Application Delivery Controller Industry Overview

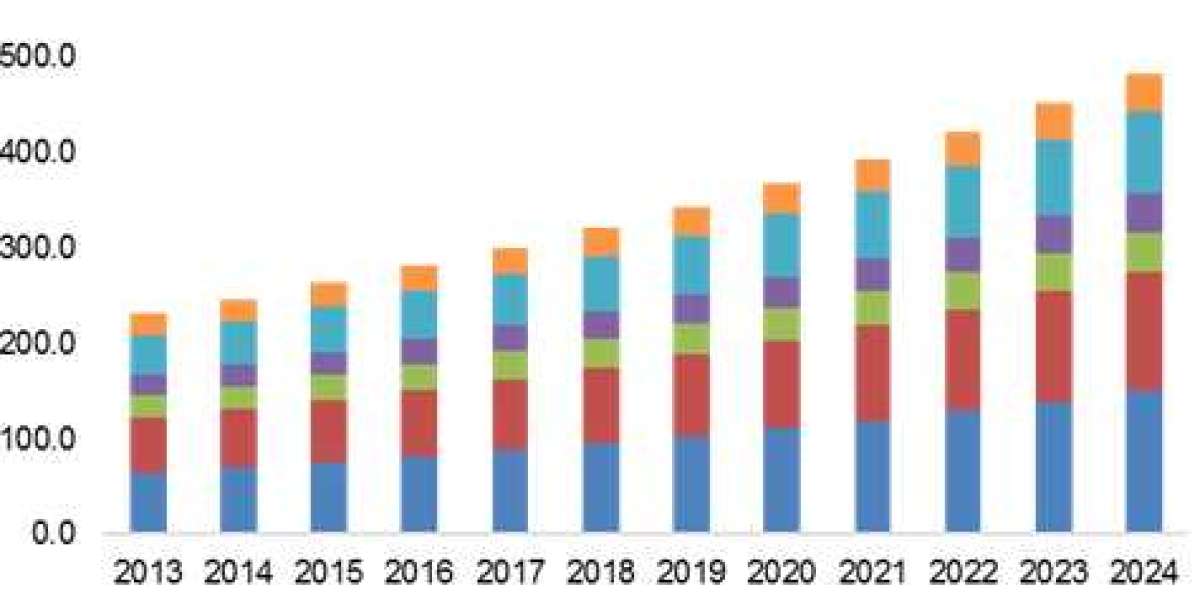

The global application delivery controller market accounted for USD 4.34 billion in 2021 and is expected to witness growth at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2029. An ADC is a device that is typically placed in a data center between one or more applications and the server’s firewall. Application delivery controllers have gained traction within the last decade, largely due to the growing need for legacy load balancing appliances to improve the performance as well as to handle more advanced requirements associated with application delivery. ADCs are purpose-built networking appliances that function to improve the security, resiliency, and performance of apps delivered over the web.

Gather more insights about the market drivers, restrains and growth of the Application Delivery Controller Market

The industry is expected to grow at a considerable rate owing to the increasing requirement for cloud computing, big data, and virtualization that has resulted in an increased requirement for efficient and reliable webbing solutions. Emerging technologies, such as software-defined storage and software-defined networking, are anticipated to propel the application delivery controller market demand over the forecast years.

The growing end-user mobility is extending the connectivity requirements for corporate IT resources. The rise in the number of mobile device connections is further increasing the scale of the challenges faced. Furthermore, companies are increasingly focusing on implementing policies such as "Bring Your Own Device", resulting in the introduction of additional end-points (i.e. laptops, tablets, and smartphones) into the network environment, which results in increased network complications.

The governments worldwide are aware of the increased importance of the internet in particular as well as of the growing criticality of IT in general. This awareness has resulted in the increased emphasis on regulations and legislations owing to the government’s attempt to exert control over the business operations. These regulations include Payment Card Industry Data Security Standard (PCI DSS), Health Insurance Privacy and Accountability Act (HIPPA), Communications Assistance for Law Enforcement Act (CALEA), and Gramm-Leach-Bliley Act, among others.

The mounting ADC demand in countries including the U.S., UK, and Germany is anticipated to offer avenues for growth over the next eight years. Asia Pacific is expected to exhibit a substantial growth rate over the next eight years majorly owing to the increasing globalization, distributed enterprise architecture, rising security awareness, and rapid population increase, primarily in countries including China and India.

Browse through Grand View Research's Network Security Industry Research Reports.

- The global bring your own device market size was valued at USD 90.59 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.9% from 2023 to 2030.

- The global Software-Defined Storage (SDS) market size was valued at USD 1,900.9 million in 2015. The market is anticipated to gain traction, owing to the emergence of the Big Data technology.

Application Delivery Controller Market Segmentation

Grand View Research has segmented the application delivery controller market on the basis of deployment, enterprise size, end-use, and region:

Application Delivery Controller Deployment Outlook (Revenue, USD Million; 2017 - 2029)

- Hardware-based ADCs

- Virtual ADCs

Application Delivery Controller Enterprise Size Outlook (Revenue, USD Million; 2017 - 2029)

- Small Medium Enterprise

- Large Enterprise

Application Delivery Controller End-Use Outlook (Revenue, USD Million; 2017 - 2029)

- IT Telecom

- BFSI

- Government

- Healthcare

- Retail

- Others

Application Delivery Controller Regional Outlook (Revenue, USD Million; 2017 - 2029)

- North America

- U.S.

- Canada

- Europe

- U.K

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- Latin America

- Brazil

- Mexico

- MEA

- Saudi Arabia

- UAE

Key Companies profiled:

- F5 Networks; Inc.

- A10 Networks; Inc.

- Array Networks; Inc.

- Citrix Systems

- Brocade Communications Systems; Inc.

- Dell Inc.

- Fortinet Inc.

- Barracuda Networks Inc.

- KEMP Technologies Inc.

Key Application Delivery Controller Company Insights

The industry is consolidated in nature owing to the presence of a few industry players that govern the market. The key industry players include F5 Networks, Inc., A10 Networks, Inc., Array Networks, Inc., Citrix Systems, Brocade Communications Systems, Inc., Dell Inc., Fortinet Inc., Barracuda Networks Inc., and KEMP Technologies Inc. among others. Mergers acquisitions to expand the existing product portfolio and gain advantage remains to be a key growth strategy. For example, in 2015, Brocade acquired the SteelApp business unit from the Riverbed technology to strengthen the company‘s software networking portfolio for the new IP data center deployments.

Recent Developments

- In May 2023, F5 announced Distributed Cloud Services to provide security and connectivity at both the network and application layers. The services connect APIs and apps across cloud, hybrid, and edge environments.

- In April 2023, A10 Networks announced a combined solution of the Thunder Application Delivery Controller (ADC) and the new A10 Next-Generation Web Application Firewall (WAF) to ensure security and resilience for hybrid cloud environments.

Order a free sample PDF of the Application Delivery Controller Market Intelligence Study, published by Grand View Research.