Commercial Drone Industry Overview

The global commercial drone market size was estimated at USD 19.89 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. The market growth is attributed to the increasing enterprise application of drones across various industry verticals. Several drone manufacturers are continually testing, inventing, and upgrading solutions for diverse markets. Besides, the integration of modern technologies in commercial drones to deliver enhanced solutions is opening new growth opportunities for the commercial drone industry. The business use cases of commercial drones have expanded significantly over the past few years.

Drones are increasingly adopted in the construction and real estate sectors due to their ability to survey a property, offer constant and exact project alerts, increase safety, and prevent harmful accidents on construction sites. Moreover, their conventional applications, such as monitoring, surveillance, and security, have boosted the product demand for search and rescue operations, identifying unstable roofs in dangerous and inaccessible positions, and inspecting elevated infrastructure that might damage equipment such as electrical cables.

Gather more insights about the market drivers, restrains and growth of the Commercial Drone Market

The commercial drone market growth is further driven by technological advances in electronics, such as modern computing, microcontrollers, processors, mobile hardware, and cameras. For instance, in September 2022, AeroVironment Inc. launched Vapor 55MX, a next-generation VAPOR Helicopter that caters to customers from the defense, commercial, and industrial sectors.

Technological advancements allow companies to design and construct measurement and annotation tools for estimating area, volume, and distance. As a result, organizations are constantly adopting Artificial Intelligence (AI) and Machine Learning (ML) solutions to retrieve accurate findings from large volumes of data. Integration of these modern technologies provides the industry with ample opportunities as they facilitate real-time, data-driven decision-making through high-speed data capture, processing, and transfer. AI-powered drones also allow users to interact and observe footage captured by other drones in real-time and track their flight paths.

Furthermore, due to the COVID-19 outbreak, there has been a significant surge in the use of drone technology in various contexts, with drones becoming immensely beneficial in such scenarios. To speed up transportation turnaround times and reduce the risk of infection, drones were widely used in the healthcare industry for the pickup and delivery of test samples and the transportation of medical supplies. According to UNICEF, over eighteen countries used drones for delivery and transportation throughout the pandemic.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global net-zero energy buildings market size was valued at USD 46.60 billion in 2023 and is projected to grow at a CAGR of 17.5% from 2024 to 2030.

- The global food robotics market size was valued at USD 1.81 billion in 2023 and is projected to grow at a CAGR of 20.6% from 2024 to 2030.

Commercial Drone Market Segmentation

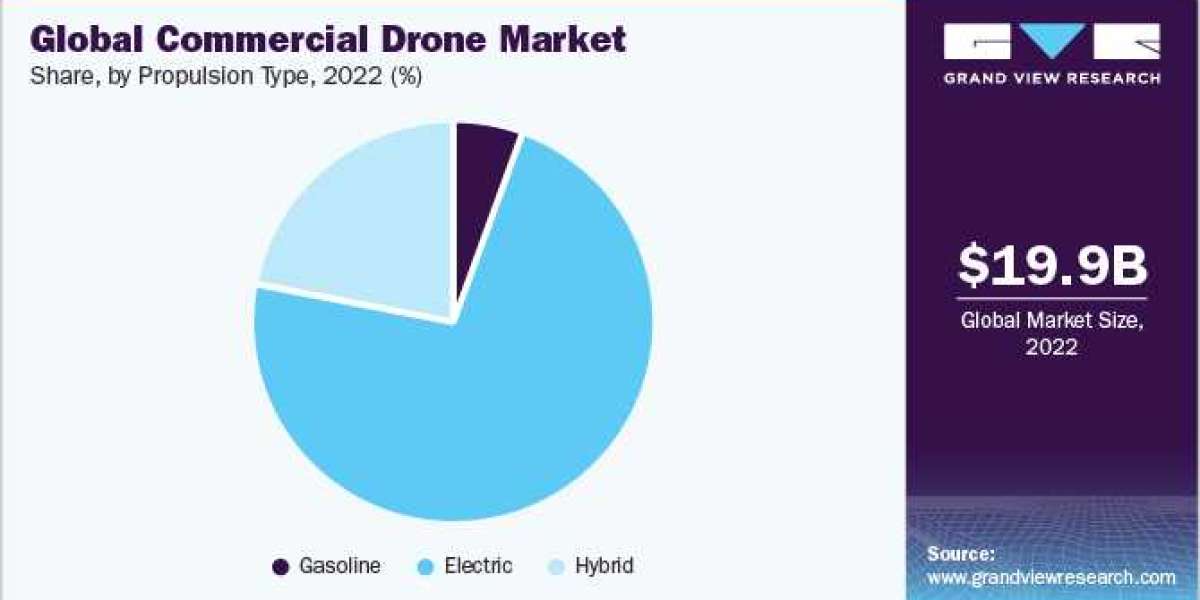

Grand View Research has segmented the global commercial drone market based on product, application, end-use, propulsion type, range, operating mode, endurance, maximum takeoff weight, and region:

Commercial Drone Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

- Fixed wing

- Hybrid

- Rotary blade

Commercial Drone Application Outlook (Revenue, USD Million, 2018 - 2030)

- Commercial

- Filming Photography

- Inspection Maintenance

- Mapping Surveying

- Precision Agriculture

- Surveillance Monitoring

- Others

- Government Law Enforcement

- Firefighting Disaster Management

- Search Rescue

- Maritime Security

- Border Patrol

- Police Operations

- Traffic Monitoring

- Others

Commercial Drone End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Agriculture

- Delivery Logistics

- Energy

- Media Entertainment

- Real Estate Construction

- Security Law Enforcement

- Others

Commercial Drone Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

- Gasoline

- Electric

- Hybrid

Commercial Drone Range Outlook (Revenue, USD Million, 2018 - 2030)

- Visual Line of Sight (VLOS)

- Extended Visual Line of Sight (EVLOS)

- Beyond Visual Line of Sight (BVLOS)

Commercial Drone Operating Mode Outlook (Revenue, USD Million, 2018 - 2030)

- Remotely Piloted

- Partially Piloted

- Fully Autonomous

Commercial Drone Endurance Outlook (Revenue, USD Million, 2018 - 2030)

- 5 Hours

- 5 - 10 Hours

- 10 Hours

Commercial Drone Maximum Takeoff Weight Outlook (Revenue, USD Million, 2018 - 2030)

- 25 Kg

- 25 - 500 Kg

- 500 Kg

Commercial Drone Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Ireland

- Sweden

- Denmark

- Norway

- Finland

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East Africa (MEA)

- UAE

- South Africa

Key Companies profiled:

- Aeronavics Ltd.

- AeroVironment Inc.

- Autel Robotics

- SZ DJI Technology Co Ltd

- Draganfly Innovations Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd

- Intel Corporation

- Parrot Drones SAS

- PrecisionHawk Inc.

- YUNEEC International

Order a free sample PDF of the Commercial Drone Market Intelligence Study, published by Grand View Research.