Natural Gas Procurement Intelligence

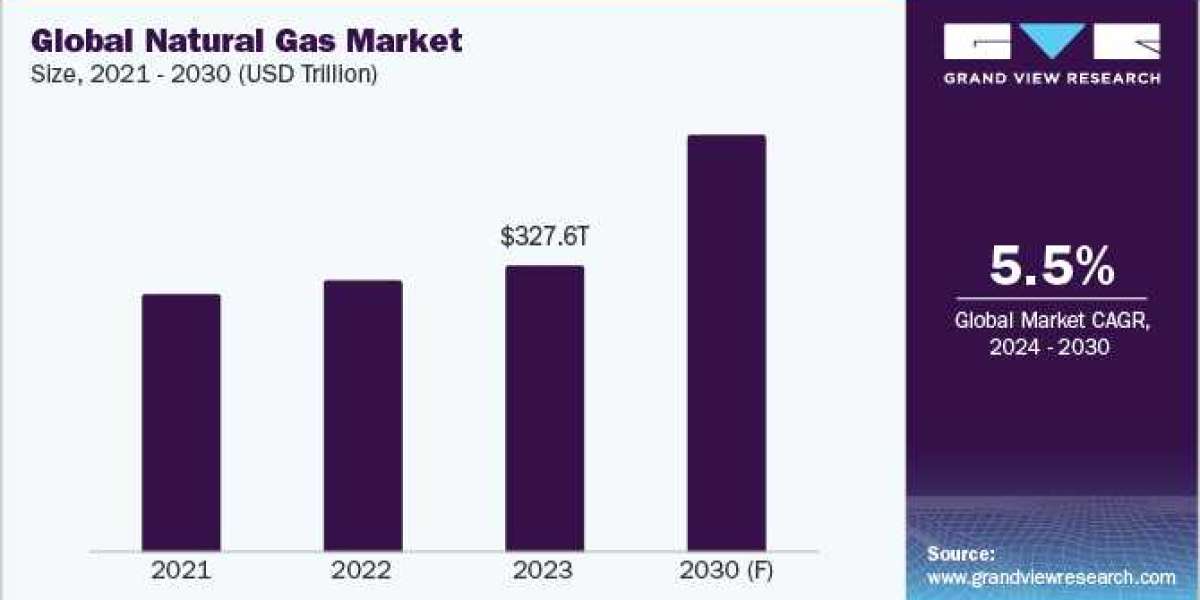

The procurement of natural gas is an essential part of ensuring a reliable energy supply. The global market size was estimated at USD 327.58 trillion in 2023. The increasing consumption from electricity and power sectors, focus on renewable energy, and the steady growth in global demand are driving the growth of the market. Prudent management of natural gas procurement helps companies provide the foundation for meeting society's energy needs sustainably. IEA projects that global gas demand will increase by 2.5% in 2024. Some of the frequent challenges faced by companies in this industry include regulatory and legal obstacles as a result of climate and weather changes, rising demand, fluctuations in prices, and aging pipelines. Thus, the integration of new technologies such as the Internet of Things (IoT), AI/ ML, and robots enable companies to monitor effectively, automate, and thereby optimize the commodity supply chain. A few examples include the implementation of sensors in wells and pressure control safety devices for real-time data collection, automation controls, and remote monitoring for maintenance checkups and upkeep.

One of the crucial aspects in achieving energy sustainability is the rising integration of renewable energy sources in this entire energy infrastructure. In this regard, the use of hydrogen and biomethane has become popular. For instance, Hydron is a Canada-based startup company that upgrades its organic waste to form renewable natural gas. The company’s own “Intensified Regenerative Upgrading Platform Technology (INTRUPT)” is an adsorption platform/ system that enables it to produce this energy commodity.

The industry is globally fragmented. The presence of several alternatives such as biofuels, hydrogen, coal, and nuclear energy increases the threat of substitutes. There is intense competition in this industry and integrated companies such as ExxonMobil, Sinopec, Chevron, and Aramco hold powerful positions in their respective regions as well as worldwide. Hence, compared to other fragmented players, these companies have higher bargaining power. The major buyers in this industry include refineries, national or international oil gas companies, distribution companies or traders, major industrial/power/electricity companies, etc. On a global scale, in the integrated oil and energy industry, in Q4 2023, there were around 290 deals related to MAs, which were worth around USD 192+ billion in total. A Deloitte report published in 2023 revealed that 82% of upstream and midstream deals in 2022 were based on natural gas assets.

Order your copy of the Natural Gas category procurement intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The key cost components associated with production include extraction and equipment, facilities and storage, transportation and distribution, labor, and overheads. The majority of extractions are conducted in reserves that are situated deep within the earth, typically in close proximity to solid or liquid hydrocarbon deposits, such as coal or crude oil. Exploration and extraction can occur in three ways-vertical or horizontal drilling and hydraulic fracturing. Storage is another crucial cost aspect as for storage of huge quantities; the commodity is generally kept in facilities that remain underground. For smaller amounts, it is stored in tanks above the ground. With regards to transportation, the commodity can either be transported in pipelines or via ships on water. Most of the distribution happens with the use of pipelines. Fluctuations in storage or factors related to transportation can significantly impact the final prices of this commodity in the market. One such instance was the costs of shipping freight to Northern Europe from Asia in January 2024 had increased between 5% – 10% as a result of the Houthi rebels' attack on commercial vessels. The increase in demand for this product coupled with the high transportation costs was one of the factors which contributed to the spike in commodity prices.

The international consumption of gas increased by 1% in 2023. This was mainly attributed to higher demand from the U.S., China, and some emerging countries in the APAC region. In contrast, consumption in Europe decreased by 7% in 2023. This reduction was exacerbated by the rapid spread of renewables and the greater availability of nuclear power. This impacted consumption negatively in both Europe and mature markets in Asia, according to IEA. Under sourcing and procurement, companies select the vendors based on multiple specifications. Some of them include cost per cubic meter or feet, pricing plans-fixed or variable, the size and diversification of its fuel base-(for instance, hydrocarbon resource base), integration in operations, presence and operations in countries as per client’s target locations and other sustainable factors (for instance, technologies used, worker’s safety, reliability and lead/delivery times, quality, capacity, environmental competencies, etc.).

Natural Gas Sourcing Intelligence Highlights

- The market is fragmented. This is because the companies have a high reliance on pipeline infrastructure, which prohibits cross-regional arbitrages.

- The top ten category producers worldwide are from the U.S., Russia, China, the UK, the Netherlands, and France

- This fossil-fuel-based energy prices are determined by two factors: commodity prices and basis prices. The commodity price is calculated using the NYMEX Henry Hub futures prices. The basis pricing includes storage, fuel, local production, and transportation costs. Fixed and floating pricing are the most common pricing models in this industry.

- In terms of market production and consumption, the U.S. is the leading country followed by Russia and China.

List of Key Suppliers

- PJSC Gazprom

- China National Petroleum Corporation (CNPC)

- China Petroleum Chemical Corporation, (or Sinopec)

- ExxonMobil Corporation

- BP p.l.c.

- Chevron Corporation

- Shell plc

- TotalEnergies SE

- Saudi Arabian Oil Group (or, Aramco)

- Eni S.p.A.

- PJSC Rosneft Oil Company

- Petróleo Brasileiro S.A

- Equinor ASA

- ConocoPhillips Company

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Natural Gas Procurement Intelligence Report Scope

- Natural Gas Category Growth Rate : CAGR of 5.5% from 2024 to 2030

- Pricing Growth Outlook : 12% - 18% (Annually)

- Pricing Models : Contract-based, spot-price, and volume-based

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Production capacity, type of gas (dry or LNG), quality and grade of product, distribution and transportation options, technical specifications, and other operational and functional capabilities

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions