Fuel Cell Vehicle Industry Overview

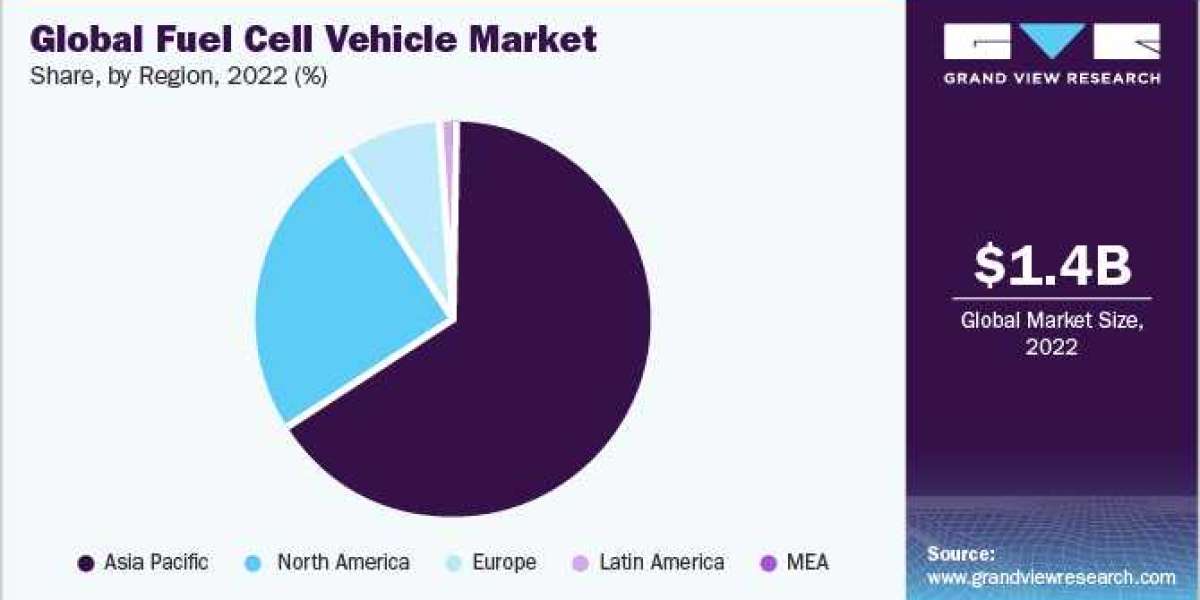

The global fuel cell vehicle market size was valued at USD 1.45 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 52.5% from 2023 to 2030.

The surge in population has resulted in rising pollution levels and has shifted the trend toward clean fuels and green technology to curb carbon emissions effectively. It has had a favorable influence on FCV demand in recent years. The change from conventional fuel automobiles to environment-friendly vehicles has recently accelerated the demand for FCVs. Other factors, such as strict environmental laws, incentives and subsidies for clean fuels, and hazardous gas emissions from combustion engine vehicles, drive the market growth throughout the forecast period. Furthermore, the increasing awareness regarding vehicle emissions has led manufacturers to design alternate powertrains, increasing the market's development.

The outbreak of COVID-19 brought the whole ecosystem to a halt, prohibiting the development and sale of revolutionary automobiles worldwide. Fuel cell vehicles had to halt until the lockdowns were released before they could continue to prosper, impacting their manufacturing operations. As a result, manufacturing volumes for car production had to be adjusted, causing late final delivery and a decline in revenue.

Gather more insights about the market drivers, restrains and growth of the Fuel Cell Vehicle Market

The automotive industry is known for its heavy investments and requirement of constant funding to stay afloat. During the early months of the pandemic, this resulted in the stoppage of production and decreased demand, which had an adverse impact on manufacturers of fuel cell vehicles and automotive fuel cell producers. However, as the pandemic subsided, the cash flow for revenue and investment resumed. With the financial resources becoming stable, the production of automobiles started gaining pace. It prompted automotive fuel cell producers to resume research, development, and testing operations again, thereby positively impacting the market growth.

The fuel cell vehicle market is still in its early development and growth stages. Many technologies are in the testing stage, with a few automobiles from Toyota Motor Corporation, Honda Motor Corp., and Hyundai Motor Group running in some regions. European manufacturers such as BMW AG and Audi are developing fuel cell vehicles based on their earlier prototypes to launch in the later years. Many other companies are following BMW and Audi's footprints.

For instance, in May 2022, Renault manufactured the hydrogen fuel cell-powered SUV prototype. The SUV, Scenic Vision, was planned to be equipped with a 16kW fuel cell to help expand the car's driving range to 800 kilometers without charging. With a lightweight battery other exceptional features, the company aimed to reduce the carbon footprint by 75% compared to traditional electric vehicle models. However, the French carmaker model will not be available before 2030 and 2032. The company will launch its fully electric version by 2024.

Hydrogen fuel cell vehicles are expanding their applications to heavy commercial vehicles to increase efficiency. For instance, a major global player in zero-emission hydrogen fuel cell-based commercial vehicles- Hyzon Motors Inc. announced the development of the hydrogen storage system technology, in July 2021, which can decrease the manufacturing cost and weight of the commercial vehicle. The new technology is yet to be patented and can potentially reduce the manufacturing component count by 75%, the weight of the system by 43%, and the system storage cost by 52%. This technology uses lightweight composite material for system metal print, based on a single rack system capable of storing five hydrogen cylinders simultaneously. The development of this onboard storage system technology is a collaboration between the European and U.S. divisions of Hyzon Motors Inc. These technological developments for reducing cost and carbon emissions are attempts to integrate hydrogen fuel cell technology as the primary power source for future vehicle production.

Fuel cell vehicles are expensive, and the cost of hydrogen (per kilo) in some places is high, restraining the market growth. Furthermore, the number of gasoline stations is restricted or inadequate in regions worldwide. The industry's progress is limited by a skeptical distribution network, fear of electric shock, and flammability owing to the chemical attribute of hydrogen fuel cells, which limit the market's growth. The manufacturing cost of hydrogen fuel cell vehicles is higher than that of conventional vehicles. The production cost and aftermarket services cost significantly increase the total ownership cost compared to that of a standard vehicle. Apart from that, it faces competition from battery electric vehicles and plug-in hybrid electric vehicles, which are becoming popular and are limiting the market's growth.

Browse through Grand View Research's Automotive Transportation Industry Research Reports.

- The global electric van market size was estimated at USD 13.33 billion in 2023 and is expected to grow at a CAGR of 13.8% from 2024 to 2030.

- The global truck rental market was estimated at USD 121.38 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030.

Fuel Cell Vehicle Market Segmentation

Grand View Research has segmented the global fuel cell vehicle market based on vehicle type and region:

Fuel Cell Vehicle Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Passenger Cars

- LCVs

- HCVs

Fuel Cell Vehicle Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Key Companies profiled:

- Daimler AG

- Honda Motors Co. Ltd.

- Nikola Corporation

- Toyota Motor Corporation

- Hyundai Motor Group

- Ballard Power System Inc.

- Volvo AB

- General Motors

- BMW AG

- Audi AG

Order a free sample PDF of the Fuel Cell Vehicle Market Intelligence Study, published by Grand View Research.