Beverage Cans Industry Overview

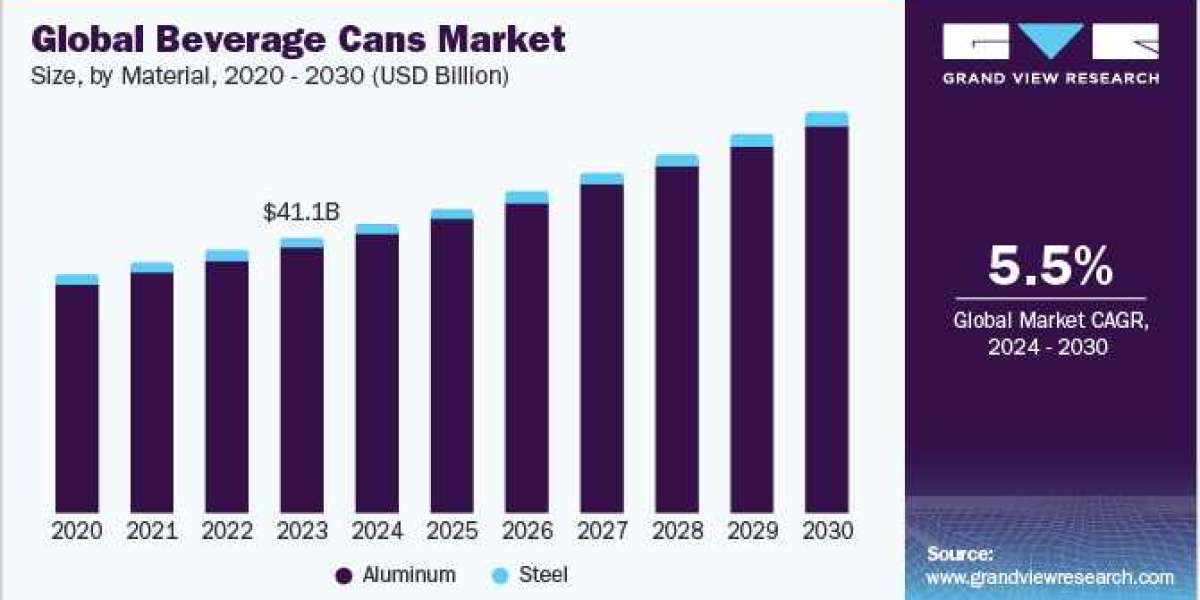

The global beverage cans market size was estimated at USD 41.14 billion in 2023 and is expected to expand at a CAGR of 5.5% from 2024 to 2030. An increasing consumption of beverages such as carbonated soft drinks, beer, and cider on a global level is driving the demand for beverage cans. In addition, high recycling rate of aluminum cans and superior physical properties of metals over its alternatives is expected to drive the growth of beverage cans market during the forecast period.

Beverage cans offer exceptional convenience and portability, making them an attractive choice for on-the-go consumption. They are lightweight, easy to carry, and resealable, allowing consumers to enjoy their beverages at their convenience. This aspect is particularly appealing to urban populations with busy lifestyles and a preference for convenient packaging solutions. For instance, energy drink manufacturers have leveraged the portability of cans to cater to active consumers who demand readily available beverages during their workouts or outdoor activities.

Gather more insights about the market drivers, restrains and growth of the Beverage Cans Market

In addition, the recyclability of beverage cans has become a significant driving factor due to the increasing environmental consciousness among consumers and companies. Aluminum cans are highly recyclable and can be recycled repeatedly without losing their quality, making them a sustainable packaging option. Many beverage companies are actively promoting their use of cans as part of their sustainability initiatives, appealing to eco-conscious consumers. For instance, in June 2023, Marlish Waters Ltd, a UK-based drinks company, launched a new 150 ml can format for its tonics and mixers beverage range. This new format is glass-free and made of aluminum, which is infinitely recyclable, cheaper, and easier to recycle than glass. The launch focused on four of the brand’s most popular SKUs including English Tonic Water, Premium Lemonade, Ginger Ale, and Soda Water.

Beverage cans offer a unique canvas for eye-catching designs and branding opportunities. Companies can leverage the 360-degree printable surface of cans to create visually appealing and distinctive packaging that stands out on retail shelves. This aspect is particularly important in the craft beer and flavored alcoholic beverage segments, where unique and creative can designs have become a key differentiator in the market.

Moreover, collaborations and agreements between raw material suppliers and beverage cans manufacturers are expected to foster innovation and drive new product development in the beverage cans market. For instance, in January 2024, Novelis, a major sustainable aluminum solutions provider and the global player in aluminum rolling and recycling, entered into a new agreement with Ardagh Group S.A., a global supplier in sustainable aluminum beverage packaging solutions. Under the contract, Novelis will supply aluminum beverage packaging sheets to Ardagh's metal production facilities in North America.

Browse through Grand View Research's Food Safety Processing Industry Research Reports.

- The global craft beer market size was valued at USD 85.02 billion in 2015 and is expected to witness significant growth over the forecast period owing to the increasing penetration of the product in countries including South Africa, Australia, New Zealand, and Brazil.

- The global steel market size was estimated at USD 1,469.04 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030.

Beverage Cans Market Segmentation

Grand View Research has segmented the global beverage cans market report on the basis of material, application, and region:

Beverage Cans Material Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

- Aluminum

- Steel

Beverage Cans Application Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

- Carbonated Soft Drinks

- Alcoholic Beverages

- Fruits Vegetable Juices

- Other Applications

Beverage Cans Regional Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Belarus

- Bulgaria

- Czech Republic

- Poland

- Hungary

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Kazakhstan

- Uzbekistan

- Tajikistan

- Central South America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Middle East Africa

- South Africa

- Ghana

- Nigeria

- Kenya

- Mauritius

- Egypt

- Iran

- Kuwait

- Israel

- Saudi Arabia

- UAE

Key Companies profiled:

- Ball Corporation

- Ardagh Group S.A.

- Toyo Seikan Co., Ltd.

- CPMC Holdings Limited

- Orora Packaging Australia Pty. Ltd.

- CANPACK

- Crown Holdings, Inc.

- Mahmood Saeed Can and End Industry Company Limited (MSCANCO)

- Kian Joo Can Factory Berhad

- SWAN Industries (Thailand) Company Limited

- GZI Industries Limited

- Olayan Group

- Bangkok Can Manufacturing

- Nampak Ltd.

- Envases Group

Key Beverage Cans Company Insights

The market consists of a significant number of companies producing beverage cans. Beverage Cans industry has been witnessing a significant number of new product developments and launches over the past few years in order to strengthen their market presence.

- In January 2024, NOMOQ, a pioneer and leading provider of digitally printed cans in Europe, launched its Blank Cans Service for European drink brands. This new offering includes blank (undecorated) aluminum beverage cans, which expands NOMOQ's product range beyond its core business of digitally printed cans. This initiative is expected to provide greater flexibility and customization options for European drink brands, allowing them to create unique and personalized packaging solutions for their products.

- In June 2023, Ball Corporation showcased its latest aluminum can and bottle portfolio at the BevNET Live Summer 2023 event. This showcase included new supply locations for 6.8 oz, 8.4 oz, and 250 mL can sizes, as well as their exclusive Alumi-Tek aluminum bottles. In addition, the company sponsored the BevNET Live Official Happy Hour during the event, encouraging attendees to explore the latest innovations in beverage packaging.

Order a free sample PDF of the Beverage Cans Market Intelligence Study, published by Grand View Research.