Wheat Protein Industry Overview

The global wheat protein market size was valued at USD 6.77 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. The growth of the wheat protein industry is expected to be driven by the rising adoption of plant-based diets as well as an increase in the number of people adopting vegan diets in developing economies. Furthermore, product demand is likely to be fueled by a rising geriatric population, income levels, and increased urbanization.

The growth of the wheat protein industry is expected to be driven by the rising adoption of plant-based diets as well as an increase in the number of people adopting vegan diets in developing economies. Furthermore, product demand is likely to be fueled by a rising geriatric population, income levels, and increased urbanization.

Gather more insights about the market drivers, restrains and growth of the Wheat Protein Market

Weight control was always a concern in the global population and now obesity has become an epidemic worldwide. According to the World Health Organization, global obesity has tripled since 1975, with approximately 13% of adults obese and 39% of adults overweight. Furthermore, according to the Global Nutrition Report, 149.2 million children under the age of five are stunted, 38.9 million are overweight, and 45.4 million are wasted. As a result, people are focusing on eating a healthy, plant-based diet to maintain their overall health and weight, which is driving market growth.

Wheat protein offers exceptional capabilities for a broad range of industries due to several benefits. Among its many uses are bakery products, flour milling, meat replacer, pasta, aquafeed, breakfast cereal, milk replacer, and pet food. The baker's adjustment, also known as the flour miller, is the most fundamental and widely used application of wheat protein. As a result, such a wide range of applications for various end-use industries is anticipated to fuel market growth over the forecast period.

Lactose intolerance is a condition in which the body is unable to digest lactose, a type of natural sugar in dairy products such as milk. Although whey protein isolates are more filtered and processed to effectively remove more lactose than whey protein concentrates, individuals who have even a slight lactose intolerance should avoid such products. For consumers who want to boost protein intake for health or training purposes, plant-based alternatives such as wheat protein are the best option which may contribute to the market growth.

The limited supply of wheat for protein extraction in some regions is expected to limit market growth over the coming years. Furthermore, it contains gluten, which can cause diseases in consumers thereby limiting the product demand. Additionally, rising wheat prices with high protein content, the presence of a large number of alternatives, and increasing incidences of celiac disease are expected to limit growth over the projected timeframe.

Browse through Grand View Research's Nutraceuticals Functional Foods Industry Research Reports.

- The global animal feed market size was estimated at USD 570.72 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030.

- The global pea protein market size was valued at USD 2.12 billion in 2023 and is expected to grow at a CAGR of 12.1% from 2024 to 2030.

Wheat Protein Market Segmentation

Grand View Research has segmented the global wheat protein market report on the basis of product, application, concentration, form, and region:

Wheat Protein Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- Others

Wheat Protein Concentration Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

- 75% concentration

- 80% concentration

- 95% concentration

Wheat Protein Form Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

- Dry

- Liquid

Wheat Protein Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

- Bakery Confectionery

- Animal Feed

- Dairy

- Personal Care

- Sports Nutrition

Wheat Protein Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Russia

- Ukraine

- Poland

- France

- Benelux

Asia Pacific

- China

- India

- Japan

- Australia

Central South America

- Brazil

- Argentina

Middle East Africa

- Turkey

- Egypt

Key Companies profiled:

- Archer Daniels Midland Company (ADM)

- Agridient

- MGP Ingredients

- AB Amilina

- Cargill Inc

- Manildra Group

- Crespel Deiters GmbH and Co. KG

- Kroener Staerke

- Crop Energies AG

- Roquette

Key Wheat Protein Company Insights

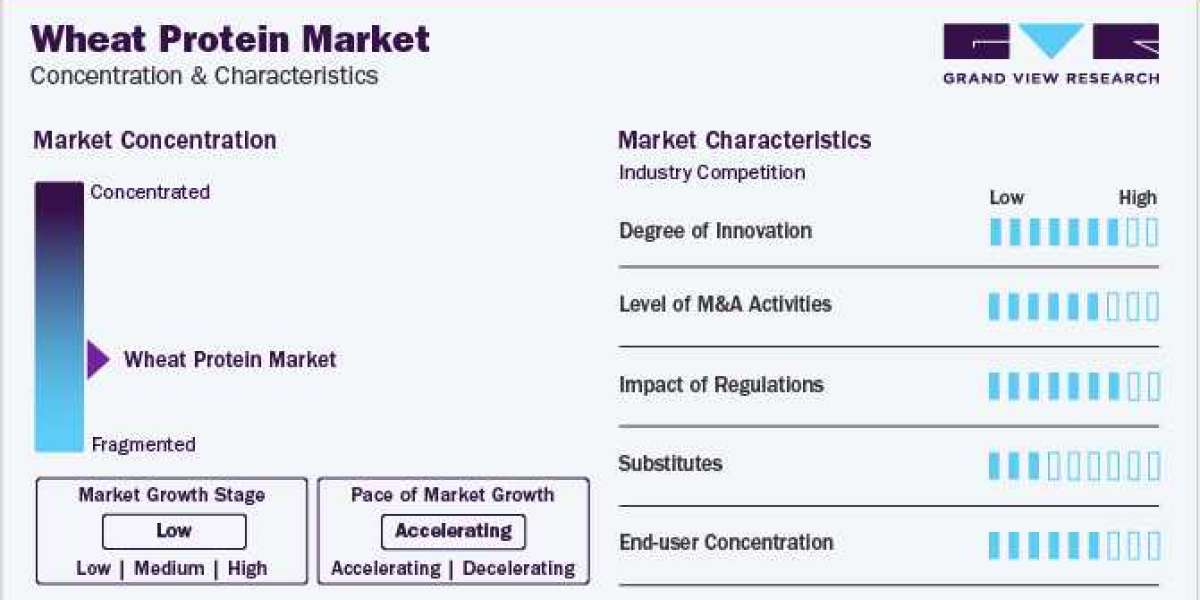

The global wheat protein market is expected to witness high competition among the companies owing to the presence of a large number of players across the globe. Manufacturers are increasingly engaged in RD activities to formulate innovative products owing to increasing demand from consumers. The players focus on capacity and geographic expansions as well as strategic mergers acquisitions to gain a competitive edge in the market.

For instance, in August 2021, Summit Ag along with its portfolio company named Summit Sustainable Ingredients announced the establishment of a wheat protein manufacturing facility worth USD 200 million to be built near Prairie Horizon Agri-Energy. The facility is expected to be operational by the summer of 2023 which will expand the production capacity of wheat protein to nearly double any existing unit in North America.

Recent Developments

- In January 2023, Amber Wave has initiated operations at the largest wheat protein facility in North America, following an investment from Summit Agricultural Group. The company is currently manufacturing AmberPro™ Vital Wheat Gluten, serving as a domestic gluten source for various industries including commercial bakeries, food ingredient plants, alternative meat producers, pet food processors, and specialty feed companies.

- In January 2021, MGP Ingredients, Inc., a prominent provider of high-quality distilled spirits and specialized wheat proteins and starches, finalized the acquisition of Luxco, Inc., and its affiliated companies, as per the definitive agreement announced. Luxco, boasting over 60 years of business heritage, stood out as a top-tier branded beverage alcohol company across diverse categories. The acquisition marked a significant development in MGP Ingredients, Inc.'s strategic expansion within the industry.

Order a free sample PDF of the Wheat Protein Market Intelligence Study, published by Grand View Research.