Helium Procurement Intelligence

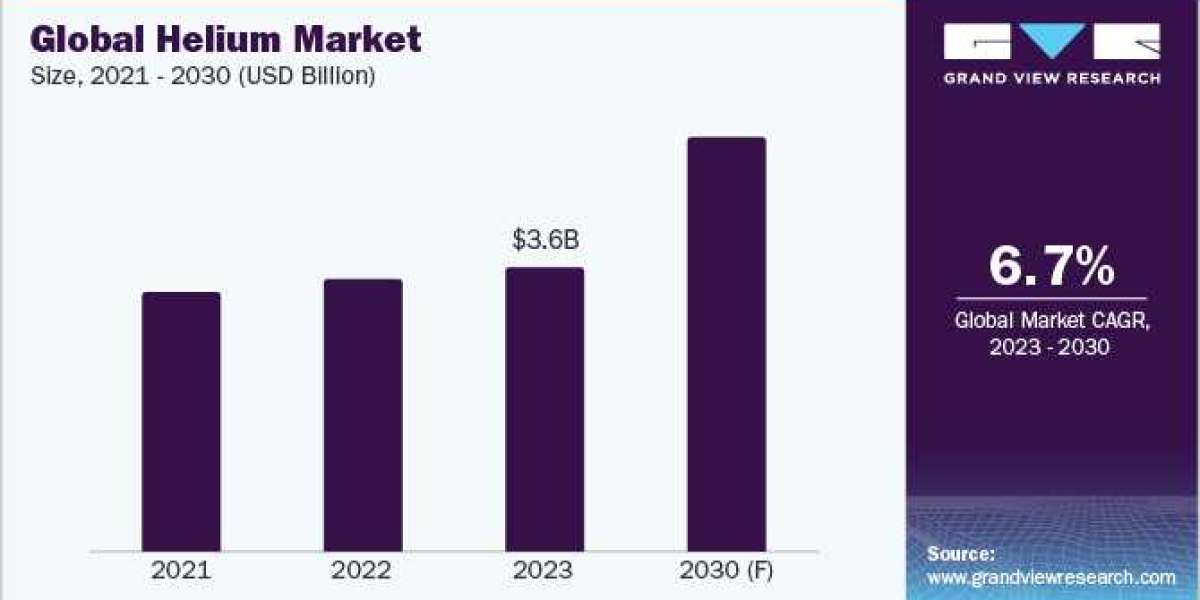

The helium market is expected to grow at a CAGR of 6.7% from 2024 to 2030. The market is predicted to grow significantly due to the rising demand for helium utilization in aerospace, healthcare, deep-sea exploration, automotive, and manufacturing industries. In 2023, North America accounted for the highest proportion of the industry share, with more than 36%. Helium's supercooling property has led to its use in medical equipment such as MRI and NMR machines, particle accelerators, and superconducting materials due to advances in cryogenic technologies. Helium is used in the semiconductor industry to test electrical components and cool circuit boards.

NASA is investing heavily in the RD of helium to improve the efficiency of GPS-enabled vehicles. For instance, in September 2022, NASA awarded a contract of USD 149 million to Air Products and Chemicals, Linde, and Messer Group. The three leaders would provide helium of 1.4 million liters (liquid) and 87.7 million standard cubic feet of helium (gaseous) to different NASA facilities. It is being used in International Space Station programs.

In the noble gas market, helium dominated with 47% of the overall share in 2023. Technology-wise, it was found that in 2023, more than 80% of gas companies use advanced analytics and robotic process automation and leverage AI/ML technology in their processes. Suppliers actively engage in multiple mergers and acquisitions, capacity expansion, partnerships and collaborations, launch new products, develop new technologies, and invest heavily in RD to gain competitive advantage.

Order your copy of the Helium category procurement intelligence report 2024-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Helium Sourcing Intelligence Highlights

- The global helium market features an oligopolistic landscape with the dominance of five major players. The top five players (Linde, Air Liquide, Air Products, Taiyo Nippon Sanso, and Iwatani) contribute around 80% of the market share.

- The competition is intense as big players such as Linde Plc, Air Products Chemicals, and Air Liquide are extensively competing with each other to extend their global presence and product portfolio to cater to large global markets.

- The threat of substitutes is low as the alternatives for this category are limited. For instance, in some cases, argon, hydrogen, or nitrogen may be used in place of helium. However, nitrogen is a very poor substitute for helium despite having a low cost. Hydrogen on the other hand is a highly flammable commodity.

- The cost components associated with the production of helium are raw materials/feedstock, manufacturing process and equipment, electricity/energy, transportation/distribution, warehousing and storage, facilities and labor.

- The most preferred countries for sourcing helium are the U.S., Qatar, Algeria, Australia, and China.

List of Key Suppliers in the Helium Category

- Linde Plc

- Nippon Sanso Holdings Corporation

- Messer SE Co. KGaA

- Air Products and Chemicals, Inc.

- Air Liquide S.A.

- Iwatani Corporation

- STRANDMOLLEN A/S

- Axcel Gases

- Gulf Cryo

- The Southern Gas Limited

- Ellenbarrie Industrial Gases Limited

- Qatargas Operating Company Limited

- Buzwair Industrial Gases Factories

- nexAir, LLC

- Exxon Mobil Corporation

Browse through Grand View Research’s collection of procurement intelligence studies:

- Pressure Vessels Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Business Intelligence Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Helium Procurement Intelligence Report Scope

· Helium Category Growth Rate: CAGR of 6.7% from 2024 to 2030

· Pricing Growth Outlook: 15% - 20% (Annually)

· Pricing Models: Volume-based, contract-based pricing model

· Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

· Supplier Selection Criteria: Application areas served, supply type, production capacity, purity level, type of helium provided, sources of helium, sub-helium brands, operational capabilities, quality measures, technology, certifications, data privacy regulations, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions