Managed Services Industry Overview

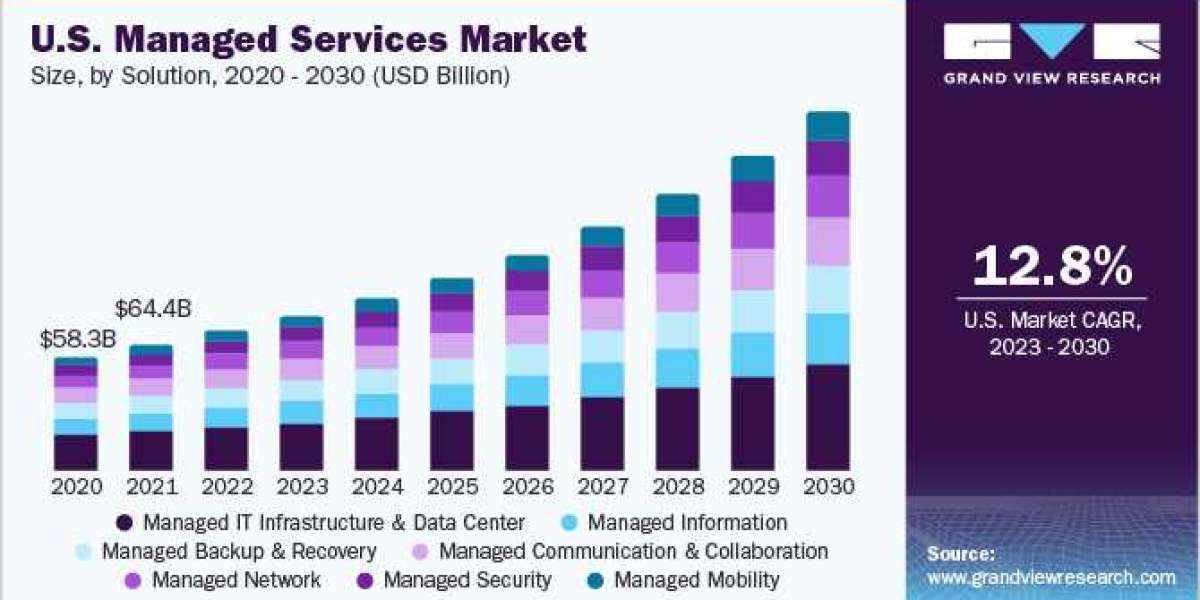

The global managed services market size was estimated at USD 299.01 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030.

Managed services reduce downtime redundancy and provide customized value-added services such as application testing, service catalog building, and expert consultancy. Multiple monitoring tools and several layers of infrastructure managed by isolated teams contribute to market growth. Furthermore, to streamline infrastructure and reduce costs, enterprises globally are migrating to the cloud platform and adopting managed IT services to optimize their infrastructure costs. Professional and managed services help enterprises compete with this digital transformation faster and more efficiently. Market players are focusing on unveiling innovative managed services for enterprise businesses to acquire a significant share of this potential market.

Gather more insights about the market drivers, restrains and growth of the Managed Services Market

The companies operating in the managed services market are establishing strategic partnerships to provide their cloud infrastructure managed services to the client for increased security compliance and enhanced business performance. For instance, in April 2023, Sinch, a Microsoft Operator Connect partner, announced a partnership with Synoptek to provide managed and professional services for the Microsoft Teams Phone System, which is integrated with direct routing or operator connect. Factors such as improving operational efficiency by focusing more effectively on core competencies, cutting operating expenses, and increasing use of cloud-based technologies such as automation, IoT, blockchain, and cloud computing are driving market growth.

Moreover, managed services focusing on providing secure and customized IT solutions and end-to-end hosting applications are expected to drive market growth. For instance, in November 2022, UiPath, an automation software provider, extended its partnership with Neostella, an enterprise automation software provider, to offer managed services for midmarket business segment. With this partnership, Neostella offers RPA-managed services based on customers’ specific requirements and also eliminates requirements for up-front licensing.

Rising end-user firms’ focus on transferring their business operations to cloud platforms is driving the growth of the managed services market in Australia. For instance, in February 2023, Tech Data Corp., a technology solutions company, launched its cloud managed services in Australia, enabling clients to leverage advanced cloud technology-equipped tools, platform to grow their businesses.

Managed services involve outsourcing management functions to a third party to advance business operations. Introduction of cloud-based technologies and their technological proliferation have led to managed services. Managed services assist businesses in improving operational efficiency and cutting down companies' operating expenses. Moreover, an increasing preference for outsourcing management functions to cloud service providers and managed service providers is anticipated to drive the market's growth over the forecast period.

Adoption of cloud services has particularly increased as businesses remain keen on ensuring business scalability. Most companies are renewing their contracts with managed cloud service providers in anticipation of cloud migration becoming more common among enterprises and, in some cases, even gaining traction. Furthermore, businesses and organizations strongly emphasize adopting latest technologies, such as machine learning and augmented reality, along with their existing IT infrastructure as part of the efforts to encourage digital transformation.

Adoption of the latest technologies, such as artificial intelligence (AI), cloud management, and others, is eventually helping organizations meet various functional business requirements while driving business process optimization. Managed services deliver effective functionalities at minimal costs without compromising on quality. In addition, managed services also support and ensure the reliability and consistency of services offered for various business processes.

As cyber threats become more prevalent, organizations are adopting managed security services (MSSs) into their business models. There is an increase in cyber threats in government sectors and enterprises. Thus, forcing managed service providers (MSPs) to develop advanced offerings that can detect and address cyber risks. For instance, in April 2023, Aeries Technology, a consulting and professional services provider, announced the launch of cyber security managed services. The new offering includes application security services; data security privacy; identity access management; cloud infrastructure security; governance, risk, compliance; security operations center services; enterprise security design implementation; and audit compliance certifications.

However, a lack of knowledge and experience in integrating new technologies and implementing managed services is expected to limit the market's growth. Other factors, such as concerns about efficacy of managed services models, concerns about data security and privacy protection, and need for skilled resources, among others, are expected to limit market growth to some extent.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global net-zero energy buildings market size was valued at USD 46.60 billion in 2023 and is projected to grow at a CAGR of 17.5% from 2024 to 2030.

- The global food robotics market size was valued at USD 1.81 billion in 2023 and is projected to grow at a CAGR of 20.6% from 2024 to 2030.

Managed Services Market Segmentation

Grand View Research has segmented the global managed services market report based on solution, managed information service (MIS), deployment, enterprise size, end use, and region:

Managed Services Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Managed IT Infrastructure Data Center

- Server Management

- Storage Management

- Managed Print Services

- Others

- Managed Network

- Managed Wi-Fi

- Managed LAN

- Managed VPN

- Managed WAN

- Network Monitoring

- Others

- Managed Mobility

- Application Management

- Device Life Cycle Management

- Managed Communication Collaboration

- Managed Voice over Internet Protocol (VoIP)

- Managed Unified Communications as a Service (UCaaS)

- Others

- Managed Information

- Managed Operational Support Systems/Business Support Systems (OSS/BSS)

- Business Process Management

- Managed Security

- Managed Firewall

- Managed Vulnerability Management

- Managed Risk Compliance Management

- Managed Antivirus/Antimalware

- Managed Encryption

- Managed Unified Threat Management

- Managed Security Information Event Management (SIEM)

- Managed Intrusion Detection Systems/Intrusion Prevention Systems (IDS/IPS)

- Others

- Managed Backup and Recovery

Managed Services Managed Information Service (MIS) Outlook (Revenue, USD Billion, 2018 - 2030)

- Business Process Outsourcing (BPO)

- Business Support Systems

- Project Portfolio Management

- Others

Managed Services Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- On-premise

- Hosted

Managed Services Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Small Medium Enterprises (SMEs)

- Large Enterprises

Managed Services End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Government

- Healthcare

- IT Telecom

- Manufacturing

- Media Entertainment

- Retail

- Others

Managed Services Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East Africa (MEA)

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

Key Companies profiled:

- Accenture

- Atera Networks Ltd.

- ARYAKA NETWORKS, INC.

- ATT Inc.

- BMC Software, Inc.

- Broadcom

- Cisco Systems, Inc.

- DXC Technology Company

- Fujitsu

- HCL Technologies Limited

- HP Development Company, L.P.

- International Business Machines Corporation

- Lenovo

- ScalePad Software Inc.

- Telefonaktiebolaget LM Ericsson

Key Managed Services Company Insights

Some of the key players operating in the market include Accenture, International Business Machines Corporation, and Cisco Systems, Inc.

- Accenture provides various infrastructure-managed services that include hosting, migrating, and managing the client’s infrastructure. It also helps clients streamline the human-centric experiences to optimize the physical workspace and support workforce collaboration.

- Cisco Systems, Inc. offers managed services to protect the clients’ end-point devices and provides actionable insights to the clients to assist them in making data-driven decisions to maximize business profitability.

Recent Developments

- In October 2023, technology services provider Logicalis launched an Intelligent Connectivity suite that includes solutions such as SASE, SSE, SD-WAN, and Private 5G powered by Cisco Systems, Inc. This will enable Logicalis customers to access digitally managed services developed using Cisco technology and supported by the Logicalis Digital Fabric Platform.

- In September 2023, communications technology solution provider Cloud5 Communications launched its new managed services division. The division is designed to support the IT-related requirements challenges in various markets, such as the hospitality industry, student housing, and senior living, among others. This division will assist consumers in efficiently managing IT operations, technology infrastructures, and security.

- In May 2023, Alfar Capital and Walter Capital Partners completed the acquisition of MSP Corp, a managed IT service provider in Canada. The MSP Corp would merge with Groupe Access, an MSP of IT and cybersecurity solutions. The acquisition would help company to deliver cutting-edge solutions and strengthen its position in Canada.

- In January 2023, Rackspace Technology, a multi-cloud technology solutions provider, launched Rackspace Technology Modern Operations, a managed service for public cloud for customers across Azure, AWS, and GCP. The service will provide benefits including 24x7x365 managed support, cloud expertise, cloud resiliency, and innovation with cloud services which help the company’s customers manage complex cloud environments.

Order a free sample PDF of the Managed Services Market Intelligence Study, published by Grand View Research.