Office Supplies Procurement Intelligence

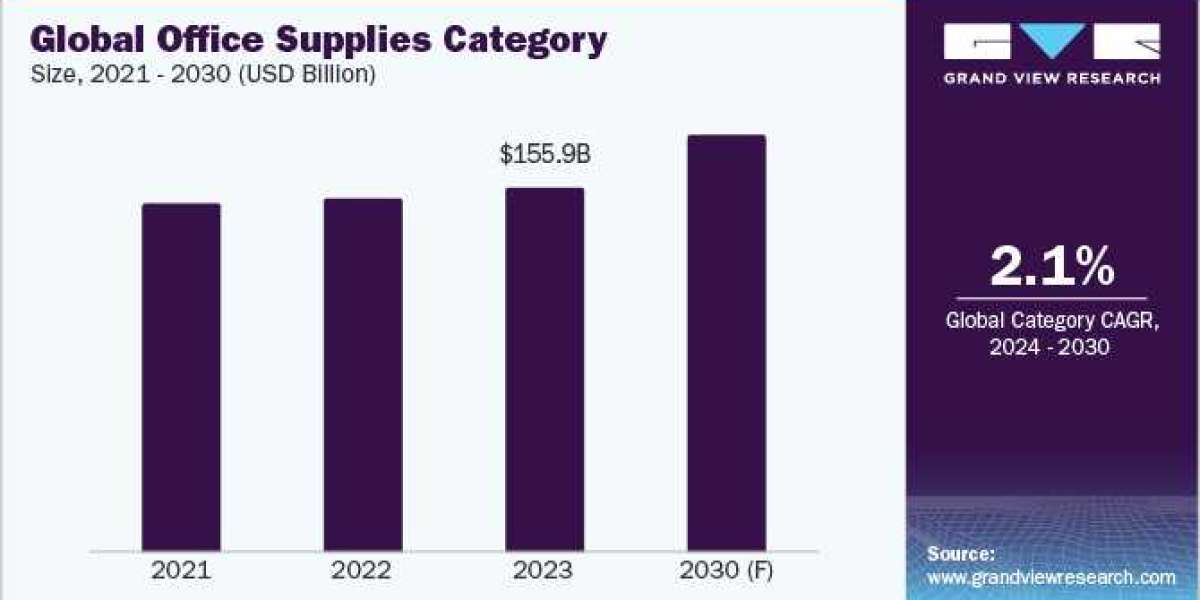

The office supplies category is forecasted to grow at a CAGR of 2.1% from 2024 to 2030. In 2023, North America held the largest share of the global category, accounting for 32%. This region’s growth is attributed to the strong demand for personalized stationery, advancements in manufacturing technology, and a rising preference for green products. Asia Pacific is poised to witness the fastest growth rate during the forecast period, due to rapid expansion of urban areas, rising demand for innovative products, expansion of co-working spaces, and increased adoption of e-commerce.

Office supplies are utilized by a wide range of end-users to enable administrative tasks, enhance workplace functionality, and ensure a well-equipped and productive workspace. Key end-users of this category include corporations, educational institutes, hospitals, hotels, and NGOs. For instance, hospitals use office supplies for patient records and billing, and NGOs deploy these items for processing documentation, fundraising, and preparing outreach materials.

Order your copy of the Office Supplies category procurement intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Key technologies influencing the growth of this category include smart notebooks and pens, IoT-enabled office stationery, AI-powered inventory management, collaborative whiteboards, and smart toners. Collaborative whiteboards are being deployed to facilitate interactive workplace environments. They allow employees to plan, brainstorm, and visualize ideas in real time, regardless of their geographical location. They are equipped with features such as drawing tools, document-sharing capabilities, and sticky notes to enhance teamwork, communication, and project management within remote teams.

Key suppliers that are providing office supplies are competing based on pricing strategies, profit margins, product personalization and customization, sustainability measures, lead time reduction, and regulatory compliance. Customers in this category have diverse options in terms of product range, budget size, flexible payment terms, value-added services, after-sales support, and competitive benchmarking. Regulatory laws in several regions require suppliers to comply with rigorous standards related to product safety, manufacturing, environmental impact, and materal recycling.

The prices of office supplies are affected by several variables. Key factors affecting the prices include product range, production costs, distribution and logistics costs, and market competition. Production costs vary based on fluctuations in the prices of key raw materials and labor. For instance, prices of raw materials such as polymers, pulp, plastic, paper, metals, and adhesive materials are affected by feedstock and energy costs. Labor costs fluctuate based on geographic location, economic conditions, labor laws, skill requirements, and competition.

Office Supplies Sourcing Intelligence Highlights

- The office supplies category comprises a fragmented landscape, with vendors engaged in intense competition.

- Due to the intense market competition, customers within the category have significant bargaining power, providing them the flexibility to switch to superior alternatives.

- India and China are favored as low-cost or best-cost countries for office supplies due to their reasonable raw material, labor, equipment, packaging, labeling, and distribution costs.

- The key cost components of this category encompass raw materials, labor, equipment, packaging and labeling, storage and distribution, and other costs. Other costs comprise RD, rent and utilities, general and administrative, sales and marketing, compliance, and taxes.

List of Key Suppliers

- 3M Company

- ACCO Brands Corporation

- Deli Group Co., Ltd.

- Global Office Supplies Ltd.

- Nauticon Office Solutions

- Novatech, Inc.

- SASCO Group

- Stanley Black Decker, Inc.

- Staples, Inc.

- The Lyreco Group

- The ODP Corporation

- W. Grainger, Inc.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement IntelligenceReport, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Office Supplies Procurement Intelligence Report Scope

- Office Supplies Category Growth Rate : CAGR of 2.1% from 2024 to 2030

- Pricing Growth Outlook : 5% - 10% increase (Annually)

- Pricing Models : Cost-plus pricing, bundled pricing, demand-based pricing, competition-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, regulatory certifications, product range, delivery mode (online/offline), sustainable product offerings, lead time, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions