Call Center Service Procurement Intelligence

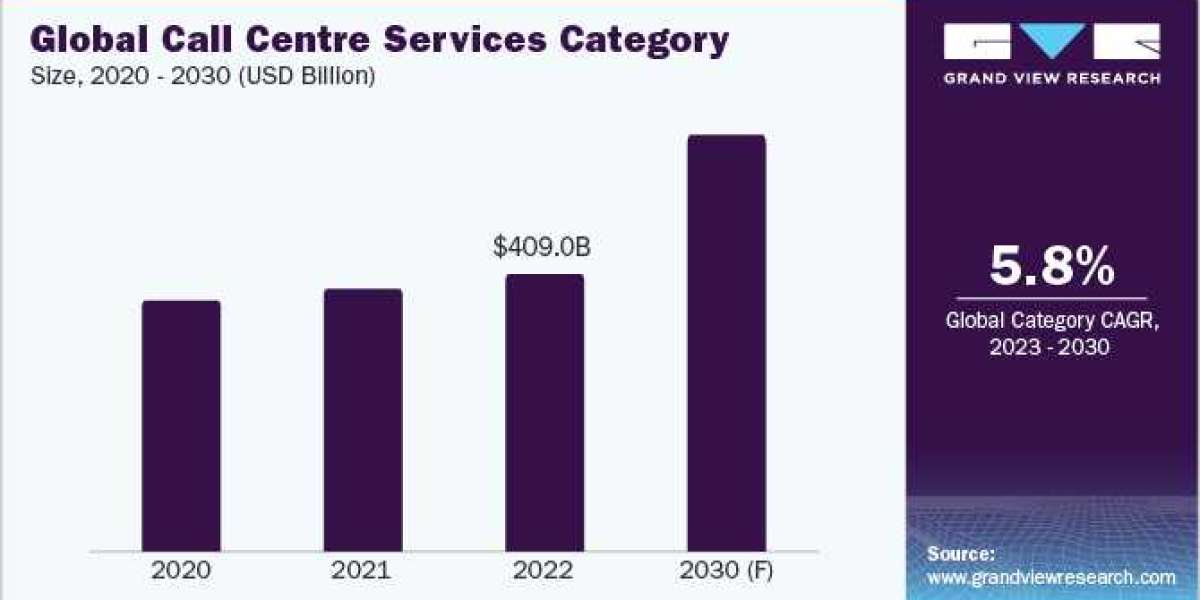

The call center service category is expected to grow at a 5.8% CAGR from 2023 to 2030. The rise of omnichannel communication is one of the primary factors driving this category’s growth since customers want to be able to engage with businesses via a variety of channels, including phone, email, chat, and social media. Call center solutions can help businesses that support omnichannel communication to provide a seamless client experience across all media.

This industry is growing because of the acceptance of cloud-based call center solutions, which offer superior adaptability, scalability, and affordability over traditional on-premise call centers. Data analytics tools are used to uncover customer pain points and areas where a company's product or service offering might be improved. This can assist companies in increasing customer happiness and loyalty. Because many businesses now operate in multiple places, the rise in business globalization has increased the demand for multilingual call center agents.

Order your copy of the Call Center Service category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on collaborating or acquiring to enhance their operational and/or service capabilities. For instance,

- In May 2022, Sprinklr, a unified customer experience administration (Unified-CXM) platform, announced a partnership with Twilio, the customer engagement solution that delivers real-time, tailored interactions. Clients of Sprinklr could create the next generation call centers by integrating Twilio voice and SMS technology with Sprinklr Modern Care−a full, cloud-based platform for true omnichannel customer care.

- In January 2022, with the acquisition of Hoodoo Digital, Genpact is strengthening Rightpoint's Adobe capabilities, expanding its understanding of the business, and assisting clients in managing content, business, and promotional activities throughout the organization, which leads to sharper insights and better strategic impact.

- In January 2022, with the acquisition of Diversify, an Australian value-added BPM service provider, HGS, expanded its geographical presence to the Australia and New Zealand region. This acquisition adds 1,100+ domain experts to its existing pool of experts while augmenting four delivery centers in the Philippines, bolstering HGS’ portfolio of back-office and non-voice business.

AI is becoming increasingly prevalent in call centers, as it can automate tasks traditionally performed by agents, such as answering simple questions, routing calls, and providing customer support. This frees up agents to focus on more complex tasks, such as resolving customer issues. Virtual assistants, chatbots, speech recognition technology, video conferencing, and cloud computing are also being utilized in call centers to automate tasks such as scheduling appointments, making reservations, and providing customer support.

Pricing would be determined by the outcomes, such as greater customer happiness or sales. Because it balances incentives and emphasizes focus on delivering high-quality solutions, this approach benefits both the service provider and the client. This model also helps suppliers differentiate themselves from the competition by allowing them to offer more personalized solutions that are suited to the demands of specific consumers.

Call Center Service Sourcing Intelligence Highlights

- The number of both large and small companies operating in different areas has caused the call center services category to become highly fragmented on a worldwide scale. Players compete aggressively with one another to grow their customer base and offer superior customer service.

- Upkeep and Maintenance cost, staffing cost, and fixed overheads account for the largest cost component of the call center service business

- Most of the service providers offer services such as technical support, marketing, and generating leads.

List of Key Suppliers

- [24]7.ai, Inc.

- Alorica Inc.

- Atento Spain Holdco, S.L.U.

- Concentrix Corporation

- Entel S.A.

- Foundever

- Genpact

- IBEX Global Solutions, Inc.

- Intrado Life Safety, Inc.

- TD SYNNEX Corporation

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Call Center Service Procurement Intelligence Report Scope

- Call Center Service Category Growth Rate : CAGR of 5.8% from 2023 to 2030

- Pricing Growth Outlook : 6% - 7% (Annually)

- Pricing Models : Value-based pricing model and volume-based pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Price, quality, reliability, flexibility, technical specifications, operational capabilities, regulatory standards and mandates, category innovations, and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions