U.S. Wine Industry Overview

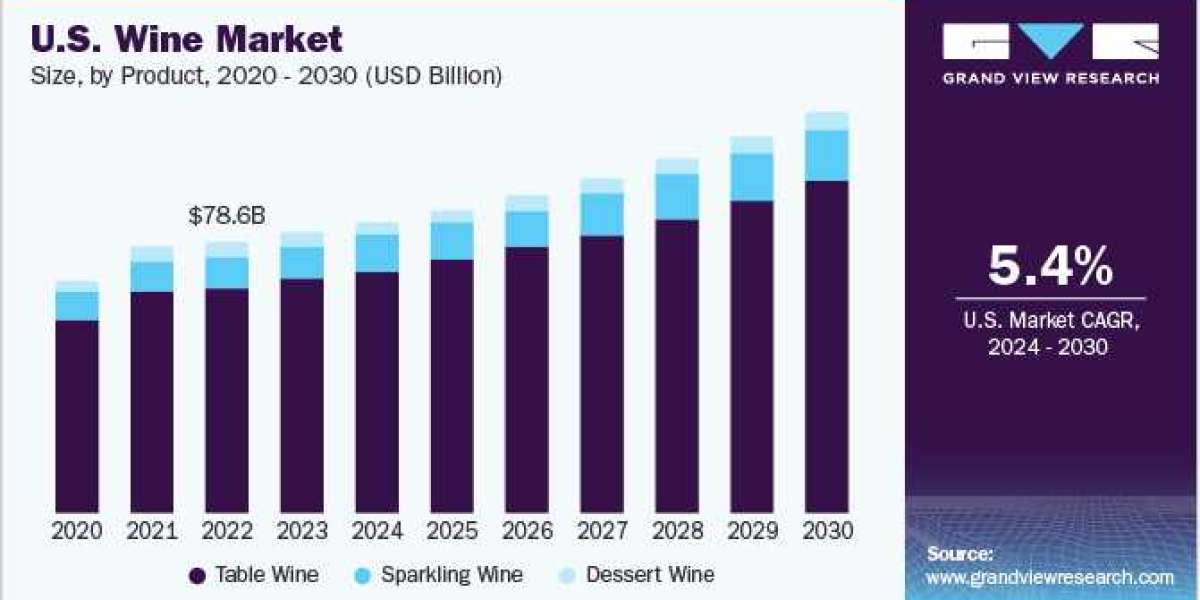

The U.S. wine market size was estimated at USD 81.33 billion in 2023 and is expected to expand at a CAGR of 5.4% from 2024 to 2030. Wine sales have surged across the U.S. owing to innovation in its flavor, color, and packaging. Beyond the classic wines, niche markets and emerging wine regions are gaining prominence. Regions like Willamette Valley located in Oregon, Finger Lakes located in New York, Santa Rita Hills located in California, and Columbia Valley are carving out niches with their distinct offerings. Indigenous grape varieties, innovative winemaking techniques, and unique terroirs are captivating adventurous palates.

Gather more insights about the market drivers, restrains and growth of the U.S. Wine Market

Evolving consumer tastes and preferences play a significant role in shaping the U.S. wine industry. Consumers are increasingly seeking diverse and unique wine experiences, leading to a growing demand for a variety of wine styles, including organic, biodynamic, and sustainable options. The millennial demographic has a considerable impact on the wine market. This group tends to value authenticity, sustainability, and unique experiences, driving the demand for wines that align with these preferences. Millennial consumers often explore new and niche varietals, contributing to the diversification of the market.

The rise of wine tourism emerges as a noteworthy factor boosting the U.S. market, with consumers expressing a growing interest in immersive experiences such as vineyard visits, tastings, and insights into the winemaking process. Wine regions, in turn, benefit from the favorable economic impact generated by the influx of tourists.

Many manufacturers prefer to purchase grapes in large quantities from local vineyards for wine production to create a product at a reduced price. Locally-made wine has also been gaining traction owing to the rising consumer demand for organic and natural products. Though U.S. wine is still a niche segment in the overall wine category, its production and consumption have increased in recent years due to rising consumer awareness regarding health and wellness. Furthermore, some manufacturers are of the opinion that organic practices are a necessity for their business growth.

Mergers, acquisitions, and consolidation have been occurring among wineries worldwide. For instance, in October 2023, Treasury Wine Estates Ltd (TWE), a globally renowned wine company, officially disclosed its acquisition agreement with the U.S -based DAOU Vineyards, an esteemed luxury wine business founded by brothers and co-proprietors Daniel Daou and Georges. The acquisition involves an upfront consideration of USD 900 million, along with a potential additional earn-out of up to USD 100 million. This strategic move marks a significant transformation for TWE, as it propels the company toward an enhanced emphasis on a luxury-driven portfolio, amplifying its presence in crucial growth markets, notably the U.S.

Browse through Grand View Research's Alcohol Tobacco Industry Research Reports.

- The global wine market size was valued at USD 417.85 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2021 to 2028.

- The global rice wine market size was estimated at USD 4.90 billion in 2023 and is anticipated to grow at a CAGR of 4.3% from 2024 to 2030.

U.S. Wine Market Segmentation

Grand View Research has segmented the U.S. wine market based on product and distribution channel.

U.S. Wine Product Outlook (Revenue, USD Million, 2018 - 2030)

- Table Wine

- Dessert Wine

- Sparkling Wine

U.S. Wine Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- On-trade

- Off-trade

Key Companies profiled:

- J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Trinchero Family Estates

- Pernod Ricard

- Deutsch Family Wine Spirits

- Accolade Wines

- Castel Frères

- Casella Family Brands

- Bronco Wine Company

Key U.S. Wine Company Insights

- J. Gallo owns fifteen wineries and oversees over 20,000 acres of vineyards in California. The company also collaborates with growers nationwide to ensure a consistent supply.

- Constellation Brands, Inc., is a U.S.-based producer distributor of beer, wine, and alcohol spirits. The company has over 40 breweries, distilleries, wineries, and corporate offices in nine countries-the U.S., Australia, China, Canada, Switzerland, Italy, Mexico, New Zealand, and Hong Kong. Constellation Brands has a portfolio of over 100 brands, including Corona, Modelo, Kim Crawford, Cooper Thief, Robert Mondavi, Ruffino, Casa Noble, SVEDKA, and Mi Campo.

Recent Developments

- In August 2023, J. Gallo's Luxury Wine Groupannounced an agreement with the Rombauer family to acquire Rombauer Vineyards. The acquisition encompasses the Rombauer Vineyards brand, three state-of-the-art winery and production facilities, two tasting rooms offering stunning vineyard panoramas, and extensive 700-plus acres of vineyards under sustainable cultivation in Carneros, St. Helena, Atlas Peak, Sonoma Valley, Calistoga, and the Sierra Foothills.

- In June 2023, E. J. Gallo Winery announced its acquisition of the Hahn Family Wines portfolio, enhancing Gallo's current offerings throughout the Central Coast. This strategic investment includes well-known brands such as Hahn SLH, Smith Hook, and Hahn.

Order a free sample PDF of the U.S. Wine Market Intelligence Study, published by Grand View Research.