Ultrasound Devices Industry Overview

The global ultrasound devices market size was estimated at USD 9.79 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.24% from 2024 to 2030. The market growth is poised to be driven by the rising usage of ultrasound equipment for diagnostic imaging and treatment, along with the increasing prevalence of chronic and lifestyle disorders. Other factors influencing market growth include increased demand for minimally invasive surgeries and frequent developments in ultrasound imaging technology. Ultrasound is a leading diagnostic tool in medical imaging, compared to other diagnostic imaging systems, since it is less expensive and faster. Moreover, as it does not utilize ionizing radiation or magnetic fields, it is safer than other imaging technologies.

Gather more insights about the market drivers, restrains and growth of the Ultrasound Devices Market

Both diagnostic and therapeutic uses for the ultrasonic medical device are extensive. Specific therapeutic applications of ultrasound, from oncology to cardiology, have grown in popularity. The development of wireless transducers, app-based ultrasound technology, fusion with CT/MR, laparoscopic ultrasound, and the expansion of ultrasound device applications in 3D imaging and shear wave elastography are expected to support market growth. For instance, in March 2023, KronosMD, INC., a division of Kronos Advanced Technologies Inc., confirmed its acquisition of all current and future properties and patents related to its planned breakthrough 3D ultrasonic dentistry imaging and diagnostic equipment.

As the transaction approaches completion, it aims to boost the industrialization of the S-WAVETM system and S-WAVETM ultrasonic imaging equipment. Currently, manufacturers are focusing on expanding product applications in radiology. Radiologists still utilize 2-D ultrasound imaging for examinations even though 3-D/4-D volume imaging in obstetrics and gynecology and 4DUS imaging are used to visualize heart wall movements. Manufacturers and scientists have driven interest in the market due to improved imaging quality and workflow and growing awareness about radiation dose issues with other imaging modalities. Real-time ultrasound imaging can be very important in the emerging field of fusion imaging.

Due to radiologists' predilection for modalities, such as CT and MRI, ultrasound fusion imaging needs to be more well-established in the radiology industry. Radiologists are concentrating more on the market due to recent developments in ultrasound imaging technology and growing radiation exposure concerns. The COVID-19 pandemic has led the healthcare sector to face many difficulties. As installations were delayed and manufacturers had to concentrate on producing COVID-critical devices, there was an uneven demand for ultrasound devices during the pandemic. However, handheld ultrasound devices were in high demand due to their effectiveness, portability, speed, and usability in treating patients needing critical care in crowded hospitals.

Browse through Grand View Research's Medical Imaging Industry Research Reports.

- The global medical imaging market size was estimated at USD 39.8 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030.

- The global handheld ultrasound devices market size was estimated at USD 298.2 million in 2023 and is expected to grow at a CAGR of 5.6% from 2024 to 2030.

Ultrasound Devices Market Segmentation

Grand View Research has segmented the global ultrasound devices market on the basis of on product, portability, application, end-use, and region:

Ultrasound Device Product Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostic Ultrasound Devices

- 2D

- 3D/4D

- Doppler

- Therapeutic Ultrasound Devices

- High-intensity Focused Ultrasound

- Extracorporeal Shockwave Lithotripsy

Ultrasound Device Portability Outlook (Revenue, USD Million, 2018 - 2030)

- Handheld

- Compact

- Cart/Trolley

- Point-of-Care Cart/Trolley Based Ultrasound

- Higher-end Cart/Trolley Based Ultrasound

Ultrasound Device Application Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiology

- Obstetrics/Gynaecology

- Radiology

- Orthopaedic

- Anaesthesia

- Emergency Medicine

- Primary Care

- Critical Care

Ultrasound Device End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Imaging Centres

- Research Centres

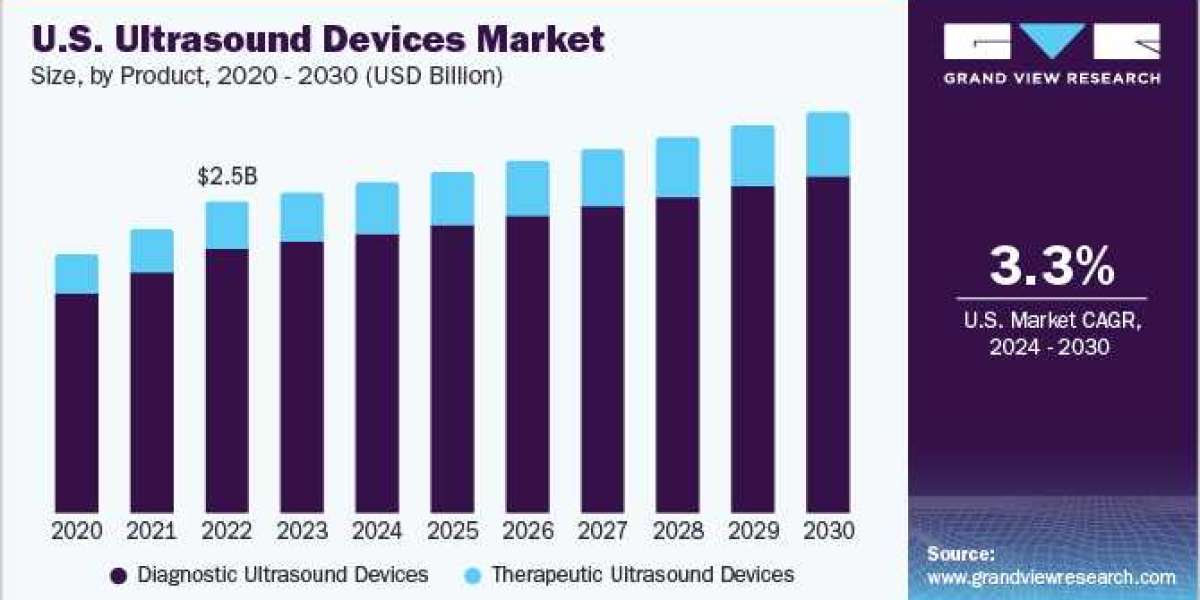

Ultrasound Device Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Norway

- Denmark

- Sweden

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Koninklijke Philips N.V.

- GE Healthcare

- Siemens Healthineers AG

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- FUJIFILM SonoSite, Inc.

- Konica Minolta Inc.

- Esaote

Key Ultrasound Devices Company Insights

Major players are working to improve their product offerings by upgrading their products, taking advantage of important cooperation activities, and exploring acquisitions and government clearances to expand their customer base and gain a larger market share. For instance, in March 2023, Siemens Healthineers announced the evolution of the Acuson Sequoia Flagship series of ultrasound devices at the European Congress of Radiology (ECR), 2023, in Vienna. With an estimated growth rate of 6.3% to reach a value of USD 9.0 billion by 2026, Ultrasound is one of the fastest-growing global markets.

In addition, in February 2023, Boston Imaging launched the Hera W10 Elite, the exclusive model of the Hera platform for obstetrics and gynecology, providing clinicians with powerful AI tools and clinical applications to enhance the diagnostic experience. Boston Imaging is the U.S. headquarters for marketing, sales, and distribution of all Samsung digital radiography and ultrasound systems.

Order a free sample PDF of the Ultrasound Devices Market Intelligence Study, published by Grand View Research.