Operating Room Integration Industry Overview

The global operating room integration market size was estimated at USD 1.86 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. Increasing demand for technologically advanced Applications, a growing number of surgical procedures, congestion in Operating Rooms (OR), patient safety concerns in OR coupled with the surge in preference for Minimally Invasive Surgeries (MIS) are major factors primarily fueling the market growth. A decrease in the number of surgical procedures led to a decline in demand for devices and products required for respective procedures. For instance, Barco’s co-CEOs have recognized problems with the supply chain, producing value from technology, organizational structure, and RD.

Gather more insights about the market drivers, restrains and growth of the Operating Room Integration Market

Longer intervals of peak loads in hospitals often produce an exponentially rising surgery waitlist of semi-urgent and non-urgent surgeries. The COVID-19 caused considerable wait times for patients standing by for surgery. A study published in the British Journal of Surgery showed that COVID-19 led to 28 million postponed or canceled surgeries globally in 2020 with millions of surgeries pushed into 2021. Thus, with thousands of patients facing delays in surgeries the necessity to enhance scheduling efficiencies has become more important. As a result, market players have introduced various technologies to cater to demand in the market for operating room integration. For instance, in June 2021, Getinge revealed that it released the “Torin” AI-based OR management system in the U.S.

Furthermore, the pandemic has pushed market players to operate in new ways, thus accelerating digitization. Operating rooms and surgical procedures changed in the following three ways in response to the pandemic-increased pre-surgical planning, video conferencing, and remote post-surgical patient engagement. Preoperative planning is already common in most areas of surgery. Shortly, there might be a better chance to take advantage of the preoperative phase of surgery, since preparations can be done with other clinicians in the office with negligible contact.

Improvements in AI technology can play a vital role in a complete plan to deal with these backlogs and can assist to enhance efficiency and decreasing costs for hospitals and surgery centers. In addition, the advent of advanced imaging as well as diagnostic technologies for OR, rising funding by the government to improve OR infrastructure or redevelopment projects in hospitals, an increasing need to curtail healthcare expenditure, and an increase in investments in OR equipment are some of the factors contributing to market growth. For instance, Okayama University Hospital installed a notable 20 new ORs, including one Hybrid OR. The hospital, located in Okayama, Japan, entered a partnership with Toshiba and Getinge for this key undertaking.

Improved patient outcomes with less invasive procedures are expected to drive the market for operating room integration. The adoption of a patient-centric approach for surgery further led to improved use of ORs in a more sophisticated way. These types of initiatives are anticipated to fuel market growth over the forecast period. Furthermore, an increasing number of MIS procedures and their benefits such as reduced hospital stays, rapid adoption of integrated systems to reduce complexity in OR is stimulating market growth. Increasing demand for improving surgical workflow in OR, and managing, sharing, and storing video-rich content across hospitals is also boosting the OR integration market growth.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- The global surgical display market size was estimated at USD 773.86 million in 2023 and is projected to grow at a CAGR of 3.12% from 2024 to 2030.

- The global surgical equipment market size was valued at USD 16.88 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030.

Operating Room Integration Market Segmentation

Grand View Research has segmented the global operating room integration market by component, device type, application, end-use, and region:

Operating Room Integration Component Outlook (Revenue, USD Million, 2017 - 2030)

- Software

- Services

Operating Room Integration Device Type Outlook (Revenue, USD Million, 2017 - 2030)

- Audio Video Management System

- Display System

- Documentation Management System

Operating Room Integration Application Outlook (Revenue, USD Million, 2017 - 2030)

- General Surgery

- Orthopedic Surgery

- Neurosurgery

- Others

Operating Room Integration End-Use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Ambulatory Surgery Centers

Operating Room Integration Regional Outlook (Revenue, USD Million, 2017 - 2030)

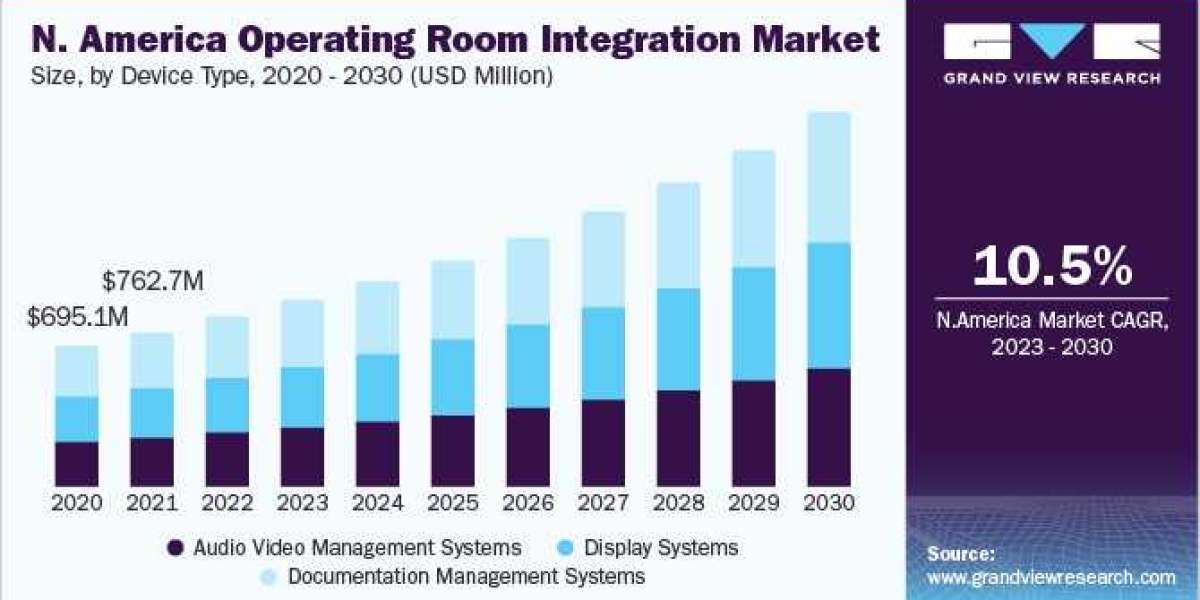

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- Singapore

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East Africa

- Saudi Arabia

- UAE

- South Africa

Key Companies profiled:

- Braiblab AG

- Barco

- Dragerwerk AG Co. KGaA

- Steris Plc.

- KARL STORZ SE CO. KG

- Olympus

- Care Syntax

- Arthrex, Inc.

- Stryker Corporation

- Olympus Corporation

- Getinge AB

- ALVO Medical

- Skytron, LLC,

- Merivaara

- TRILUX Medical GmbH Co. KG

- Caresyntax

- Sony Corporation

- Richard Wolf GmbH

- FUJIFILM Holdings Corporation

- Ditec Medical

- Doricon Medical Systems

- Hill-Rom Holdings, Inc.

- EIZO GmbH

- OPExPARK

- ISIS-Surgimedia,

- Meditek

- Zimmer Biomet Holdings, Inc.

Key Operating Room Integration Company Insights

The industry is fragmented with a large number of players operating in this sector. The key players are focusing on implementing new strategies such as regional expansion, mergers, and acquisitions, improving their application portfolio through innovation, partnerships, and distribution agreements to increase their revenue share and mark their presence in the market. For instance, in April 2021, Barco launched surgical teleconferencing, telementoring, and teleassistance solution called NexxisLive as a secure cloud-based platform for ORs. While, in April 2021, caresyntax’s digital surgery platform was selected as part of a pilot program by the American Board of Surgery to enhance surgeon certifications with video-based assessments.

Likewise in January 2020, Caresyntax announced the installation of 16 digital ORs in Calvary Adelaide Hospital in South Australia with its digital OR integration platform, PRIME365. These types of initiatives are attributing to the increasing penetration of I-ORs in the coming years. Furthermore, Innovations like these by the established market players focused on introducing integrated OR platform globally is likely to propel market growth.

Order a free sample PDF of the Operating Room Integration Market Intelligence Study, published by Grand View Research.