Employee Background Screening Services Procurement Intelligence

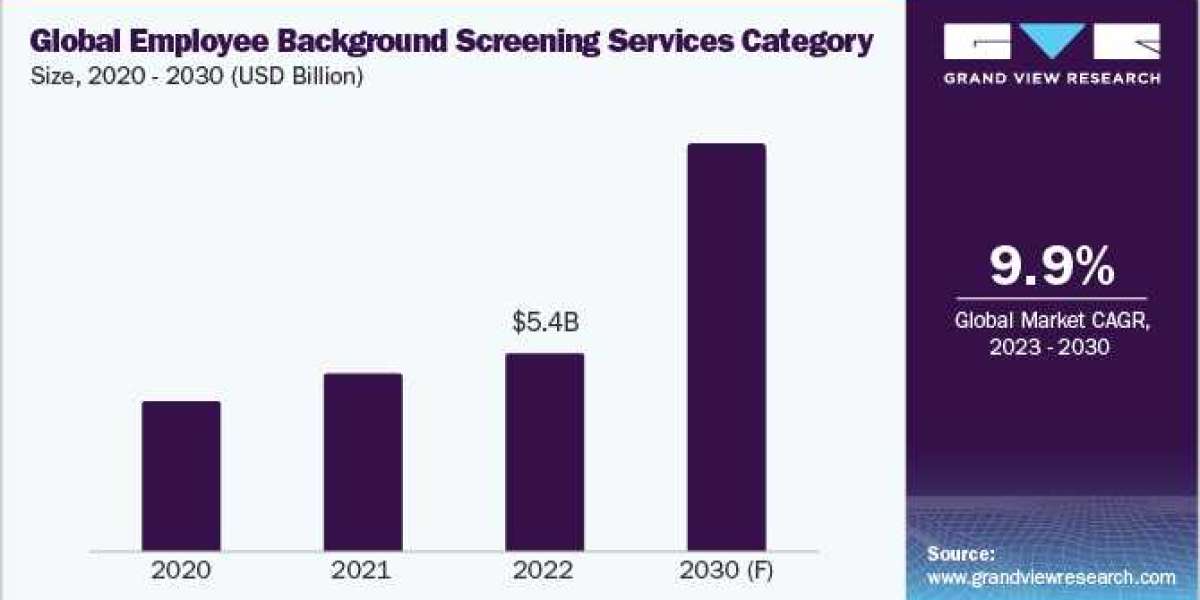

The employee background screening services category is expected to grow at a CAGR of 9.9% from 2023 to 2030. Businesses are increasingly implementing background checks to protect themselves from legal liability and ensure employee safety. These checks identify potential risks like criminal histories, financial issues, and drug use, enabling them to make informed hiring decisions. For instance, companies can protect themselves against liability in case of crime or accident and ensure employee safety by identifying potential risks like violence or drug use. Through the identification of individuals with a history of violence or criminal behavior, background checks can assist businesses in spotting possible hazards to workplace safety. The growing risk of fraud brought on by employee fraud is a major problem for businesses of all kinds. Employers can use background checks to spot possible fraudsters by looking up their criminal histories, financial difficulties, and work histories.

Technology has made background checks more affordable and accessible, leading to increased demand for these services. Globalization has made it more challenging for employers to verify employee backgrounds due to a lack of international cooperation and increasing use of technology as it is easier for people to hide their criminal records, but employment screening services can help overcome this by providing access to global databases of criminal records. Employers are increasingly becoming aware of the importance of background checks due to the increasing number of noteworthy fraud and violence cases linked to employees with criminal records. For instance, in April 2023, a branch manager (BM) of the Central Bank of India was charged with fraud of USD 37,000 by the Aligarh police. The BM, who was absconding, was charged with stealing the money and using it to wager on IPL cricket matches, according to the police.

Order your copy of the Employee Background Screening Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on increasing accuracy through strategic acquisitions or technological partnerships. For instance,

- In March 2023, VerifyNow Pty Ltd, an Australian provider of job screening, was purchased by Accurate Background. The acquisition strengthened Accurate's offering of worldwide compliance-driven employment screening products while enhancing its vision to expand globally.

- In November 2022, Oracle partnered with Global HR Research (GHRR), a technology leader in employment screening services, drug testing, and verifications, to enhance its human capital management (HCM) system and boost its HR resources job placement efficiency.

Background checks are becoming more effective and economical for companies by using AI to automate tasks like data collecting and processing. Employers can make better hiring judgments because AI can spot patterns and trends in data that human analysts miss. By learning and developing over time, machine learning, a type of AI, raises the accuracy and effectiveness of background checks. Employers may conduct background checks more easily and affordably without investing in their own equipment thanks to cloud computing and natural language processing (NLP), which automate the extraction of information from documents. Overall, background checks and hiring decisions are improving thanks to AI and NLP.

Employee Background Screening Services Sourcing Intelligence Highlights

- The number of both large and small companies operating in different areas has caused the employee background screening services category to become highly fragmented globally. Players compete aggressively with one another to grow their customer base and offer superior customer service.

- Financial integrity checks, criminal record checks, and ID verifications account for the largest cost component of the employee background screening services business.

- Most of the service providers offer services such as criminal background checks, drug testing, and employment verification.

List of Key Suppliers

- Pinkerton Consulting Investigations, Inc

- HireRight, LLC

- A-Check America Inc.

- Verity Screening Solutions

- Capita Plc

- Triton

- DataFlow Group

- Sterling Talent Solutions

- First Advantage Corporation

- Accurate Background

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Cyber Security Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Lab Equipment Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Commercial Real Estate Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Employee Background Screening Services Procurement Intelligence Report Scope

- Employee Background Screening Services Category Growth Rate : CAGR of 9.9% from 2023 to 2030

- Pricing Growth Outlook : 6% - 8% (Annually)

- Pricing Models : Volume-based pricing model and flat rate pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Employment verification, reference check, education verification, criminal background checks, technical specifications, operational capabilities, regulatory standards and mandates, category innovations, and others.

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions