Maintenance Repair Operations (MRO) Procurement Intelligence

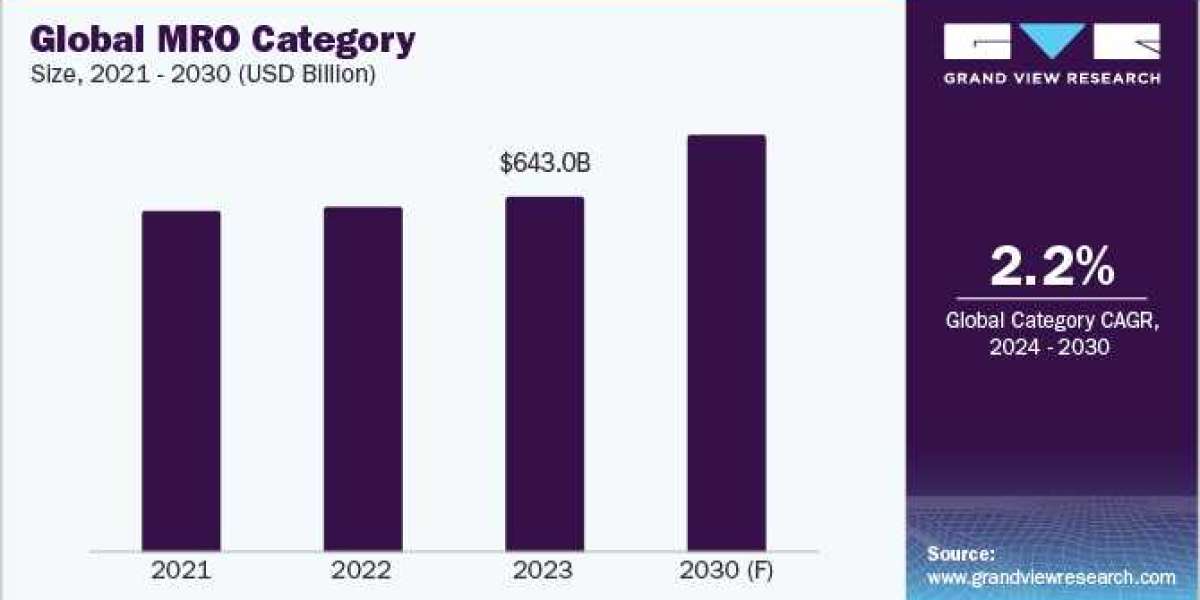

The maintenance repair operations (MRO) category is expected to grow at a CAGR of 2.2% from 2024 to 2030. The increasing demand from the manufacturing industries, the high adoption of smart technologies, and the growing requirement to reduce equipment downtime are driving the category’s growth. Companies are increasingly using MRO services to manage their supply chain and inventory efficiently. It is mainly helpful when multiple materials are used in the production process and the absence of any particular material can have a significant impact on production. Robotics is one of the fastest-growing technologies in this category used for improving operational efficiency. It is widely implemented in the industrial, manufacturing, and aftermarket segments. The major applications include single-part repairs, carbon fiber manufacturing, and intricate inspection tasks using miniaturization, which enables robots to inspect components normally difficult for humans to access.

The category is fragmented with a mix of players ranging from spare parts suppliers to national and international-level distributors. MRO often involves a wide, fragmented network of suppliers providing anything from tools, safety equipment, and cleaning supplies. According to industry experts, there is a growth trajectory for aftermarket and maintenance, engineered and machined components suppliers in lower-tier (or, Tier 3) segments in fragmented markets. Companies are increasingly collaborating or collaborating with technology providers to improve their services or expand their product lines.

Labor, warehousing, rent and utilities, technology or IT infrastructure, and overheads. Other costs can include transportation, marketing, legal, or tax. Labor is the largest cost component. IT infrastructure is crucial as it includes elements like engineering systems, computerized maintenance management systems (CMMS), enterprise resource planning (ERP) software, and e-procurement systems that impact costs. A CMMS system allows firms to simplify maintenance operations by tracking equipment, inventory, and manpower.

Order your copy of the maintenance repair operations procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Maintenance Repair Operations (MRO) Sourcing Intelligence Highlights

- The maintenance repair operations (MRO) category is fragmented. As a result of this fragmentation, the major challenges for vendors include high acquisition costs, poor visibility into demand, and duplication.

- The competitive rivalry is high among players due to low switching costs and industry fragmentation. One of the major barriers to entry among new entrants is information asymmetry as a result of information or data controls and manuals by manufacturers, OEMs, or vendors.

- Labor forms the largest component, accounting for a 40% - 50% share of the total cost structure.

- Some of the other preferred countries for procuring MRO services include Malaysia, Singapore, Turkey, and UAE (Dubai). These nations have consistently established themselves as reliable players in the APAC region. This is mainly due to the favorable government policies and tax incentives, the ability to create viable ecosystems, and the presence of cost-efficient skilled labor.

List of Key Suppliers

- Adolf Würth GmbH Co. KG

- Air Liquide S.A.

- Applied Industrial Technologies, Inc.

- MSC Industrial Direct Co., Inc.

- Rubix Group International Limited

- Linde Engineering

- ERIKS Group

- Sonepar Group

- WESCO International, Inc.

- W. Grainger, Inc.

- RS Group (formerly Electrocomponents plc)

- Critica Infrastructure (Henkel)

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Maintenance Repair Operations (MRO) Procurement Intelligence Report Scope

- Maintenance Repair Operations (MRO) Category Growth Rate: CAGR of 2.2% from 2024 to 2030

- Pricing Growth Outlook: 8% - 15% (Annually)

- Pricing Models: Cost Plus pricing, contract-based pricing model

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: By types of services and supplies (industrial and production equipment, construction and infrastructure repairs, material handling equipment, tools and supplies, etc.), operational and functional capabilities, quality measures, standards followed, certifications, regulations, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions