Pea Protein Industry Overview

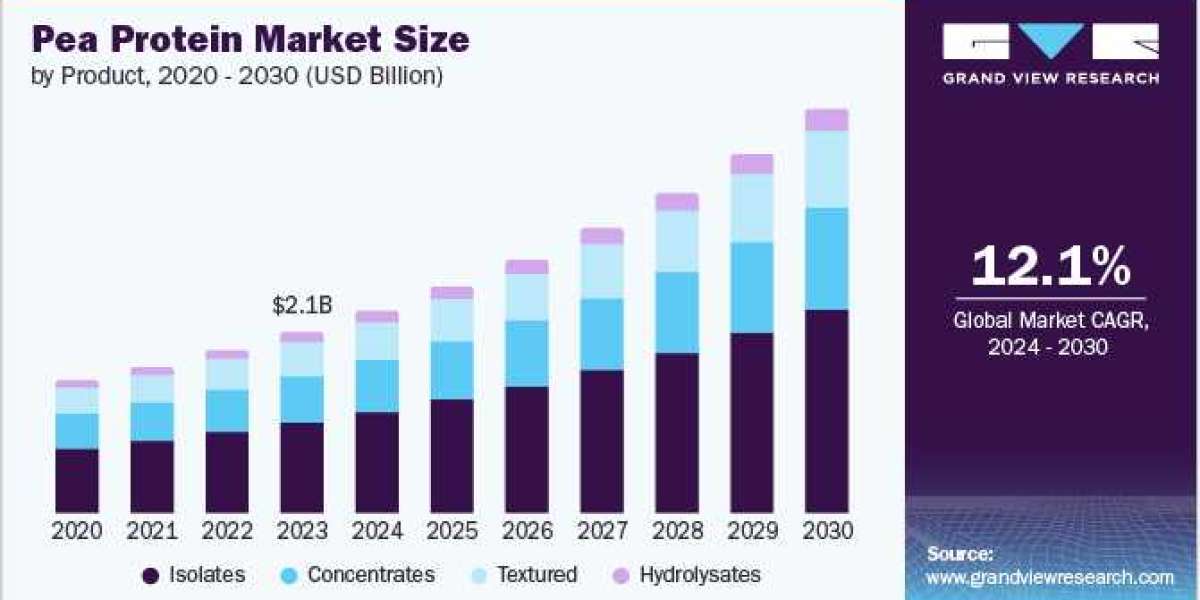

The global pea protein market size was valued at USD 2.12 billion in 2023 and is expected to grow at a CAGR of 12.1% from 2024 to 2030. With increasing awareness about animal agriculture's environmental impact and health concerns associated with meat consumption, more consumers opt for plant-based alternatives. Pea protein, a high-quality protein source, is gaining popularity among vegetarians, vegans, and health-conscious consumers. It is free from common allergens such as soy and gluten, making it a suitable option for people with dietary limitations.

The global rise in vegan and vegetarian lifestyles is significantly reshaping consumer preferences, leading to a surge in demand for plant-based alternatives. Pea protein is a versatile ingredient increasingly used in meat substitutes, from meat substitutes and dairy alternatives to functional foods. The growing number of vegan restaurants, cafes, and product launches catering to this demographic is increasing the demand for pea protein. Additionally, the rising importance of a flexitarian diet due to increasing concerns about the cardiological impacts of red meat consumption and growing awareness regarding the adverse effects of foods containing gluten and lactose drives market growth.

Gather more insights about the market drivers, restrains and growth of the Pea Protein Market

Detailed Segmentation:

Product Insights

Isolates segment dominated the market with a revenue share of 49.9% in 2022. Pea protein isolates are rich in essential amino acids, particularly branched-chain amino acids (BCAAs), necessary for muscle growth and recovery. They also contain high levels of iron and are easily digestible, making them a suitable option for health-conscious consumers. The increasing focus on fitness, weight management, and overall wellness increases the demand for high-quality protein sources such as pea protein isolates. Additionally, their benefits for heart health, muscle maintenance, and growth further drive consumer interest.

Form Insights

Dry segment accounted for the largest revenue share in 2023. The dry processing methods used to produce pea protein concentrates and isolates produce a more concentrated protein product, making it suitable for manufacturers and consumers seeking efficient protein sources. This stability allows for easy storage and transportation, making it ideal for various applications, including protein powders, snack bars, and meal replacements. The convenience of dry pea protein aligns with the busy lifestyles of modern consumers who seek quick and easy ways to meet their nutritional needs.

Source Insights

The yellow split peas segment accounted for the largest revenue share in 2023. Their high protein content and essential nutrients, including fiber, vitamins, and minerals, make them ideal for pea protein extraction. Additionally, they are widely available, ensuring a consistent supply. Yellow split peas also have favorable functional properties and a neutral flavor, making them versatile for various food applications. Consumer familiarity and acceptance of yellow split peas contribute to their prominence in the market.

Application Insights

The food beverages segment dominated the market in 2023 due to the increasing consumer demand for plant-based and vegetarian/vegan options. Pea protein's functional properties, nutritional benefits, and versatility make it a preferred ingredient for enhancing various food and beverage product's texture, stability, and nutritional profile. Pea proteins offer several functional benefits in bakery applications, including water holding, gelation, and increased browning, particularly in gluten-free applications.

Regional Insights Trends

The North America pea protein market accounted for the largest revenue share of 33.1% in 2023. Major regional retailers and food chains have identified the growing demand for plant-based products, leading to increased shelf space and product offerings featuring pea protein. The widespread availability of these products in supermarkets, health food stores, and online platforms has made it convenient for consumers to access and try pea protein-based products. Additionally, the food service industry, including restaurants, cafes, and fast-food chains, increasingly offers plant-based options to cater to consumers' growing preferences, further boosting the demand for pea protein.

Browse through Grand View Research's Category Nutraceuticals Functional Foods Industry Research Reports.

- The global black tea extracts market size was valued at USD 8.09 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.3% from 2024 to 2030.

- The global fermented ingredients market size was valued at USD 35.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.1% from 2024 to 2030.

Key Companies Market Share Insights

Key players in pea protein market include Nutri-Pea, The Scoular Company, Roquette Frères, Axiom Foods, Inc., and others

- Nutri-Pea specializes in the production of high-quality pea protein and other pea-derived ingredients. Its food applications include health foods, sports nutrition, plant-based meal Replacements, dairy Replacements, baked goods, meat, and seafood. Its product offerings include Propulse Pea Protein, Centara Pea Hull Fiber, Accu-Gel Pea Starch, Uptake 80 Pea Cell Wall Fiber, and others.

- The Scoular Company is a prominent player in the global agriculture industry. Focusing on connecting farmers, processors, and end-users, Scoular operates across various sectors, including grain trading, feed and food ingredient supply, and logistics. It provides grains and seeds, food ingredients, pet food ingredients, and animal food ingredients.

Pea Protein Market Segmentation

Grand View Research has segmented the global pea protein market based on product, form, source, application, and region:

Pea Protein Product Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

- Isolates

- Concentrates

- Textured

- Hydrolysates

Pea Protein Form Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

- Dry

- Wet

Pea Protein Source Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

- Yellow Split Peas

- Others

Pea Protein Application Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

- Food Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care Cosmetics

- Animal Feed

- Others

Pea Protein Regional Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

- North America

- U.S

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia New Zealand

- South Korea

- Central South America

- Brazil

- Argentina

- Middle East Africa

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In March 2023, Nepra Foods announced a manufacturing distribution partnership with Scoular for specialized plant-based products. Under this agreement, Nepra provides its RD team with the development of new products, with specialty ingredients from both companies involved. Scoular further promotes Nepra’s products through its strong supply chain network

- In January 2023, Roquette announced a significant investment in the Japan-based food tech startup DAIZ Inc. DAIZ specializes in developing technologies and processes to improve plant-based food's texture, flavor, and nutritional profile. DAIZ's proprietary germination technology, the Ochiai Germination Method JP-5795679, was initially developed for soy and recently expanded to peas.

- In July 2024, Ingredion Incorporated announced the launch of Vitessence Pea 100 HD, a new pea protein enhanced for cold-pressed bars for the Canada and U.S. markets. It delivers softness throughout the shelf life of cold-pressed bars.