Customer Relationship Management (CRM) Procurement Intelligence

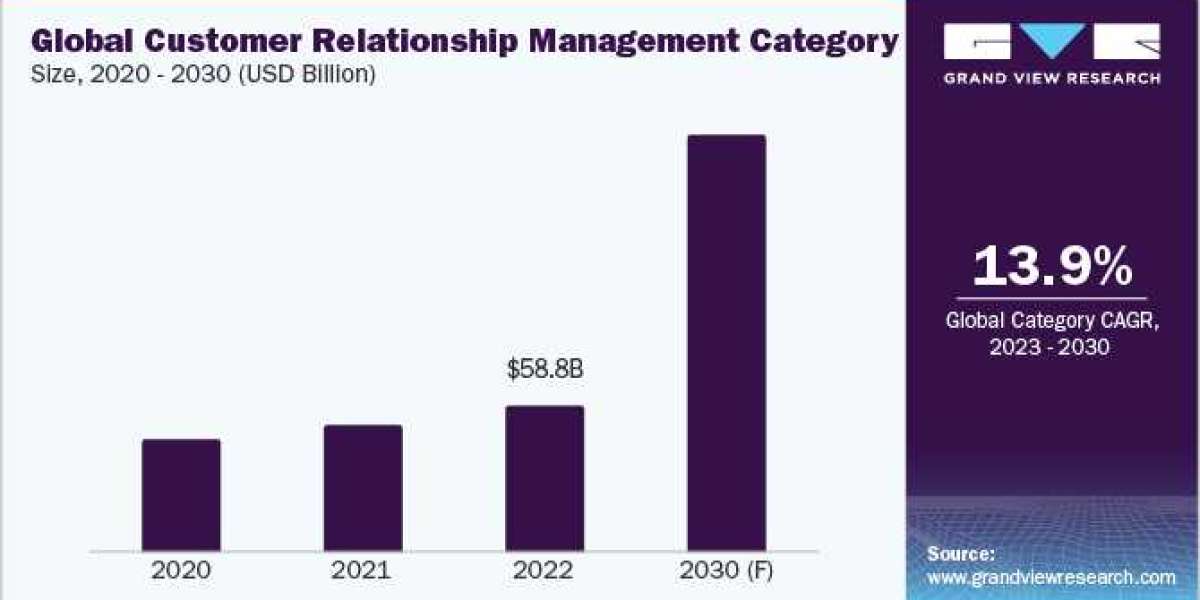

The customer relationship management category is expected to grow at a CAGR of 13.9% from 2023 to 2030. The persistent need for creative approaches to gather essential customer data, assess customer details, and convert them into an enhanced strategy for customer experience stands as a driving force behind the adoption of customer relationship management (CRM) solutions across businesses of all scales.

The CRM analytics search insights aid salesforce clients in uncovering relevant datasets, dashboards, and optimal groupings aligned with their searches. These advancements in CRM solutions and services are poised to potentially enhance category expansion. The rising trend of customers utilizing digital channels for interactions with brands and organizations is expected to be a driving force behind the growth of the customer relationship management industry in the foreseeable future.

Order your copy of the Customer Relationship Management (CRM) category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The landscape of business has been transformed by the inclusion of CRM and cloud computing. Among the noteworthy advancements in CRM systems, the transition from on-premises software to cloud-based solutions stands out. This shift has unburdened organizations from the requirement of installing software on numerous desktops and mobile devices, liberating them to relocate data, software, and services to a safeguarded online realm, a realization that is being acknowledged by entities globally.

Chatbots revolutionized customer relationship management by employing AI-driven systems to replicate human-like interactions with clients through websites, text messages, messaging platforms, and even phone conversations. These sophisticated applications are capable of seamlessly imitating natural conversations, progressively resembling human interaction.

Chatbots find applications in various domains including customer service, marketing, e-commerce, and sales. They excel at swiftly addressing basic inquiries, outpacing human representatives without subjecting customers to mundane hold music, and remaining operational around the clock. Additionally, chatbots excel at post-purchase follow-ups, providing assistance, gathering feedback, conducting surveys, and offering personalized product and content recommendations based on previous engagements.

CRM software providers are developing technology-based systems in CRM to improve customer experience, for instance:

- In March 2023, Salesforce, a CRM company launched Einstein GPT, the first generative AI for CRM technology that will enable the creation of AI-generated content for various interactions encompassing sales, service, marketing, commerce, and IT on a vast scale. Through the introduction of Einstein GPT, Salesforce aims to revolutionize customer experiences by incorporating the power of generative AI.

- In March 2023, One AI company unveiled its AI solution designed for CRM firms and corporate clients. The company asserts that its versatile multilingual AI capabilities can be customized to align with individual customer requirements and seamlessly incorporated into any pre-existing CRM system within a few days.

A set of tools emerging as the technological trend in CRM systems include conversational user interfaces, natural language processing, and voice technology. Conversational user interfaces are poised to become the dominant choice for a variety of sales and service interactions. For instance, users will be able to confirm by simply saying "yes" or "no" instead of having to tap a button on the screen. Fundamental elements of marketing, including calls to action (CTAs), will likewise require adaptation to the capabilities of voice and natural language processing (NLP) technologies which will further fuel the category growth.

Customer Relationship Management (CRM) Sourcing Intelligence Highlights

- CRM software providers include software development firms, data providers, and technology infrastructure providers. Their bargaining power can be moderate to high, particularly for unique or critical components. CRM providers heavily rely on technology infrastructure, and if there are limited suppliers for crucial components, it could increase supplier power. However, as the tech industry is constantly evolving, there's often competition among suppliers, which can mitigate this power.

- Labor cost, staff training cost, software implementation, technical support, licensing, maintenance, security compliance, additional service charges, and others are some of the costs incurred in developing CRM software.

- The cost for CRM software typically commences at approximately USD 7 per user per month, while more advanced choices range between USD 15 and USD 150 per user per month. In the case of enterprise-grade solutions, the expenditure could potentially reach up to USD 300 per user per month.

List of Key Suppliers

- Salesforce, Inc.

- Pipedrive

- HubSpot, Inc.

- Zoho Corporation Pvt. Ltd.

- Nutshell

- Oracle

- Insightly, Inc.

- Monday.com

- Freshworks Inc.

- Nextiva

Browse through Grand View Research’s collection of procurement intelligence studies:

- Corn Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Catering Service Procurement Intelligence Report Scope

- Catering Service Category Growth Rate : CAGR of 13.9% from 2023 to 2030

- Pricing Growth Outlook : 7% - 8% (Annually)

- Pricing Models : Service-based pricing, flat rate pricing, user-based pricing, licensing pricing, competition-based pricing

- Supplier Selection Scope : End-to-end service, cost and pricing, security and compliance, service reliability, and scalability

- Supplier Selection Criteria : Functionality and features, quality, number of services offered, technical support, customization offered, operational capabilities, client relationship, track record and reputation, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions