Virus Filtration Industry Overview

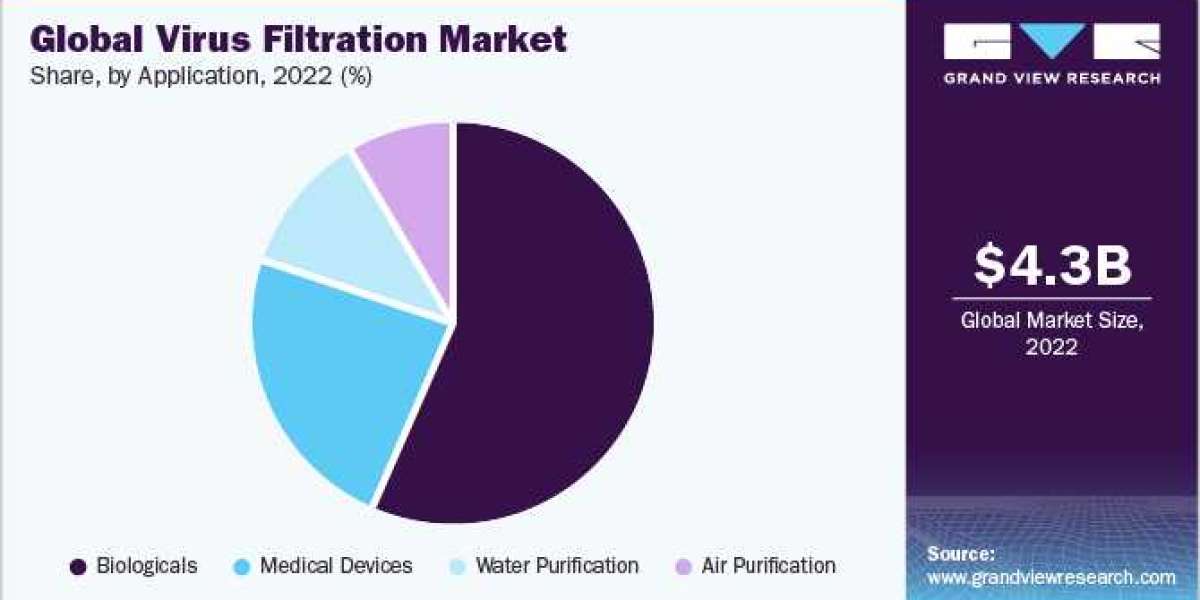

The global virus filtration market size was estimated at USD 4.26 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.1% from 2023 to 2030.

The rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is anticipated to propel the demand for biologics. According to the World Health Organization (WHO), around 422 million people globally are affected by diabetes. Rapid prevalence is observed in low- and middle-income nations compared to high-income nations. Amputation of the lower limbs is a common complication of diabetes, as are kidney disease, cardiac arrest, stroke, and blindness. According to the WHO, between 2000 and 2019, the mortality rates from diabetes rose by 3% for each age group and an estimated 2 million people died in 2019 from diabetes-related kidney disease.

Gather more insights about the market drivers, restrains and growth of the Virus Filtration Market

The COVID-19 pandemic positively impacted the market of virus filtration. The market is expected to grow significantly in the coming years, as the COVID-19 pandemic has highlighted the importance of sterilizing biopharmaceutical products, vaccines, medical devices, and air and water systems from viral contaminants. Virus filtration is a crucial step in ensuring the safety and efficacy of biopharmaceuticals and vaccines, as well as preventing the transmission of infectious diseases.

Another significant factor anticipated to increase market growth is adherence to regulatory frameworks for drug development and production, such as Current Good Manufacturing Practice (cGMP) regulations. The virus safety of these products is guaranteed by the manufacturers through a variety of quality control procedures, including monitoring and quality checking of raw materials, validating and putting into practice effective virus clearance technology, and validating the finished product for the absence of virus contamination. As a result, there is a huge market for these products in both manufacturing and RD.

High-Efficiency Particulate Air (HEPA) filters had a boost in demand due to HEPA H13 being able to filter out the SARS-CoV-2 virus from the air, making the air sterile. Manufacturers such as Clean Liquid Systems, Liberty Industries, Inc., and Filtration Technology Inc. saw exponential growth in the market of HEPA H13 filters.

Clinical Research Organizations (CROs) are collaborating with biotechnology and biopharmaceutical companies for the development of novel drugs and therapies, which is also expected to support market growth. For instance, in May 2023, CRO firm IQVIA announced its partnership with RED, an organization that aims to fight AIDS and the injustices that help the COVID-19 virus to spread, to help the laboratory system strengthen.

Biologics, such as biopharmaceutical drugs, require more time, and money, and is complex to develop than chemical medications. Producing the same drug as the original is very challenging because every biopharmaceutical is distinct. The efficacy, quality, and safety of medicine could change as a result of even a minor change in the protein structure. To prevent protein denaturation or variation in protein structure, which could negatively impact the demand for these products, filtration products like chromatography reagents and kits must be used very carefully.

Browse through Grand View Research's Biotechnology Industry Research Reports.

- The global medical biomimetics market size was valued at USD 33.28 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030.

- The global structural biology molecular modeling techniques market size was valued at USD 7.13 billion in 2023 and is projected to grow at a CAGR of 15.4% from 2024 to 2030.

Virus Filtration Market Segmentation

Grand View Research has segmented the global virus filtration market based on product, technology, application, end-use, and region:

Virus Filtration Product Outlook (Revenue, USD Million, 2018 - 2030)

- Consumables

- Kits and Reagents

- Others

- Instruments

- Filtration Systems

- Chromatography Systems

- Services

Virus Filtration Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Filtration

- Consumables

- Instruments

- Services

- Chromatography

- Consumables

- Instruments

- Services

Virus Filtration Application Outlook (Revenue, USD Million, 2018 - 2030)

- Biologicals

- Vaccines and Therapeutics

- Blood and Blood Products

- Cellular and Gene Therapy Products

- Tissue and Tissue Products

- Stem Cell Products

- Medical Devices

- Water Purification

- Air Purification

Virus Filtration End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Biopharmaceutical Biotechnology Companies

- Contract Research Organizations

- Medical device companies

- Academic Institutes Research Laboratories

Virus Filtration Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Merck KGaA

- Danaher

- Sartorius AG

- Thermo Fisher Scientific Inc.

- GE Healthcare

- Charles River Laboratories

- Asahi Kasei Medical Co., Ltd.

- WuXi AppTec

- Lonza

- Clean Biologics

Order a free sample PDF of the Virus Filtration Market Intelligence Study, published by Grand View Research.