Solid Oxide Fuel Cell Industry Overview

The global solid oxide fuel cell market size was estimated at USD 627.43 million in 2023 and is expected to grow at a CAGR of 40.7% from 2024 to 2030.

The increasing private-public partnerships are one of the key factors fostering market growth. Solid oxide fuel cells (SOFC) are one of the fastest-growing alternate backup power options, primarily due to their ability to generate electricity using a variety of fuels. In addition, they are eco-friendly as their by-product is harmless, unlike other conventional technologies.

Gather more insights about the market drivers, restrains and growth of the Solid Oxide Fuel Cell Market

Favorable government regulations and their ability to cut down emission rates and use domestic energy sources, such as natural gas, are some of the key factors likely to boost the over the next eight years. Furthermore, the rising emphasis of the regional governments of mature economies, such as the U.S. and Europe, on reducing emissions and their inclination toward a technological shift to support or, to some extent, even replace the aging electric grids is likely to drive the market over the forecast period.

Drivers, Opportunities Restraints

Proactive involvement and coordination between public and private companies are essential to deploy hydrogen fuel to the expanding application base and implement new, economically viable technologies. During the forecast period, the market is anticipated to witness a rise in public-private partnerships, especially for RD projects.

SOFC is emerging as one of the prominent fuel cell technologies worldwide. The governments of countries such as the U.S., Japan, South Korea, and the European Union have aided vendors worldwide to enhance research development efforts due to the availability of research grants and funds disbursed by organizations such as the U.S. Department of Energy.

The high cost of solid oxide fuel cell systems is anticipated to increase total vehicle costs and stationary power application costs compared to substitute fuel cell technologies. Hence, a major challenge for market players lies in developing technologies or systems to manage the solid oxide fuel cell stack and balance of plant (BOP) costs while increasing the system’s service lifetime. Implementing suitable policies that help manufacturers achieve economies of scale will likely play a key role in making this technology economically viable.

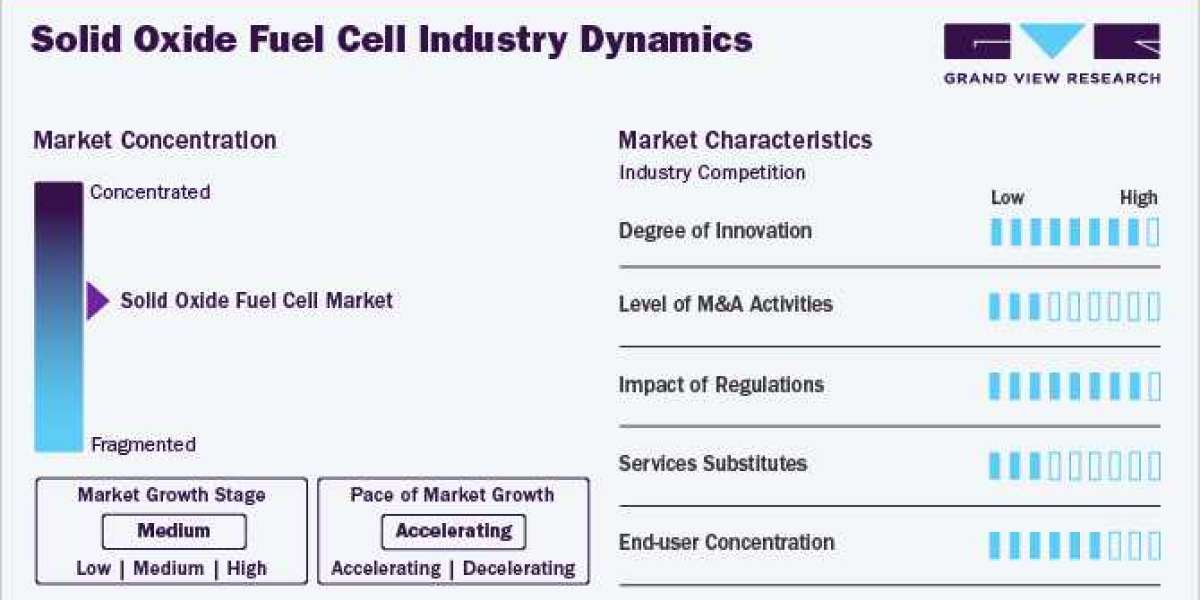

Market Concentration Characteristics

The solid oxide fuel cell (SOFC) market is poised for significant growth, driven by several key dynamics: growing demand for clean energy, technological advancements, government support and incentives, increasing applications in data centers, and rising investments and partnerships. Continuous RD efforts lead to improvements in SOFC technology, such as increased energy conversion efficiency, reduced manufacturing costs, and enhanced durability, making SOFCs more competitive with other energy technologies and driving market adoption.

Many countries offer financial incentives, subsidies, and policy support to encourage SOFC adoption, with the U.S. providing funding for small-scale SOFC system design and construction. The increasing demand for data center services, particularly in Asia Pacific, is creating opportunities for SOFC deployment, as data centers require reliable and efficient power sources.

Major players in the market invest in RD, manufacturing capacity, and strategic partnerships to drive market growth, with Asia Pacific, led by China and Japan, anticipated to dominate the global market due to strong government support and growing demand for clean energy technologies.

Browse through Grand View Research's Renewable Energy Industry Research Reports.

- The global sucrose esters market size was estimated at USD 82.50 million in 2023 and is projected to grow at a CAGR of 5.0% in terms of revenue from 2024 to 2030.

- The global fuel ethanol market size was valued at USD 100.9 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030.

Solid Oxide Fuel Cell Market Segmentation

Grand View Research has segmented the solid oxide fuel cell market report based on application, and region:

SOFC Application Outlook (Volume, Thousand Units; Capacity, kW; Revenue, USD Million, 2019 - 2030)

- Transportation

- Portable

- Stationary

SOFC Regional Outlook (Volume, Thousand Units; Capacity, kW; Revenue, USD Million, 2019 - 2030)

- North America

- U.S.

- Europe

- Germany

- France

- UK

- Asia Pacific

- China

- Japan

- South Korea

- Rest of World

Key Companies profiled:

- Bloom Energy

- Mitsubishi Power Ltd.

- Cummins Inc.

- Ceres

- General Electric

- FuelCell Energy Inc.

- Ningbo SOFCMAN Energy

- KYOCERA Corporation

- AVL

- NGK SPARK PLUG CO., LTD.

Recent Developments

- In March 2024, Nissan started trials of a power generation system fueled by bio-ethanol, which is powered by SOFC. The trials began at Nissan’s Tochigi Plant, the company aims to improve power generation capacity toward full-scale operations by 2030

- In March 2023, Elcogen and Bumhan announced a partnership to commercialize SOFCs and electrolyzers. Under the agreement, Elcogen will facilitate the supply of SOEC and SOFC technology, which offers efficient solutions to emission-free energy production

- In February 2023, Weichai Power launched a stationary power SOFC system based on Ceres technology with EU CE certification of TÜD SÜD. Moreover, the SOFC achieved an operational time of 30,000 hours

Order a free sample PDF of the Solid Oxide Fuel Cell Market Intelligence Study, published by Grand View Research.