Biopsy Devices Industry Overview

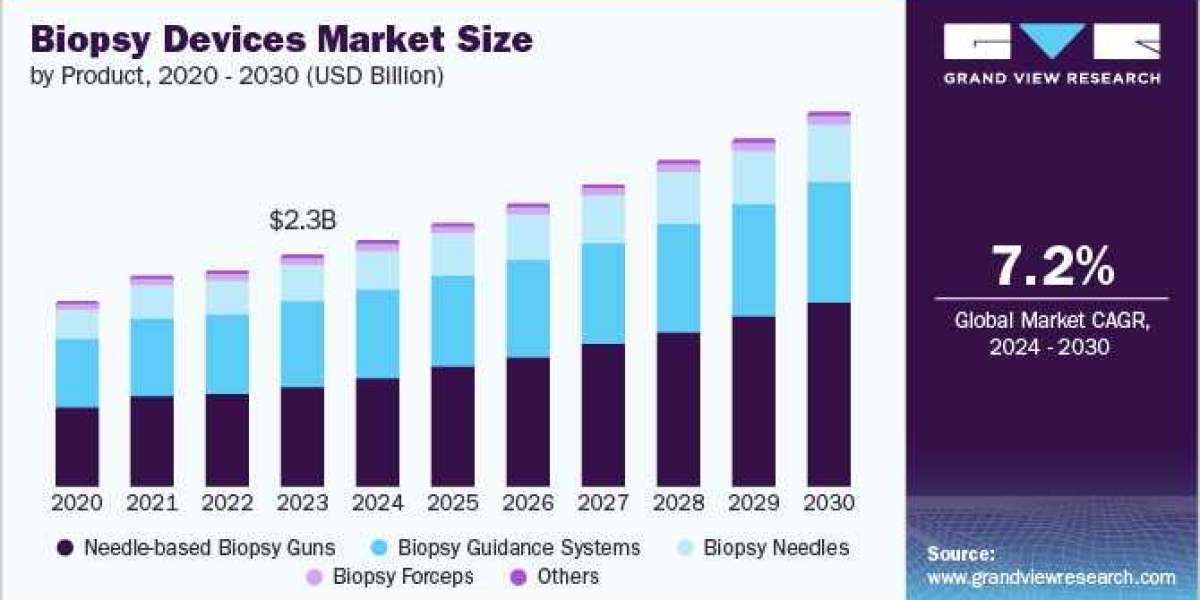

The global biopsy devices market size was valued at USD 2.25 billion in 2023 and is expected to expand at a CAGR of 7.2% from 2024 to 2030. The rising prevalence of cancer, increasing emphasis on minimally invasive surgeries, the presence of untapped opportunities in emerging economies, especially in the Asia Pacific, and improving healthcare infrastructure are among the key trends encouraging industry growth.

Gather more insights about the market drivers, restrains and growth of the Biopsy Devices Market

According to the Union for International Cancer Control (UICC), more than 35 million new cases of cancer are estimated in 2050, which shows an increase of about 77% from the estimated 20 million cases in 2022. This rise in cancer cases is expected to drive the demand for biopsy devices and foster market growth.

In addition, the advantages offered by minimally invasive procedures have driven their demand globally. These procedures result in the quicker recovery of patients and are less traumatic. The rising demand for minimally invasive procedures has further fostered innovation in the market. For instance, in July 2022, doctors introduced a new technology at NewYork-Presbyterian/Columbia, which offers a less invasive, safer, and more timely option to perform lung biopsy.

Growing cancer prevalence is driving the need for effective diagnostic procedures. This has encouraged various government bodies to increase their spending on cancer research. For instance, in the year 2022, total funds available to the National Cancer Institute amounted to USD 6.8 billion, which shows an increase of 5.7% from the previous fiscal year.

Government and healthcare bodies across the world are also making efforts to curb the high costs associated with cancer treatment. Various healthcare institutes are also encouraging people to undergo regular diagnostic examinations through awareness campaigns. For instance, the "Right to Know" campaign by the Centers for Disease Control and Prevention aims to create awareness regarding the importance of breast cancer screening among women with disabilities.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global patient monitoring accessories market size was valued at USD 7.83 billion in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030.

- The global embolic protection devices market size was valued at USD 612.9 million in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030.

Biopsy Devices Market Segmentation

Grand View Research has segmented the global biopsy devices market report on the basis of product and region:

Biopsy Device Product Outlook (Revenue, USD Million, 2018 - 2030)

- Needle-based Biopsy Guns

- Vacuum-assisted Biopsy (VAB) Devices

- Fine Needle Aspiration Biopsy (FNAB) Devices

- Core Needle Biopsy (CNB) devices

- Biopsy Guidance Systems

- Manual

- Robotic

- Biopsy Needles

- Disposable

- Reusable

- Biopsy Forceps

- General Biopsy Forceps

- Hot Biopsy Forceps

- Others

- Brushes

- Curettes

- Punches

Biopsy Device Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

Asia Pacific

- Japan

- India

- China

- South Korea

- Thailand

- Australia

Latin America

- Brazil

- Mexico

- Argentina

Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Cardinal Health Inc.

- Hologic, Inc.

- Danaher Corporation

- CONMED Corporation

- Cook Medical

- DTR Medical

- INRAD, Inc.

- Devicor Medical Products Inc.

- Gallini Srl

- TransMed7, LLC

Key Biopsy Devices Company Insights

Some players in the market include Cardinal Health Inc., Hologic, Inc., and Danaher Corporation, and others. These players are majorly engaged in RD to develop technologically advanced products to help them retain a strong position in the market. For instance, in August 2022, Devicor Medical Products, Inc. introduced the Mammotome DualCore Dual Stage Core Biopsy System, which is expected to help the company in advancing its biopsy device portfolio.

- Cardinal Health, Inc. is a global healthcare services and products company operating majorly in two segments: Pharmaceutical and Medical. The company also engages in the production of minimally invasive biopsy devices such as fine needle core biopsy (FNCB), bone marrow biopsy aspiration needles, and Tissue Biopsy Kits.

- Hologic, Inc. is a global company engaged in developing, manufacturing, and supplying medical imaging systems, diagnostic products, and surgical products, including biopsy devices. The company has introduced advanced biopsy devices such as the Eviva Breast Biopsy system, and Brevera breast biopsy system to gain a competitive edge.

Recent Developments

- In April 2024, Single Pass announced the FDA clearance of the Kronos biopsy closure device, its class II medical device.

- In May 2023, Argon Medical Devices introduced the SuperCore Advantage semi-automatic biopsy instrument, a soft tissue biopsy product in the U.S.

- In February 2023, TransMed7 announced its plans to introduce its US-guided biopsy devices.

Order a free sample PDF of the Biopsy Devices Market Intelligence Study, published by Grand View Research.