Digital Twin Industry Overview

The global digital twin market size was estimated at USD 16.75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 35.7% from 2024 to 2030.

Digital twin technology is gaining traction owing to its potential to bridge the gap between the physical and virtual worlds. The global market is expected to grow significantly over the forecast period in line with the growing adoption of the Internet of Things (IoT) and big data analytics and the growing need to ensure cost-efficient operations, optimized processes, and reduced time to market. Moreover, digital twins would continue to evolve in line with innovations in virtual reality and augmented reality, thereby boosting the market's growth. Increasing public and private investments in digital transformation solutions are creating robust opportunities for market growth. Countries, such as the U.S., India, Australia, Brazil, Saudi Arabia, and South Africa, are significantly investing in digital transformation solutions to accelerate digitization.

Gather more insights about the market drivers, restrains and growth of the Digital Twin Market

Moreover, the growing demand for cloud-based digital applications due to factors like cost-effectiveness, ease of access, and flexibility in terms of usage is encouraging market players to develop and provide advanced cloud-native digital twin solutions. Implementing emerging technologies, such as cloud computing, big data, artificial intelligence (AI), IoT, and machine learning (ML), in digital twin solutions is anticipated to boost market growth during the forecast period. Various end-user companies are deploying IoT and AI technologies to collect and interpret data from connected devices, which can be later used in digital twin models to replicate the operation and performance of the existing device. This assists designers engineers to monitor performance, identify issues, and predict any iterations of common problems.

The integration of these emerging technologies also helps companies in enhancing system productivity and operations, thereby driving market growth. Companies are focusing on deploying digital twin solutions to optimize their operational processes and supply chains to recover financial losses. Growing demand for digital twin solutions is encouraging industry players to improve their product portfolio and geographic expansion to achieve higher profitability from the market. For instance, in June 2023, a software company, Matterport, Inc., partnered with technology solution distributor CompuSoluciones to accelerate the sales of its digital twin solutions in key regions of Latin America, such as Mexico and Columbia.

With these partnerships, CompuSoluciones will offer Matterport, Inc.’s D cameras and digital twin solutions to various SMEs in Latin America. End-user industries, such as manufacturing, automotive, aerospace, defense, residential commercial, and retail consumer goods companies, can obtain greater insights into the features, qualities, specifications, and utilization of the products. Defense organizations are focused on developing their digital IT infrastructure and the digital twin, which helps them accomplish better communication, thereby driving market growth.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global unmanned surface vehicle market size was valued at USD 1,586.1 million in 2023 and is expected to grow at a CAGR of 11.9 % from 2024 to 2030.

- The global military sensors market size was estimated at USD 11.40 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030.

Digital Twin Market Segmentation

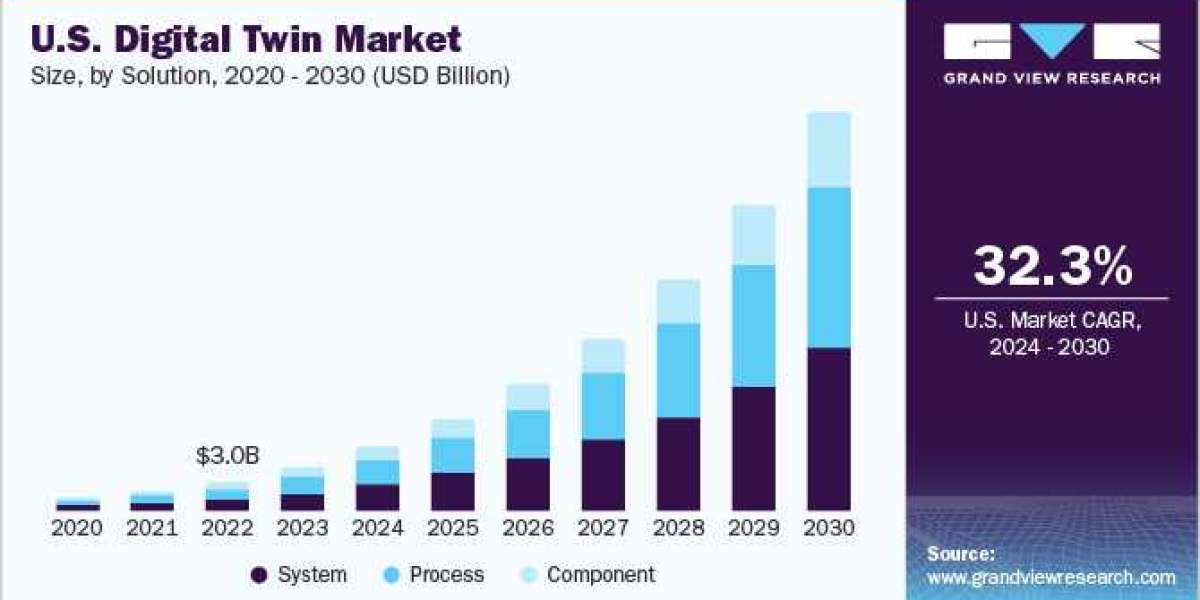

Grand View Research has segmented the global digital twin market on the basis of solution, deployment, enterprise size, application, end-use, and region:

Digital Twin Solution Outlook (Revenue, USD Billion, 2018 - 2030)

- Component

- Process

- System

Digital Twin Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

Digital Twin Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Digital Twin Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Product Design Development

- Predictive Maintenance

- Business Optimization

- Others

Digital Twin End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Manufacturing

- Agriculture

- Automotive Transport

- Energy Utilities

- Healthcare Life Sciences

- Residential Commercial

- Retail Consumer Goods

- Aerospace

- Telecommunication

- Others(Aerospace Defense, Mining, Financial Services)

Digital Twin Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- India

- China

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Key Companies profiled:

- ABB Group

- Amazon Web Services, Inc.

- ANSYS, Inc.

- Autodesk Inc.

- AVEVA Group plc

- Bentley Systems Inc.

- Dassault Systemes

- General Electric

- Hexagon AB

- International Business Machines Corporation

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation

- SAP SE

- Siemens AG

Key Digital Twin Company Insights

- ABB Group is a technology company that aids in the transformation of industry and society toward a productive and sustainable future. ABB operates its business through four business areas, namely Electrification, Process Automation, Motion, and Robotics Discrete Automation. The Robotics Discrete Automation segment offers industrial robots, software, robotic solutions and systems, field services, spare parts, and digital services

- International Business Machines Corporation is a global Information Technology (IT) company that provides software and solutions for digital technologies. The services offered by the company include business process operations, cloud services, digital workplace services, technology support services, business resilience services, network services, application services, and security services.The company has several fully owned subsidiaries, such as WTC Insurance Corporation, Ltd.; IBM Canada Limited; IBM Global Financing Denmark ApS; IBM Egypt Business Support Services; International Business Machines Gabon SARL; PT IBM Indonesia; International Business Machines Madagascar SARLU; and Companhia IBM Portuguesa, S.A.; among others

Recent Developments

- In January 2024, Valeo, an automotive technology provider, partnered with Applied Intuition, a vehicle software supplier, to provide a digital twin platform for advanced driver-assistance systems (ADAS) sensor simulation. OEMs would be able to bring reliable and safe ADAS features to market faster with the joint solution

- In April 2023, Rockwell Automation installed a Robotic Supervision System (RSS) for TotalEnergies. RSS combines the Internet of Things (IoT), gamification, and digital twin technology to improve industrial robot management and monitoring. The system aims to maximize robot performance, upkeep, and productivity, reflecting the continued growth of manufacturing automation and digital technologies in the renewable energy sector

Order a free sample PDF of the Digital Twin Market Intelligence Study, published by Grand View Research.