Manned Guarding Services Category Overview

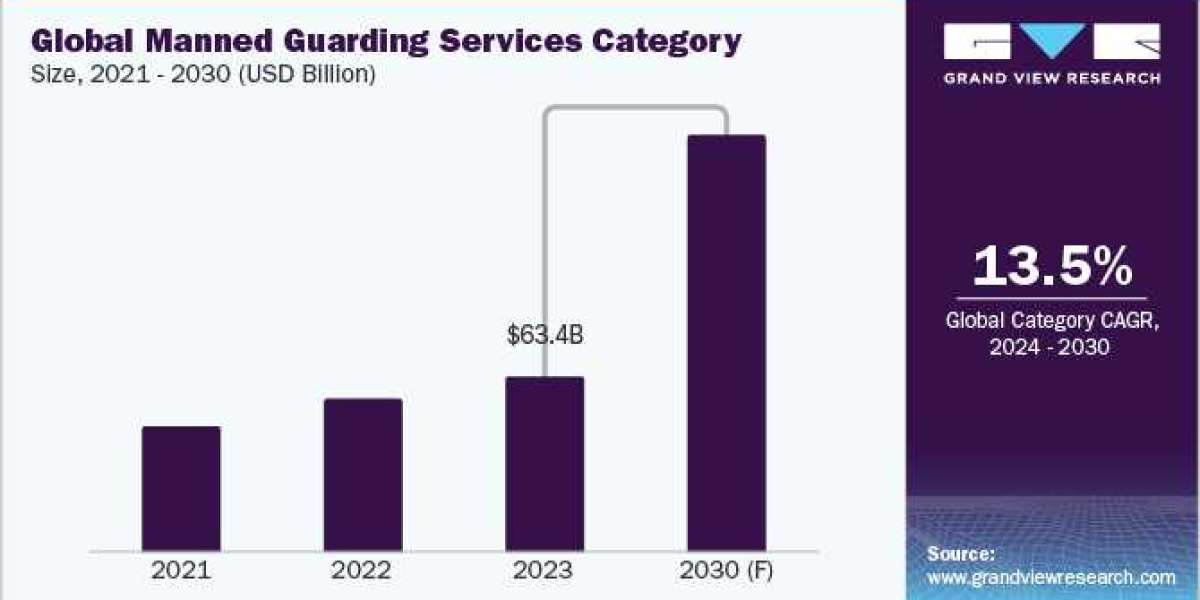

The manned guarding services category is anticipated to witness growth at a CAGR of 13.5% from 2024 to 2030. Asia Pacific dominates the global category, followed by North America (with the fastest growth rate) and Europe. Rising standards of living, urbanization, and population are the key factors driving Asia Pacific’s growth. In addition, the region’s expanding tourism industry, coupled with political and economic stability, is also propelling the category’s expansion. The growing usage of technologies, such as access control systems and CCTV, is propelling the demand for the services offered in the category in North America. It has also helped companies to cut expenses while improving the safety of their employees and facilities. The demand in Europe is driven by the demand for more security at public events and venues and the growing incidence of terrorist incidents.

Order your copy of the Manned Guarding Services Procurement Intelligence Report, 2024 – 2030 , published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Based on application, the commercial buildings segment holds the largest share of revenue. The industrial buildings segment is anticipated to grow at the highest growth rate during the forecasted timeframe. Industrial facilities need round-the-clock security in addition to having enormous areas that need to be monitored to guarantee the protection of the building’s assets. Commercial security entails safeguarding warehouses, office buildings, retail centers, and other establishments, both inside and outside. It encompasses all deployment types, from mobile patrols and stationary guard posts to guarded locks and alarms, monitoring, and access control networks. In addition, offering VIP security to high-profile businessmen and celebrities is also a crucial task that requires high qualifications and a high level of experience, as the tasks involve conducting visitors background checks, besides bodyguarding.

