Biosensors Industry Overview

The global biosensors market size was estimated at USD 28.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030.

The demand for biosensors is increasing due to the diversity of medical applications, increasing number of diabetic patients, high demand for compact diagnostic devices, and rapid technological improvement.Accurate early diagnosis of the disease is critical to a positive disease prognosis and patient survival. Demand for disposable, convenient, and economical devices with fast response times has increased dramatically in recent years. The emergence of COVID-19 had a positive impact on the medical device industry. Early symptoms of COVID-19 were scanned using a variety of methods.

Gather more insights about the market drivers, restrains and growth of the Biosensors Market

The biosensors market is on the verge of substantial expansion, driven by noteworthy technological advancements and strategic endeavors by key market players. For instance, in January 2023, Intricon, a developer and manufacturer of medical devices leveraging smart miniaturized electronics, made a significant stride by inaugurating a Biosensors Center of Excellence (CoE). This strategic move highlights Intricon's commitment to integrating its expertise and capabilities in a vertically integrated business unit devoted to introducing biosensor devices to the medical market. Combining technological innovation with a specific focus drives positive growth in the biosensors market.

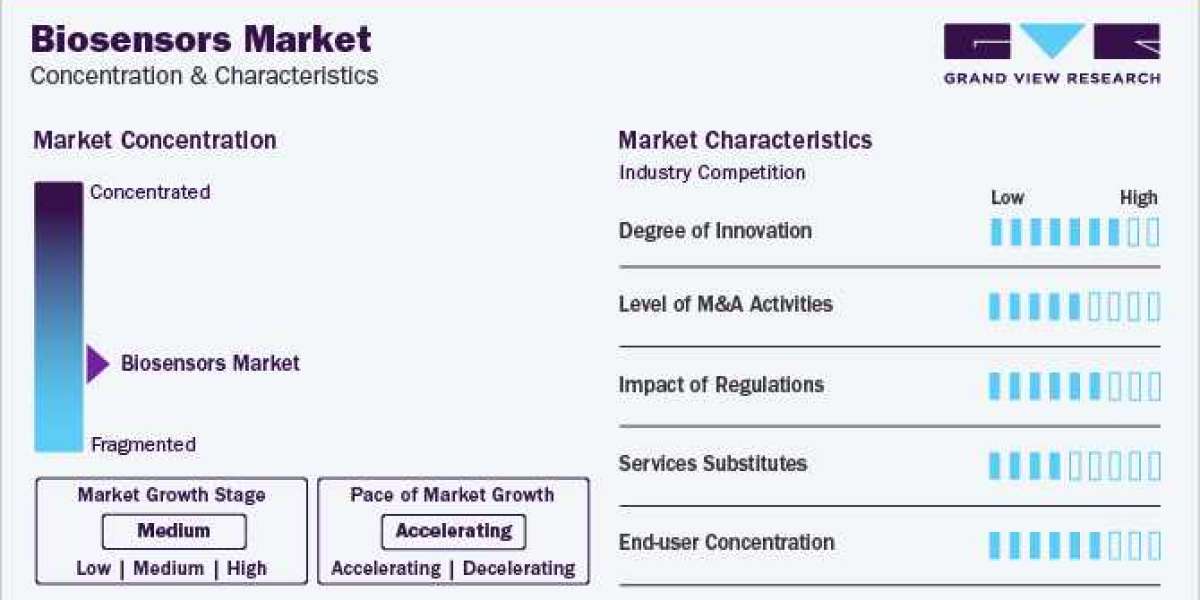

Nanotechnology-based biosensors are expected to have wide application scope in various industries, such as food analysis, imaging, and microbial activity monitoring. The global market is consolidating due to the growing preference for non-invasive biosensors, rising popularity of medical devices specialty drugs, and increasing research collaborations contracts between various manufacturers. For example, Ethicon Endo-Surgery Inc.under contracts administered by Johnson Johnson Innovation. Another important factor boostingindustry growth is the rising awareness about continuous health monitoring. As a result, the interest of athletes is increasing. Many athletes use Electromyography (EMG) biosensors to keep a close eye on their health and get alerts if something goes wrong.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global surgical drills market size was estimated at USD 1.27 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030.

- The global oral appliances market size was estimated at USD 908.7 million in 2023 and is expected to grow at a CAGR of 5.72% from 2024 to 2030.

Biosensors Market Segmentation

Grand View Research has segmented the biosensors market report on the basis of technology, application, end-user, and region:

Biosensors Technology Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- Thermal

- Electrochemical

- Piezoelectric

- Optical

Biosensors Application Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- Medical

- Cholesterol

- Blood Glucose

- Blood Gas Analyzer

- Pregnancy Testing

- Drug Discovery

- Infectious Disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

Biosensors End-user Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

Biosensors Regional Outlook (Volume, Unit; Revenue, USD Million, 2018 - 2030)

- North America

- S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Switzerland

- The Netherlands

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Indonesia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

Key Companies profiled:

- Bio-Rad Laboratories Inc.

- Medtronic

- Abbott Laboratories

- Biosensors International Group, Ltd.

- Pinnacle Technologies Inc.

- Ercon, Inc.

- DuPont Biosensor Materials

- Johnson Johnson

- Koninklijke Philips N.V.

- LifeScan, Inc.

- QTL Biodetection LLC

- Molecular Devices Corp.

Key Biosensors Company Insights

- Medtronic is a global health solutions company engaged in the development, manufacturing, distribution, and commercialization of device-based medical therapies and services. Organized into four segments—minimally invasive therapies, cardiac vascular group, restorative therapies, and diabetes group—Medtronic operates globally with a presence in over 370 locations across approximately 160 countries.

- Abbott is a prominent global healthcare company dedicated to the development, manufacturing, and commercialization of healthcare products worldwide. The company operates through four key segments: pharmaceutical products, diagnostic products, nutritional products, and medical devices.

Recent Developments

- In January 2023, Intricon Corporation announced the opening of a Bionsensor Center of Excellence (CoE). The center aims to vertically integrate the company’s business to provide biosensors in medical devices.

Order a free sample PDF of the Biosensors Market Intelligence Study, published by Grand View Research.