Employee Benefits Procurement Intelligence

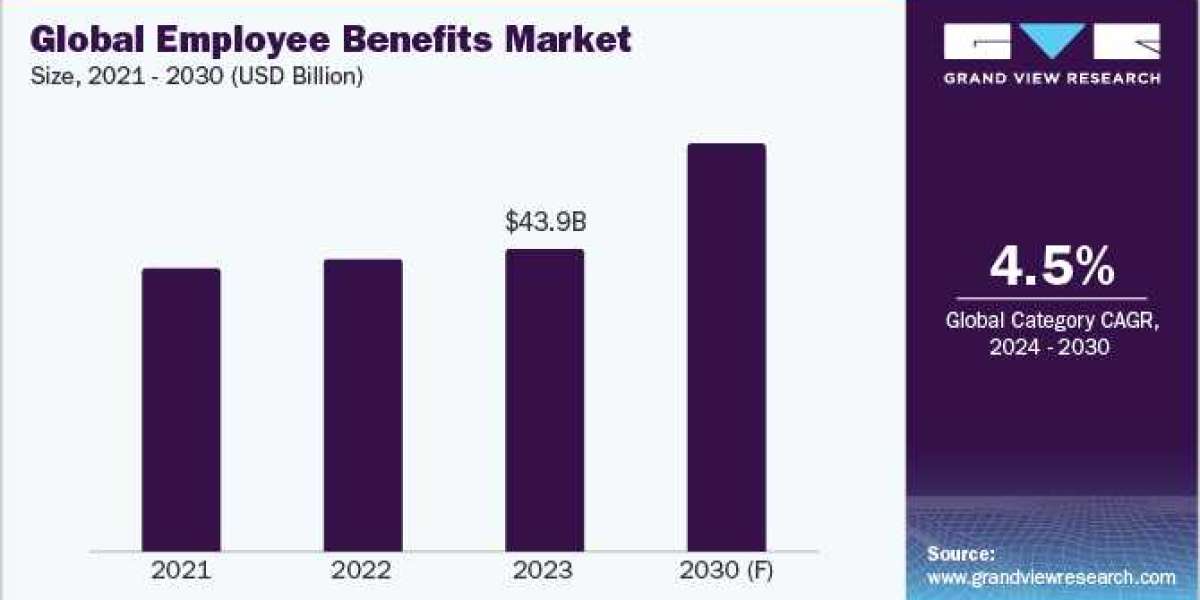

The employee benefits category is expected to grow at a CAGR of 4.5% from 2024 to 2030. North America accounts for the largest share of the category. The increased competition among employers to hire and retain talent along with increasing focus on maintaining work-life balance among employees are driving category growth. Major corporations are employing various strategies, such as mergers and acquisitions, strategic partnerships and contracts, and the development, testing, and release of new products. For instance, in August 2023, TA Associates and Warburg Pincus to expand its role as a pan-European leader in digital employee benefits solutions purchased Epassi Group, a provider of employee benefits.

Companies often provide employees with lunch and breakfast coupons so they may easily purchase meal packages. Employee meal cards will be in demand because of this aspect. Additionally, the prevalence of job-hopping is rising, which is driving up demand for goods like meal cards and employee benefits programs. This is explained by the ability of these solutions to raise staff productivity and happiness, which in turn improves a business' retention rate. The demand for these services would increase as a result of firms focusing more on such benefits to enhance the well-being of their employees due to the rising attrition rate.

Order your copy of the Employee Benefits category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on collaborating or commencing their own services. For instance,

- In June 2023, with the purchase of Benefits, an employee benefits advisory firm, together with the company's brokerage and consulting operations, Aon announced the development of the firm's Health Solutions capabilities in Chile. The acquisition considerably increases Aon's client base and the services already being offered by the company in Chile.

- In June 2023, Willis Towers Watson announced a partnership with Clyde Co. To assist customers in navigating the fast-changing climate risk and liability landscape, the collaboration will employ the organizations' experience and in-depth knowledge of critical climate concerns.

- In April 2023, Mercer announced BT Super’s integration into the Mercer Super Trust. Additionally, Mercer disclosed that it had acquired Advance Asset Management Limited, further enhancing its position as Australia's top investment multi-manager and growing its retirement offerings.

- In August 2021, Up Group purchased Leeto to improve its offerings by adding a complementary digital service to its current offerings, including a platform that enables employees to access their benefits.

Employee Benefits Sourcing Intelligence Highlights

- The global employee benefits category is fragmented, because of the presence of several large and minor companies operating both domestically and internationally. To strengthen their customer base, these businesses engage in collaborations, mergers and acquisitions, and new product releases.

- The bargaining power of buyers of employee benefits is high due to a few factors. First, there are many major suppliers in this category, giving buyers more power in negotiations. Second, switching from one provider to another is easy, meaning buyers are not locked into any one provider. Third, products and services offered by employee benefit providers are relatively standardized. This means that buyers have more options to choose from.

- Insurance, legally required benefits, and paid leave form the most significant cost component in providing employee benefits while insured

- Vendors in this category offer services from wellness programs, concierge services, retirement planning, and others.

List of Key Suppliers

- Aon Hewitt

- Mercer

- Fidelity

- Met Life Inc.

- Aetna Inc.

- ACS

- Wills Tower Watson

- Marsh McLennan Companies, Inc.

- Gallagher

- Axa S.A.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Graphite Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Heat Exchanger Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Employee Benefits Procurement Intelligence Report Scope

- Employee Benefits Category Growth Rate : CAGR of 4.5% from 2023 to 2030

- Pricing Growth Outlook : 10% - 12% (Annually)

- Pricing Models : Value-based pricing model, fixed-fee pricing model, per-employee per month pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Customization flexibility, work benefits, financial benefits, health-related benefits, lifestyle-related benefits, employee experience, service, support, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions