Meetings and Events Procurement Intelligence

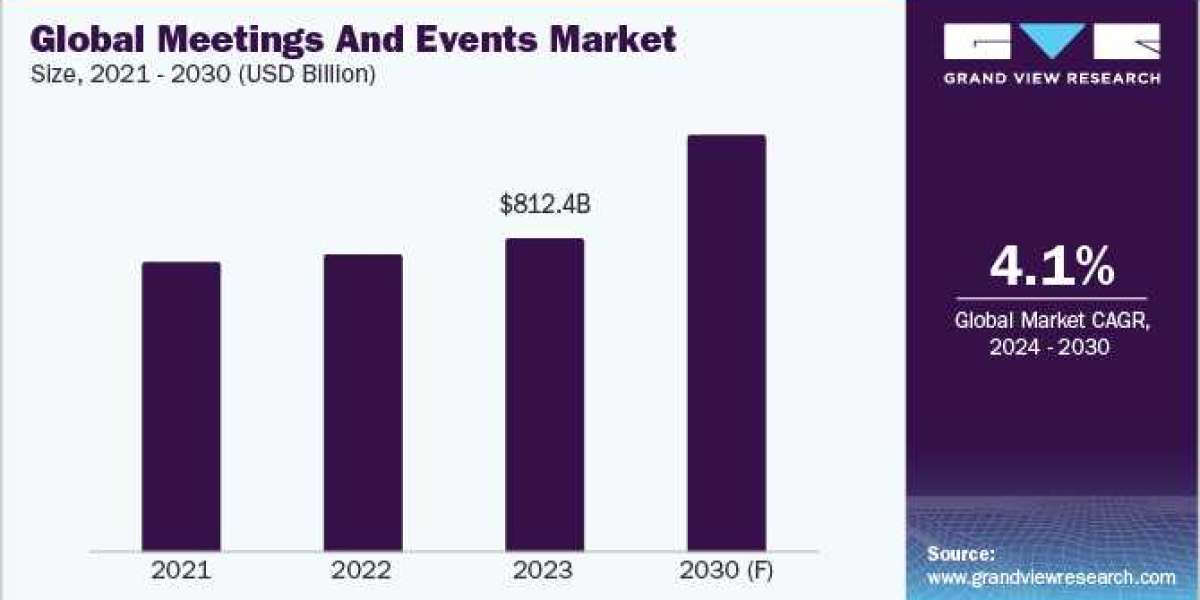

Procurement of meetings and events services involves the process of acquiring or finding suitable venues, arranging catering, securing audio-visual equipment, and hiring staff. The global market size was estimated at USD 812.4 billion in 2023. Business expansion efforts, networking opportunities, and the growing importance of face-to-face interactions in the digital age have created a demand for the services. The worldwide business environment is experiencing a significant shift in how companies conduct meetings, trade shows, seminars, and other gatherings. Changing lifestyles, professional practices, and social interactions have been fundamentally altered in recent years, resulting in a ripple effect that has generated fresh prospects within the industry.

Hybrid events are rapidly establishing themselves as the prevailing standard in the industry. Through a combination of both physical and virtual components, hybrid events are experiencing growth in the industry. Utilizing live streaming, organizers can broadcast the content of the meetings, including keynote addresses and panel discussions, to remote attendees who are unable to participate in person. The majority of gatherings and hospitality initiatives will remain anchored by in-person gatherings over the forecast period. Direct interactions offer greater potential for profound engagement, networking, and interaction, rendering them indispensable for businesses.

Theme-based gatherings are increasingly gaining traction as people seek enjoyable gatherings that promise distinct experiences. In 2023, one such instance was a show created by IMEX Group. The company, renowned for organizing the largest trade show for the global meetings, events, and incentive travel sector, chose "Human Nature" as the theme for its gatherings in Frankfurt and Las Vegas.

In 2023, there was a notable shift within the industry towards prioritizing sustainability and embracing diversity, equity, and inclusion (DEI). Numerous organizations have made public pledges in this regard and are now tasked with integrating sustainability objectives into the planning of their services. This includes decisions such as opting for destinations that prioritize sustainability and choosing venues that hold sustainability certifications. These efforts reflect a concerted push toward minimizing event emissions through comprehensive strategies and protocols.

Order your copy of the Meetings and Events category procurement intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Meetings and Events Sourcing Intelligence Highlights

- The supplier landscape in this industry consists of different types of service providers like venue providers, catering services, equipment rental companies, and technology providers. While there are many of these providers, the uniqueness of certain venues or specialized services can give these service providers some leverage. Hence, planning companies try to maintain long-term relationships with these service providers.

- The barrier to entry in the market can be moderate to high in terms of setting up an event planning business, employing high technology, and establishing a strong reputation and client base, which requires significant expertise. Existing companies may have established relationships with clients and venues, making it difficult for new entrants to gain a foothold.

- The market is fragmented, with the issue arising from the Standardized Industrial Code (SIC). As the businesses in the event industry are registered with the codes of other industries, there is a mismatch in SIC codes, which adds to further fragmentation in the industry.

- Staff salaries, venue costs, travel and accommodation, and marketing and advertisingare among the key costs incurred in providing services. Other costs include IT costs, food and beverage, printing branded elements, and staff training costs.

List of Key Suppliers

- CWT ME

- ATPI Ltd.

- Informa PLC

- BCD Travel Services B.V.

- Cvent Inc.

- Flight Centre Travel Group Limited

- Creative Group Inc.

- 360 Destination Group

- Bizzabo

- Nunify Tech Inc.

- Event Solutions

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement IntelligenceReport, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Cyber Security Procurement IntelligenceReport, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Lab Equipment Procurement IntelligenceReport, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement IntelligenceReport, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Meetings and Events Procurement Intelligence Report Scope

- Meetings and Events Category Growth Rate : CAGR of 4.1% from 2024 to 2030

- Pricing Growth Outlook : 6% - 7% (increase (Annually)

- Pricing Models : Cost plus pricing, fixed pricing, hourly pricing, competition-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Types of events, end-to-end solutions, virtual hybrid solutions, attendee and catering management, experience, time taken to design an event, geographical presence, operational capabilities, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions