5g Chipset Industry Overview

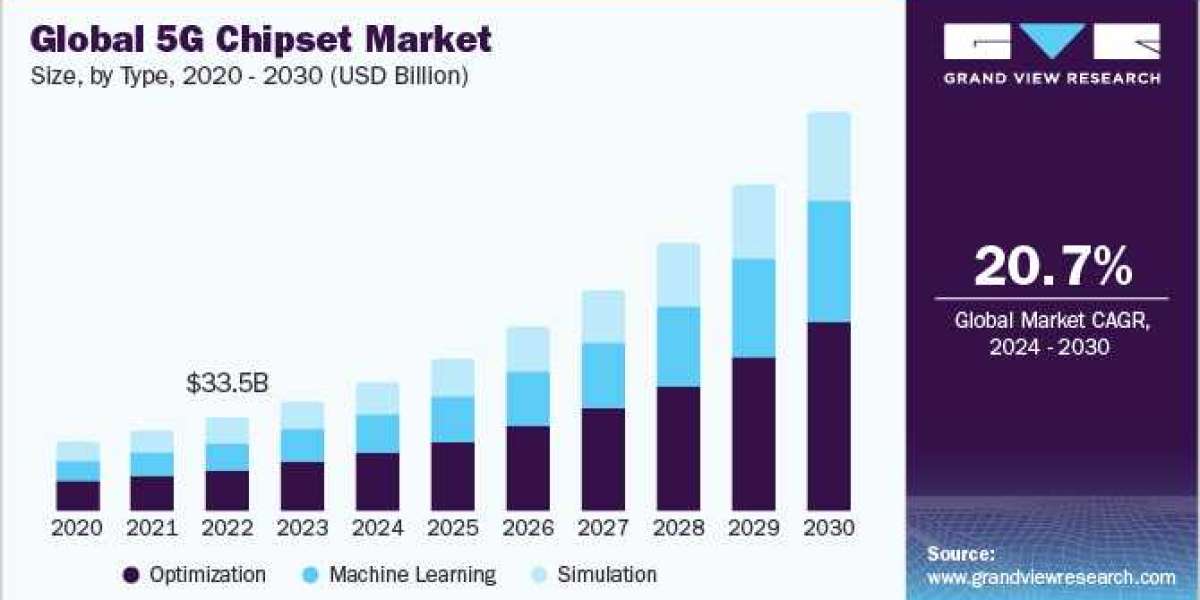

The global 5G chipset market size was estimated at USD 39.32 billion in 2023 and is expected to grow at a CAGR of 20.7% from 2024 to 2030.

Increasing demand for broad network coverage and high-speed internet and high use of Machine-to-Machine (M2M) communication technology are some of the major growth driving factors. In addition, the growing adoption of 5G networks in smart cities, automobiles, and the healthcare sector is also driving the demand for 5G chipsets. The surged use of connected cars, connected devices, smartphones, and tablets is further contributing to the market growth.

Gather more insights about the market drivers, restrains and growth of the 5g Chipset Market

The increasing penetration, adoption, and launch of 5G smartphones across the world is driving the demand for 5G chipsets. According to the GSMA’s The Mobile Economy 2023 report, 5G adoption is expected to increase owing to cheaper devices and new network deployments. By January 2023, there were around 229 commercial 5G networks across the globe, with more than 700 5G smartphone models launched, including more than 200 in 2022. Thus, with the growing number of 5G smartphone launches worldwide, the demand for 5G chipsets is expected to rise between 2024 and 2030.

Several 5G chipset solution providers are launching 5G chipsets for various applications, which in turn contributes to the market growth. For instance, in May 2023, Sequans Communications S.A., a prominent company in 4G/5G cellular IoT modules and chips, launched the 5G chipset platform, Taurus 5G NR. The chipset is specifically designed for 5G broadband IoT devices, offering cost-effective support for applications including enterprise and private networks, residential fixed wireless access, mobile computing, portable hotspots, smart cities, smart buildings, and high-end industrial IoT. Such initiatives are expected to bode well for the market growth.

The growing demand for 5G chipsets that support Vehicle to Everything (V2X) communications, offering highly reliable and low-latency solutions for connected vehicles, is boosting the market growth. In connected vehicle applications, 5G enables real-time communication between vehicles, pedestrians, infrastructure, and other road users, creating a cooperative, intelligent transport system (C-ITS) that reduces congestion, prevents accidents, and optimizes traffic flow. 5G also improves the autonomous capabilities of vehicles. With ultra-low latency, connected vehicles receive and process information faster, allowing them to make more efficient and faster decisions.

The high initial investment and deployment costs of 5G chipsets are expected to hinder the market's growth. The cost of 5G chipsets is a significant factor in the overall manufacturing of 5G-enabled devices such as smartphones. For instance, the higher prices of 5G chipsets increase the average selling price of premium smartphones that support 5G technology. However, an impending price war between key market companies is expected to lower the cost of 5G chipsets in the upcoming years.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global application integration market size was valued at USD 15.90 billion in 2023 and is projected to grow at a CAGR of 19.8% from 2024 to 2030.

- The global enterprise content management market size was valued at USD 39.46 billion in 2023 and is projected to grow at a CAGR of 15.1% from 2024 to 2030.

5G Chipset Market Segmentation

Grand View Research has segmented the global 5G chipset market based on type, operating frequency, processing node type, deployment, vertical, and region:

5G Chipset Type Outlook (Revenue, USD Million, 2019 - 2030)

- Modems

- RFICs

- RF Transceivers

- RF FE

- Others

5G Chipset Operating Frequency Outlook (Revenue, USD Million, 2019 - 2030)

- Sub-6 GHz

- 24-39 GHz

- Above 39 GHz

5G Chipset Processing Node Type Outlook (Revenue, USD Million, 2019 - 2030)

- 7 nm

- 10 nm

- Others

5G Chipset Deployment Type Outlook (Revenue, USD Million, 2019 - 2030)

- Telecom Base Station Equipment

- Smartphones/Tablets

- Single-Mode

- Standalone

- Non-Standalone

- Multi-Mode

- Single-Mode

- Connected Vehicles

- Single-Mode

- Standalone

- Non-Standalone

- Multi-Mode

- Single-Mode

- Connected Devices

- Single-Mode

- Standalone

- Non-Standalone

- Multi-Mode

- Single-Mode

- Broadband Access Gateway Devices

- Single-Mode

- Standalone

- Non-Standalone

- Multi-Mode

- Single-Mode

- Others

- Single-Mode

- Standalone

- Non-Standalone

- Multi-Mode

- Single-Mode

5G Chipset Vertical Outlook (Revenue, USD Million, 2019 - 2030)

- Manufacturing

- Energy Utilities

- Media Entertainment

- IT Telecom

- Transportation Logistics

- Healthcare

- Others

5G Chipset Regional Outlook (Revenue, USD Million, 2019 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- UK

- Germany

- Sweden

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Middle East Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

Key Companies profiled:

- Huawei Technologies, Inc.

- MediaTek Inc.

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

- Unisoc Communications Inc.

- Qorvo, Inc.

- Murata Manufacturing Co., Ltd.

- MACOM

Key 5G Chipset Company Insights

Some of the key companies operating in the market include MediaTek Inc.; Samsung Electronics Co., Ltd.; Infineon Technologies AG; Huawei Technologies, Inc.; and Qualcomm Technologies, Inc.

- MediaTek Inc. is a global provider of fabless semiconductors. The company develops innovative systems-on-chip (SoC) for mobile devices, connectivity, home entertainment, and IoT products.

- Infineon Technologies AG is a global semiconductor provider. The company designs, manufactures, develops, and markets application-specific integrated circuits. It provides microcontrollers, interfaces, sensors, and transistor products.

Recent Developments

- In November 2023, MediaTek Inc. announced the power-efficient chipset, a Dimensity 8300 for premium 5G smartphones. Dimensity 8300 combines generative AI features, adaptive gaming technology, power-efficient solutions, and rapid connectivity to deliver top-tier experiences tailored for premium 5G smartphones.

- In February 2023, Qualcomm Technologies, Inc., a semiconductor technology company, launched Snapdragon X75, its new 6th generation 5G radio frequency modem. The Snapdragon X75 5G modem's primary new feature is compatibility with 5G-Advanced (5G-A), a network protocol that will provide an advancement over standard 5G connection.

- In May 2022, MediaTek Inc., a semiconductor company, unveiled its first mmWave 5G chipset, the Dimensity 1050 System-on-Chip (SoC), which would power the next generation of 5G devices with seamless connection, displays, gaming, and power efficiency. MediaTek Inc. also revealed two new chipsets, the Dimensity 930 and the Helio G99, to broaden its 5G and gaming chip families.

Order a free sample PDF of the 5g Chipset Market Intelligence Study, published by Grand View Research.