poland

- Romania

- Czech Republic

- Greece

- Sweden

- Portugal

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- Kuwait

- UAE

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In May 2023, Straum annannounced the acquisition of GalvoSurge, a manufacturer of dental medical devices based in Switzerland. The company specializes in implant care as well as maintenance solutions, with its concept for supporting peri-implantitis treatment - the GalvoSurge Dental Implant Cleaning System GS 1000 - holding a CE mark and being in the market since 2020.

- In May 2023, T-Plus announced that its ST implant system had been made available for sale in the Chinese market, post an 8-year NMPA registration procedure.

- In March 2023, Dentsply Sirona introduced the ‘DS OmniTaper Implant System’ at the 2023 Academy of Osseointegration (AO) Annual Meeting in Phoenix, Arizona. The solution forms a part of the company’s EV Implant Family, alongside the ‘DS PrimeTaper Implant System’ and the ‘Astra Tech Implant System’.

- In January 2023, Nobel Biocare announced a partnership with Mimetis Biomaterials S.L., launching the ‘creos syntogain’ biomimetic bone graft substitute. This has helped Nobel Biocare to expand its regenerative solutions portfolio under the creos brand, adding to its creos xenoprotect, creos xenogain, creos syntoprotect, and creos mucogain offerings.

- In March 2022, Nobel Biocare announced the addition of creos syntoprotect to the company’s regenerative portfolio. The creos syntoprotect dense PTFE membranes have been designed for withstanding exposure to the oral cavity for extraction socket management when primary closure cannot be done.

- In September 2021, Straumann Group and Aspen Dental Management announced a strategic partnership for providing access to dental implant solutions, abutments, and CAD/CAM options for over 1000 ADMI and its affiliated offices across 45 states in the U.S.