Manned Guarding Services Sourcing Intelligence Highlights

- The manned guarding services category exhibits a fragmented landscape, with the presence of a large number of global and regional market players having intense competition among each other.

- Buyers in the category possess high negotiating capability due to the intense competition among the suppliers, enabling the buyers with the flexibility to switch to a better alternative.

- India is one of the preferred low-cost/best-cost countries for sourcing manned guarding services suppliers. The manned security sector in the nation is known for providing high-quality services at affordable prices.

- Labor, licensing registration, equipment weapons, rent utilities, uniforms, and others are the major cost components of manned guarding services. Other costs can be further bifurcated into training certification, administrative fees, weapon license renewal, office supplies, insurance, and performance bonuses.

Manned Guarding Services Procurement Intelligence Report Scope

The Manned Guarding Services category is expected to have pricing growth outlook of 5% – 10% increase (Annually) from 2024 to 2030, with below pricing models.

- Per-hour Pricing,

- competition-based pricing

Supplier Selection Scope of Report

- Cost and pricing,

- past engagements,

- productivity,

- geographical presence

Supplier Selection Criteria of Report

- Geographical service provision,

- years in service,

- employee strength,

- industries served,

- revenue generated,

- certifications,

- daily escort,

- VIP escort,

- static guarding,

- mobile patrolling,

- alarm response,

- technology support,

- others

Manned Guarding Services Procurement Intelligence Report Coverage

Grand View Research will cover the following aspects in the report:

- Market Intelligence along with emerging technology and regulatory landscape

- Market estimates and forecasts from 2023 to 2030

- Growth opportunities, trends, and driver analysis

- Supply chain analysis, supplier analysis with supplier ranking and positioning matrix, supplier’s recent developments

- Porter’s 5 forces

- Pricing and cost analysis, price trends, commodity price forecasting, cost structures, pricing model analysis, supply and demand analysis

- Engagement and operating models, KPI, and SLA elements

- LCC/BCC analysis and negotiation strategies

- Peer benchmarking and product analysis

- Market report in PDF, Excel, and PPT and online dashboard versions

Manned Guarding Services Procurement Cost and Supplier Intelligence

Technologies such as drones, mobile-supported security, and analytics are being highly utilized in the industry to supplement the services offered in the category. Large regions can be monitored by drones fitted with cameras and sensors, which can be operated remotely by security officers on the ground. This enables high-level security coverage of sizable events, including music festivals or athletic events. In addition, mobile devices can be particularly useful as authentication tokens in the field due to their network connectivity and ability to be updated in real time while in the field. There is no need for the security personnel to rush back to the office every time a new task is needed because they can access the system while on the go. Furthermore, the Internet of Things (IoT) and cloud connectivity are becoming essential components of physical security for buildings, assets, and people.

The COVID-19 outbreak has had varied effects on the category. The pandemic affected the demand and operational processes in the security sector, including security services, it also caused difficulties and interruptions for many other businesses. Certain industries witnessed a rise in demand for security services during the pandemic. For instance, there was an increased requirement for security at vital enterprises like hospitals, supermarkets, and crucial infrastructure because of the lockdowns and restrictions in place. However, because of lockdowns, closures, and reduced activity, the need for services offered in the category fell in sectors such as hospitality, entertainment, and some commercial areas. Technology adoption in the security sector was expedited due to the pandemic. Surveillance technologies, contactless access control systems, and remote monitoring became more common in response to the desire to reduce physical contact and increase efficiency.

List of Key Suppliers

- Allied Universal Security Services LLC

- Axis International Security Services Limited

- Corps Security (UK) Ltd.

- G4S Limited

- Guardian Protection Services Limited

- Gurkha Security Services Ltd.

- ICTS Europe S.A.

- Mitie Group plc

- Prosegur Compañía De Seguridad, S.A.

- Securitas AB

- Security and Intelligence Services Ltd.

- Transguard Group LLC

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions