Learning and Development Procurement Intelligence

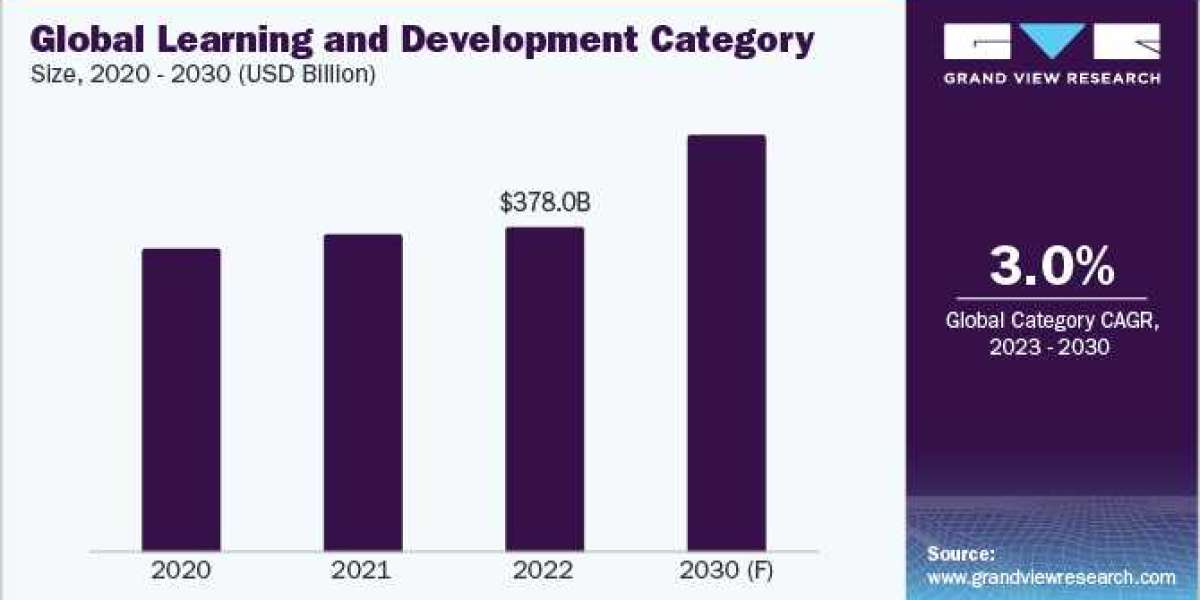

The learning and development (LD) category is expected to grow at a CAGR of 3% from 2023 to 2030. The field of the LD industry is undergoing continuous and swift transformative shifts and advancements. It is fundamentally altering how organizations tackle employee development and skills improvement. LD service providers must proactively adapt to changes, incorporating elements such as on-the-spot learning, virtual and augmented reality fusion, data-informed insights, and microlearning. Staying ahead of these developments is crucial for designing effective and forward-looking LD programs.

The landscape of LD services has experienced a transformation through the integration of eLearning, enhancing employees' learning capabilities and fostering retention. Moreover, it has streamlined the tasks of service providers by facilitating data management, information administration, and performance tracking for their clients. This, in turn, enables more informed decision-making regarding training interventions tailored to address specific knowledge and skill gaps of the client’s organization.

Personalized LD that aligns with individual employees' unique needs and preferences is becoming increasingly popular among service providers. Achieving personalized services involves utilizing various methods, such as adaptive learning algorithms, self-assessments, and one-on-one coaching sessions. The advantages of a personalized approach in employee training include heightened engagement, improved retention rates, and enhanced performance. Additionally, it empowers employees to learn quickly and in their preferred manner, which will indirectly influence LD service providers’ business positively.

The overall outcome of the service providers depends on the success of the individual employee learning experience. This has resulted in adopting a centric approach by centering on employees and optimizing each experience. To provide employee-centric expertise, service providers usually take time to understand each employee's personas and specific needs and challenges. Through this, service providers can enhance the effectiveness of their training program and move closer to achieving clients’ goals.

Service providers also focus on a collaborative learning approach, emphasizing social interaction and promoting teamwork, communication, and knowledge sharing. Various methods facilitate collaborative learning, including group projects, peer-to-peer mentoring, and online forums. This approach is instrumental in cultivating an organization's learning culture, ultimately enhancing clients’ engagement and retention with the service providers.

LD service providers maintain specialized in-house teams that skillfully manage various aspects of their services. This encompasses proficient handling of tasks such as instructional design, content creation, training delivery, and technology development. These internal teams consist of subject matter experts, instructional designers, trainers, and other experienced professionals with a focus on learning and development. On the other hand, the expenses incurred in providing LD services can vary widely depending on factors such as the type of training, the industry, the scale of the program, and whether the training is delivered in person or online. Service providers need to carefully budget for these expenses to ensure the quality and effectiveness of their programs. For instance, providing e-learning, webinars, and online materials can be a cost-effective solution compared to traditional in-person training. Reducing training expenses hinges on adopting a strategic approach to the timing and method of employee training.

Order your copy of the Learning and Development category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Learning and Development Sourcing Intelligence Highlights

- Buyers such as large corporations and organizations seeking learning and development services have high bargaining power. This depends on factors such as the availability of alternative providers, the uniqueness of the services offered, and the importance of the benefits to the buyers.

- The category is fragmented, with the presence of numerous players in the category. Top players such as Korn Ferry, Wildsparq, and Dale Carnegie continuously focus on providing specialized, innovative, and technology-driven LD programs to offer more relevant and tailored services to their clients.

- Trainers’ salary, IT costs, facility rental, staff training, marketing and advertising, and others are some expenses incurred when providing services.

- The cost of services depends on various factors, such as type of service, location of the LD session, number of participants, and complexity of the program. Providing online learning sessions is the most cost-effective approach.

List of Key Suppliers

- Korn Ferry

- Wildsparq

- Dale Carnegie

- FranklinCovey

- Cognician

- The Mintable

- AllenComm

- 360Training

- Hone

- Aptimore

Browse through Grand View Research’s collection of procurement intelligence studies:

- Cyber Security Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Lab Supplies Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Metal Finishing Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Learning and Development Procurement Intelligence Report Scope

- Learning and Development Category Growth Rate : CAGR of 3.0% from 2023 to 2030

- Pricing Growth Outlook : 5% - 7% (Annually)

- Pricing Models : Service-based pricing, competition-based pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Services provided, end-to-end services, project timeline, customization, technology used, global reach, regulatory compliance, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions