Structural Heart Devices Industry Overview

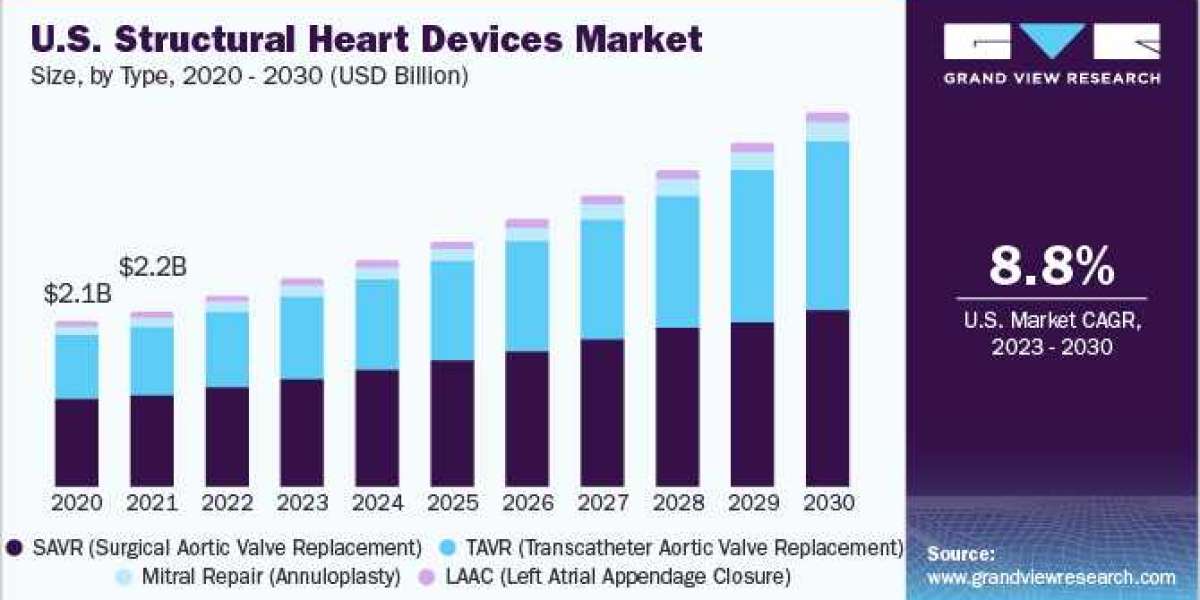

The global structural heart devices market size was valued at USD 6.33 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030.

The high prevalence of target diseases is the key driver of the market. Almost 60 million people in the U.S. have structural defects in their hearts. This accounts for around 20-25% of the country’s adult population. This indicates the huge scope of these devices in addressing structural heart defects. Structural heart disease (SHD) treatment includes a wide category of percutaneous treatments for patients with both acquired heart disease and congenital heart disease (CHD) that pertain to functional and structural abnormalities of cardiac chambers, proximal great vessels, and heart valves.

Gather more insights about the market drivers, restrains and growth of the Structural Heart Devices Market

The reimbursement scenario in the U.S. is likely to become more favorable in the coming years, thus making procedures such as TAVR (Transcatheter Aortic Valve Replacement) affordable. As the target population ages, their medical expenditure is covered under the Centers for Medicare and Medicaid Services (CMS). It eases the burden of healthcare expenditure, thereby encouraging more people to opt for these treatments. This is a positive impact-rendering factor for procedures such as Left Atrial Appendage Closure (LAAC), which are useful for the reduction of the risk of stroke.

Industry players are investing heavily in research and development procedures to launch effective products and remain competitive in the market. Medtronic, Boston Scientific, Abbott, and Edwards Lifesciences, for instance, represented a few of the organizations and revealed new data for their cardiovascular offerings at the 34th Transcatheter Cardiovascular Therapeutics (TCT) conference held in Boston in September 2022.

The market is likely to be driven by the surge in the number of people suffering from structural heart diseases. As these diseases are usually congenital, they frequently occur among infants. Tissue-enhanced aortic valves are helpful in structural replacement and repair of the heart and hence people with these diseases are moving toward such innovations. The advent of technology has enhanced the functioning of structural heart devices. The improved treatments have raised the standard of living and increased the life expectancy of people. Since structural heart surgeries are minimally invasive, they are chosen over traditional invasive procedures such as open-heart surgeries.

According to the Children's HeartLink organization, approximately 1 out of every 100 infants has congenital cardiac disorders, which can vary from moderate to severe. As per Cleveland Clinic, mitral valve regurgitation is the most commonly occurring valve disorder in the U.S. Such facts demonstrate the necessity of structural heart diagnosis devices, which creates extensive opportunities for industry players.

However, the adoption of advanced structural heart devices has been sluggish, particularly in developing countries, as these devices are costlier than their traditional equivalents. Stroke, renal failure, and gastrointestinal issues are all complications connected with these devices, which occur following a mitral valve replacement treatment. The high cost of modern structural heart implants, as well as the risks associated with these treatments, are major market restraints.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The BRIC diabetes care devices market size was valued at USD 3.60 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030.

- The global cranial fixation and stabilization devices market size was estimated at USD 2.3 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030.

Structural Heart Devices Market Segmentation

Grand View Research has segmented the structural heart devices market based on type and region:

Structural Heart Devices Type Outlook (Revenue, USD Million, 2018 - 2030)

- SAVR (Surgical Aortic Valve Replacement)

- TAVR (Transcatheter Aortic Valve Replacement)

- Mitral Repair (Annuloplasty)

- LAAC (Left Atrial Appendage Closure)

Structural Heart Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Norway

- Denmark

- Asia Pacific

- China

- Japan

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Kuwait

Key Companies profiled:

- Boston Scientific Corporation

- Medtronic

- Edwards Lifesciences Corporation

- Abbott Laboratories

- JUDE MEDICAL

- Biomerics

- Comed BV

- LivaNova PLC

- JenaValve Technology, Inc.

- CardioKinetix

Order a free sample PDF of the Structural Heart Devices Market Intelligence Study, published by Grand View Research.