Unlike different loan types, unemployed loans could not require proof of income or a lengthy credit history, making them accessible for a lot of.

Unlike different loan types, unemployed loans could not require proof of income or a lengthy credit history, making them accessible for a lot of. However, it’s essential for potential debtors to completely perceive

mouse click the following web page phrases, rates of interest, and reimbursement conditions associated with these loans. Each lender may have varying requirements, which may significantly have an effect on the general value of borrowing and the financial burden on the individual once they are employed ag

Types of Additional Loans

There are a number of types of additional loans out there, every suited to totally different financial scenarios. The commonest types embody private loans, house fairness loans, and particular financing options tailor-made to businesses. Understanding these can assist in choosing probably the most appropriate option for your ne

Interest rates for same-day loans can range significantly based on the lender and the borrower's creditworthiness. Generally, these charges can range from 15% to over 30% on an annual basis. It's important for debtors to check completely different lenders to find the most favorable terms and avoid high f

Additionally, the fast approval course of can lead some individuals to rush into borrowing choices with out fully considering their monetary circumstances. This impulsiveness might lead to taking up debt that they can not repay comfortably. It's essential to approach every mortgage with caution and conduct proper research before making a c

Additionally, loans with high-interest rates can turn out to be burdensome over time. If borrowers are solely making minimum funds, the general price of the loan can enhance considerably, leading to long-term financial pressure. It is crucial to understand the phrases of the loan, together with interest rates and compensation schedules, to avoid falling into this l

Understanding additional loans is essential for anybody seeking monetary help beyond their preliminary borrowing limits. These loans can serve various functions, from funding home improvements to consolidating debt or managing an sudden expense. With quite a few options and ranging phrases obtainable, it's essential to navigate the landscape effectively to make informed selections. This information will delve into the specifics of extra loans, their advantages, potential drawbacks, and tips for choosing the right loan for your needs. Additionally, we are going to introduce you to 베픽, a comprehensive useful resource for extra

Unsecured Loan information, professional critiques, and comparis

At 베픽, you'll find comprehensive guides overlaying every thing from the applying course of to ideas for enhancing your credit score rating, which can be instrumental in securing higher mortgage terms. With user-friendly navigation, the site ensures that finding the right further mortgage info is easy and accessible to every

Lastly, late funds on same-day loans can lead to additional penalties and further problems, impacting the borrower's credit score score. Understanding the phrases of the mortgage and being conscious of the compensation schedule is important to avoiding adverse penalt

Many same-day loans additionally provide a big selection of compensation choices, permitting debtors to pick a plan that fits their financial situation. This stage of adaptability may be useful for managing money circulate, particularly for these who may expertise fluctuations in earni

What is an Additional Loan?

An further loan, usually referenced as a supplemental mortgage, permits borrowers to entry further funds after their preliminary borrowing restrict has been reached. This sort of loan can are available varied types, including private loans, residence equity traces of credit (HELOCs), and even business loans for enterprises needing further capital. The main aim of extra loans is to supply financial flexibility to individuals or businesses dealing with unexpected expenses or wishing to pursue further investme

Establishing a clear compensation plan earlier than taking out a loan is essential to keep away from defaulting. Borrowers should review their budgets and be certain that they'll meet compensation phrases with out overly straining their fu

Benefits of Same-Day Loans

One of the most significant advantages of same-day loans is the pace with which funds are made available. Unlike conventional loans, which can take time to course of as a result of rigorous checks and documentation, same-day loans could be permitted and funded inside hours. This expediency permits people to deal with urgent monetary wants at o

What Are Unemployed Loans? Unemployed loans are monetary products particularly designed for individuals who are currently and not using a job but still want financial help. These loans acknowledge the **temporary** nature of unemployment, aiming to supply fast access to funds whereas minimizing the eligibility barriers often found in traditional lending. This type of loan can cover essential expenses such as household payments, food, and different dwelling prices till the borrower secures new employment. The objective is to help borrowers stabilize their monetary state of affairs throughout a challenging t

By Utilizing the Power Of Vibrations

By Utilizing the Power Of Vibrations

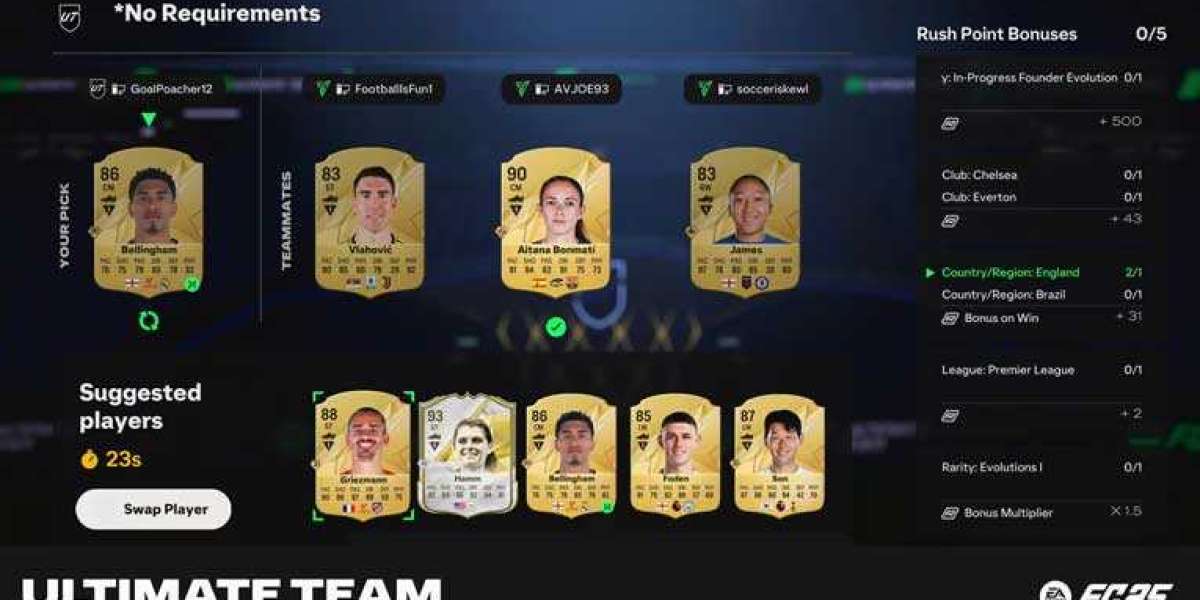

Two Animal Crossing: New Horizons Features are a Must for The Next Game on Day One

By rockrtzxc124

Two Animal Crossing: New Horizons Features are a Must for The Next Game on Day One

By rockrtzxc124 Psyonix is carry lower back a fan-favorite mode for Rocket League this weekend

By rockrtzxc124

Psyonix is carry lower back a fan-favorite mode for Rocket League this weekend

By rockrtzxc124 Psyonix mentioned how Rocket League will appearance after its unfastened-to-play replace

By rockrtzxc124

Psyonix mentioned how Rocket League will appearance after its unfastened-to-play replace

By rockrtzxc124 Less = Extra With Lash Cosmetics Vibely Mascaras

Less = Extra With Lash Cosmetics Vibely Mascaras