Rodenticides Industry Overview

The global rodenticides market size was valued at USD 5.27 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Factors such as the increasing prevalence of pest-related diseases, a surging rodent population, rising demand for pest control, and the availability of natural rodenticides are likely to be major drivers of market growth. According to the 2019 American Housing Survey, among the 124 million occupied homes in the United States, 14.8 million reported seeing mice or rats inside the house over the course of a year.

Gather more insights about the market drivers, restrains and growth of the Rodenticides Market

Rising concerns regarding economic losses associated with damages caused by rodents in agricultural fields are likely to drive growth over the coming years. However, environmental concerns over the use of chemicals and their ill effects on humans and other living beings are likely to restrain demand. Therefore, product application is highly regulated by stringent laws. Regulations related to chemical rodenticide usage have been established in North America and Europe. For instance, all pesticide products must be registered under the U.S. EPA before being sold publicly. These products are regulated by the EPA under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

Increasing rodent population is a major factor behind the growing prevalence of transferable diseases such as plague, Hantavirus infection, and Lassa fever, which affects the environment, wildlife, and human beings. This has triggered the use of rodent control products in commercial, residential, and industrial applications. These products are witnessing high demand in major cities globally. Companies are developing products to effectively control rodent population. The rising number of offices, hospitals, hotels, and housing, along with the high demand for hygiene, are expected to propel product demand.

Natural rodenticides are biodegradable and non-toxic to human, pets, and wildlife. They do not affect domestic animals or humans if consumed accidentally and they do not contaminate the environment. Moreover, such products are economically viable, as they do not require special storage, handling, transportation, and disposal.

Browse through Grand View Research's Agrochemicals Fertilizers Industry Research Reports.

- The global fungicides market size was valued at USD 16.35 billion in 2019 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.3% from 2020 to 2027.

- The global neem extracts market size was valued at USD 1.89 billion in 2023 and is expected to grow at a CAGR of 11.3% from 2024 to 2030.

Rodenticides Market Segmentation

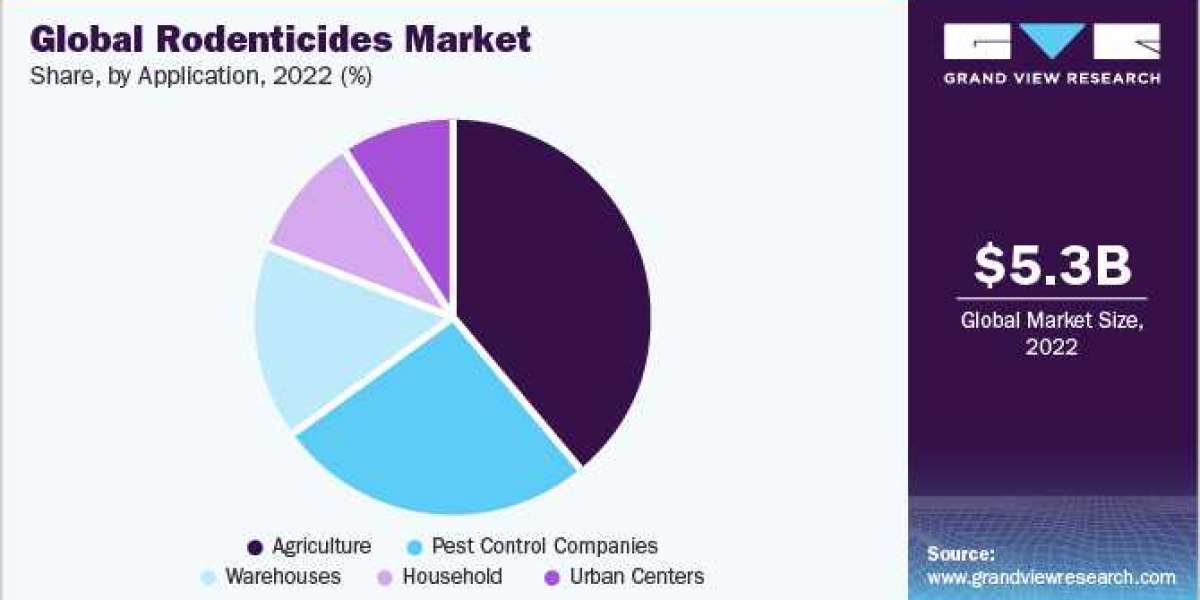

Grand View Research has segmented the global rodenticides market on the basis of product, form, application, and region:

Rodenticides Product Outlook (Revenue, USD Million, 2018 - 2030)

- Anticoagulant

- Non-anticoagulant

Rodenticides Form Outlook (Revenue, USD Million, 2018 - 2030)

- Pellets

- Blocks

- Powder

Rodenticides Application Outlook (Revenue, USD Million, 2018 - 2030)

- Agriculture

- Pest Control Companies

- Warehouses

- Urban Centers

- Household

Rodenticides Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

Key Companies profiled:

- BASF SE

- Bayer AG

- Rentokil Initial plc

- Neogen Corporation

- Bell Labs.

- Liphatech, Inc.

- Impex Europa S.L.

- EcoClear Products

Recent Developments

- In April 2023, Target Specialty Products introduced Strike MAX CITO Paste, a commercial rodenticide paste known for its rapid action and user-friendly application. Engineered for both internal and external use, it functions as a soft bait paste, with its swift efficacy attributed to its primary component, brodifacoum

- In January 2022, Syngenta Crop Protection AG successfully completed the acquisition of two advanced bio-insecticides, UniSpore and NemaTrident, from BIONEMA, a developer of biocontrol technology based in UK. This acquisition is intended to address a diverse array of insects and pests in ornamentals and horticulture, forestry, and turf amenity sectors, thus offering customers an expanded range of solutions

- In June 2022, FGV Agri Services Sdn. Bhd. unveiled an environment-friendly rodenticide, the Butik S, tailored for paddy crops in Malaysia. As a contribution to the Paddy Production Incentive Scheme (SIPP), the pioneering rodenticide has been specially designed for cage owl integration. This anti-coagulant bait is formulated using a blend of substances that are enticing to rodents, and its shape, weight, and color are carefully crafted to attract rats effectively

Order a free sample PDF of the Rodenticides Market Intelligence Study, published by Grand View Research.