Sales Intelligence Industry Overview

The global sales intelligence market size was valued at USD 2.95 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030.

Artificial intelligence (AI) has demonstrated a potential impact on the sales industry over the past decade. For instance, AI-enabled solutions like chatbots have improved customer interactions and related services in the B2C (Business-to-Consumer) domain. Also, fintech organizations offer the end-use industries a wide range of AI-supported advisor services to make automated investment decisions. Sales intelligence provides marketers with precise information about buyers and improves the process of content mapping and creation. The accessibility to real-time, enriched company data helps salespeople boost their lead generation process and transactions. Exponentially increasing data volumes, strict regulations, and low interest rates are encouraging organizations to reconsider their traditional business strategies.

Gather more insights about the market drivers, restrains and growth of the Sales Intelligence Market

Also, recent technological advancements have paved the way for artificial intelligence in sales and marketing operations. Connection of knowledge, domain-enriched Machine Learning (ML), and Natural Language Processing (NLP) are adopted by several companies to offer improved sales intelligence software and services. For instance, in September 2019, China Asset Management, a China-based fund management company, collaborated with Microsoft’s researchers to develop an AI model. This AI model analyzes the vast amount of real-time data of financial transactions, to provide insights about clients’ budgets and financial status. This partnership was done under Microsoft’s Innovation Partnership program, which allows the sharing of AI expertise with companies across various industries. This program is anticipated to help these industries derive digital transformation in their portfolio.

Artificial intelligence is integrated with sales and marketing for data extraction about a company’s several operations. These operations include extracting insights about organizational reporting structure, decision-making, customer experience and interfaces, year-over-year growth, strategic initiatives, and investment processes. An essential application of sales intelligence is lead generation. Many companies have dedicated teams to generate new business prospects. Sales intelligence provides the marketing team with an organization chart that includes a visual map of a company’s reporting structure of the entire department of peers and their hierarchy in the organization.

Researchers have made tremendous strides in developing the ultimate human-machine interaction systems in recent years. AI is used to capture audio, text, and imagery data from various vendor/internal databases and public sources by implementing computer vision, NLP, and machine learning programs. For instance, computer vision and NLP are used for data extraction from issuer filings for valuation models and transcription of analyst conference calls. More extensive programs will further process the information gathered from various sources to generate insights into the decision-making process. It often requires advanced AI techniques, such as machine learning and deep learning.

Businesses across various end-use verticals are realizing the importance of improving customer targeting to extract the best potential for future revenue. As a result, they are increasingly relying on advanced solutions for enhancing their customer targeting processes. Such solutions assist in the identification of new sales opportunities at non-customer companies as well as existing client accounts. Further, the marketing and sales executives implement such solutions for seamless workflows along with carrying out more efficient operations.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global robotic process automation market size was valued at USD 2,942.7 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 39.9% from 2023 to 2030.

- The global natural language processing market size was valued at USD 27.73 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 40.4% from 2023 to 2030.

Sales Intelligence Market Segmentation

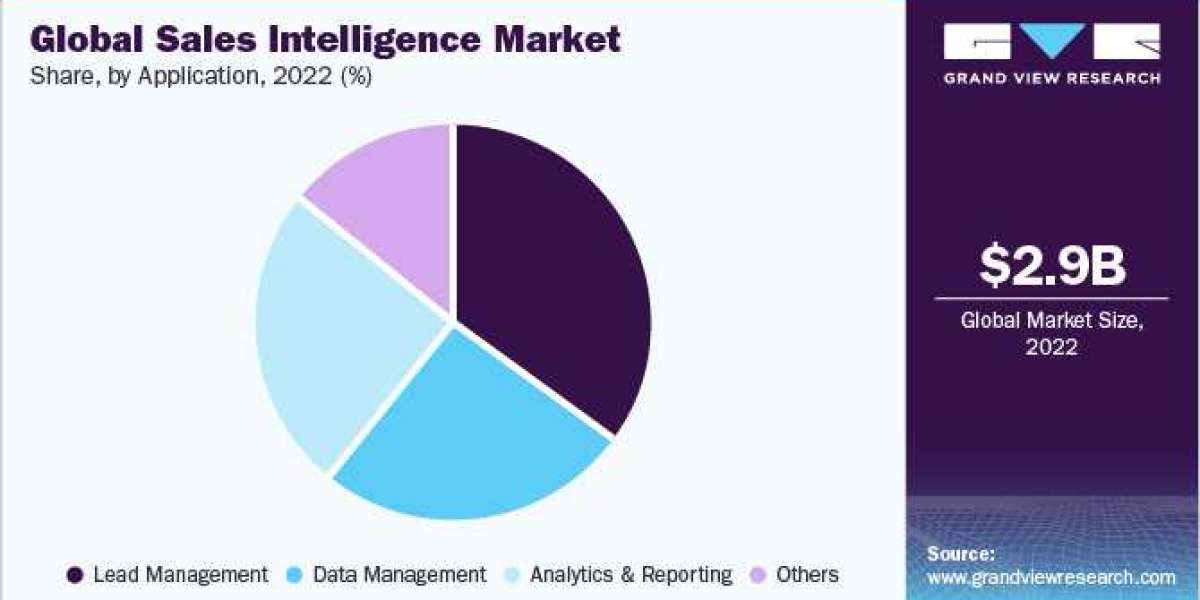

Grand View Research has segmented the global sales intelligence market based on offering, application, deployment mode, organization size, vertical, and region:

Sales Intelligence Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Software

- Service

Sales Intelligence Application Outlook (Revenue, USD Million, 2017 - 2030)

- Analytics and Reporting

- Data Management

- Lead Management

- Others

Sales Intelligence Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

- Cloud

- On-Premises

Sales Intelligence Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

- SMEs

- Large Enterprises

Sales Intelligence Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- BFSI

- IT Telecom

- Retail E-Commerce

- Healthcare

- Media Entertainment

- Others

Sales Intelligence Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Key Companies profiled:

- Clearbit

- DEMANDBASE, INC.

- Dun Bradstreet

- DueDil Ltd

- EverString Technology

- FullContact

- GRYPHON NETWORKS

- com

- Insideview

- LeadGenius

- LinkedIn Corporation

- List Partners LLC

- Oracle

- Relationship Capital Partners Inc. and RelPro, Inc.

- RingLead, Inc.

- UpLead

- Yesware, Inc.

- Zoho Corporation Pvt. Ltd.

- Zoom Information, Inc.

Recent Developments

- In June 2023, Vidyard Rooms announced the launch of its new Digital Sales Rooms (DSR). The company aims to transform how sellers and buyers engage in the digital-first era.

- In May 2023, Gong.io Inc. introduced Gong Insights, a new product that automatically transfers insights obtained from the Gong revenue intelligence platform to a company's current business intelligence (BI) platform. The solution is created in collaboration with the U.S.-based data cloud company, Snowflake.

- In March 2023, 6sense announced the launch of revenue AI for sales. By making it simpler to locate prospects and accounts in-market for products, prioritize a seller's day with high-impact activities, and identify deeper data about buyers and marketing tools, this new platform was developed to improve sellers' daily lives.

- In March 2023, DemandScience US, a top B2B demand generation company, announced the general release of Klarity, its next-generation self-service sales intelligence tool for creating, sharing, and saving contact lists. 'One-click prospecting' is now a reality for sales professionals because of Klarity's Chrome extension, user-friendly UI, and email accuracy.

Order a free sample PDF of the Sales Intelligence Market Intelligence Study, published by Grand View Research.