Finance and Accounting Outsourcing Procurement Intelligence

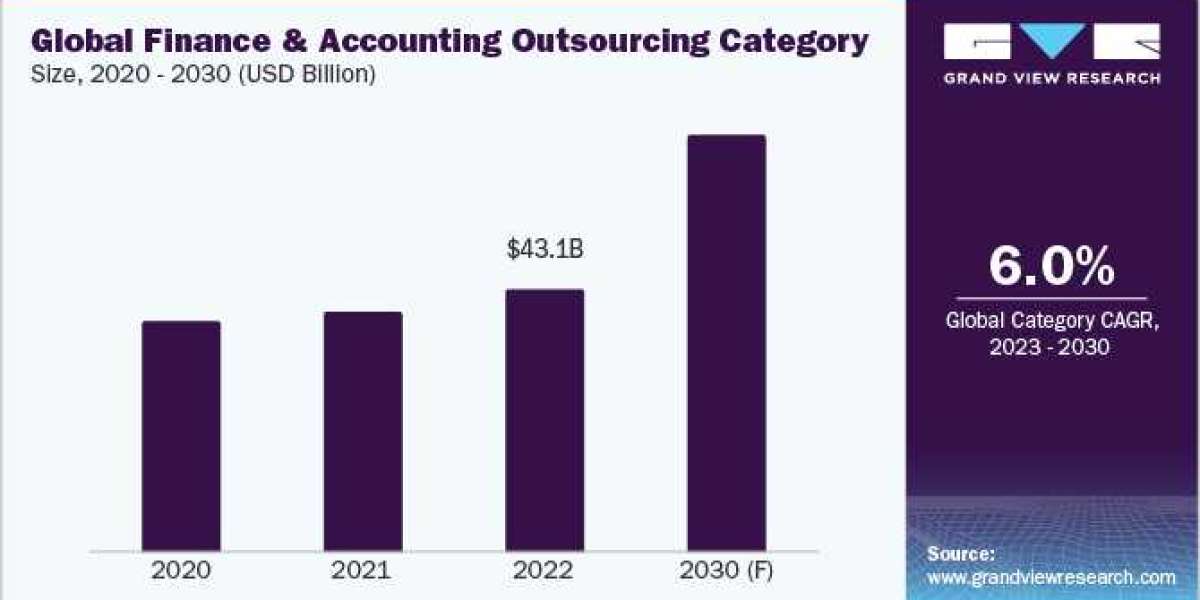

The finance and accounting outsourcing category is expected to grow at a CAGR of 6% from 2023 to 2030. Companies are concerned about data security and depend more on outsourcing partners for their financial operations. In 2023, the companies emphasized a strong focus on cybersecurity protection and severe attention to data privacy guidelines. Modern security protocols are being used by outsourcing service providers to protect sensitive financial data from online attacks. The demand for data security in this category is driving the market growth.

There is a growing emphasis on regulations and compliance, which has an impact on the financial and accounting landscape. Outsourcing providers put significant focus on ensuring the competence of national and international financial regulations such as ISO 27001, Payment Card Industry Data Security Standard (PCI DSS), etc. while remaining fully compliant with compliance standards like Generally Accepted Accounting Principles (GAAP), American Institute of Certified Public Accountants (AICPA), etc. Following these regulations helps companies and their outsourcing providers prevent potential fines and damage to their reputations.

The growing trend of remote work and digital collaboration has increased the market scope of BPO services for finance and accounting. As a result of exposure to a large pool of global talent, businesses will be able to acquire the necessary talent. The digitalization trend encourages diversity, innovation, and cost-effectiveness because it gives businesses access to a variety of highly qualified individuals around the world.

Order your copy of the Finance and Accounting Outsourcing category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies’ emphasis on collaborating and incorporating new technology to develop new products/services. For instance,

- In August 2023, Capgemini's AI-enabled Frictionless Finance platform offers professional financial insights, cutting-edge tech integration, and process optimization that promote operational efficiency and value realization for its clients.

- In February 2023, GI Outsourcing, a UK-based outsourcing provider announced a corporate training and development partnership with the Association of International Certified Professional Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA). GI Outsourcing has incorporated qualifications from the AICPA and CIMA in its employee training and development program for the employees who are assisting their international clients to keep them educated on various international accounting standards.

Finance and Accounting Outsourcing Sourcing Intelligence Highlights

- Because few service providers can compete with market leaders in terms of end-to-end service delivery capabilities and geographic reach for global/regional engagements, buyers in the finance and accounting outsourcing category have limited negotiating power.

- The average cost of outsourcing one of the finance and accounting services, i.e., accounting and bookkeeping services, ranges from USD 500 to USD 5,000 per month.

- The global finance and accounting outsourcing category is fragmented. The industry encompasses a wide range of services, including accounting and bookkeeping, payroll processing, tax return preparation, auditing, and many more.

- The category can be described as mature with several active players equipped with advanced technologies and global talent pool capabilities.

List of Key Suppliers

- Accenture Ltd.

- Capgemini SA

- Conduent Inc.

- Fusion Business Solutions (P) Limited.

- Genpact Ltd.

- Hewlett-Packard Development Company, L.P.

- Infosys BPO Limited

- Meru Accounting

- International Business Machines Corporation

- Steria Limited

- Wipro BPO

- WNS Global Services

Browse through Grand View Research’s collection of procurement intelligence studies:

- Advertising Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Graphite Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Dairy Derivatives Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Finance and Accounting Outsourcing Procurement Intelligence Report Scope

- Finance and Accounting Outsourcing Category Growth Rate : CAGR of 6% from 2023 to 2030

- Pricing Growth Outlook : 4% - 5% (Annually)

- Pricing Models : Fixed pricing model and volume-based pricing

- Supplier Selection Scope : End-to-end service, cost and pricing, compliance, service reliability, and scalability

- Supplier Selection Criteria : Range of services, technology usage, certification, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions