Corrugated Board Procurement Intelligence

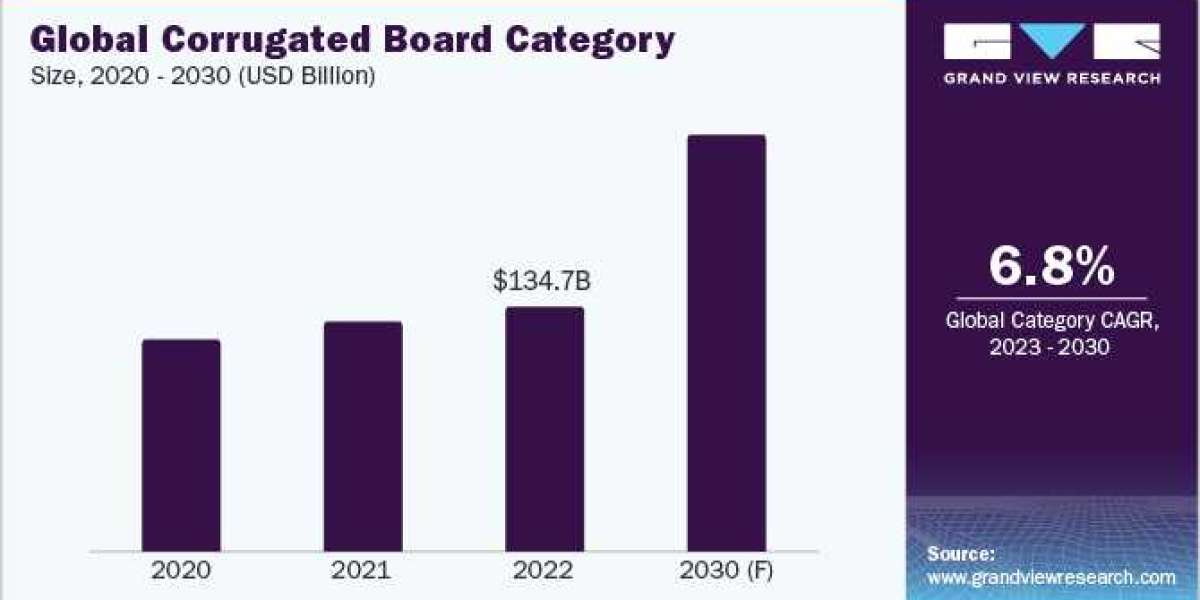

The corrugated board category is expected to grow at a CAGR of 6.8% from 2023 to 2030. APAC region accounts for the largest share of the category. Increasing spending power and growing urbanization are boosting the growth of this category. Companies are constantly developing new technology for efficient production and increased efficiency. Digitalization and technological advancements such as AI, blockchain technology, IoT, and digital printing are shaping the category with innovations.

The Ireland-based company, Smurfit Kappa, is creating a variety of innovative products and introducing them to the market. One of its kind is the launch of multifunction printers that can do both digital printings as well as flexographic and allows printing alongside the packaging material. This has resulted in increased sales and flexibility to alter as per client’s requirements.

Type-C flute segment dominates the market owing to its characteristic property of higher compression and more durable stacking strength than the B type. It is utilized for furniture packaging, glass, and shipping cases. Owing to less utilization of fiber materials, it facilitates high load-bearing capacity.

Order your copy of the Corrugated Board category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Companies are continuously focusing on partnering or developing their own technology. For instance,

- In 2022, a Menasha Corporation subsidiary, the Menasha Packaging Company signed a contract to buy the assets of color-box, an L.L.C. business unit from Georgia-Pacific, which manufactures high-graphic boxes. This collaboration will allow them to reach clients with more designs, graphics, and structural packaging options.

- In August 2021, DS Smith, as a part of Blaue Helden’s e-commerce packaging design, developed a 100% recyclable packaging solution for e-commerce. It offers eco-friendly cleaning tabs from Blaue Helden that have a more appealing packaging design with no plastic filling material.

- In March 2021, International Paper acquired two corrugated plants in Spain. This has allowed them to expand operations in Catalonia and Madrid. The company is focused on high-quality packaging solutions for e-commerce, and vegetable fruit packaging in the EMEA region.

- In February 2021, BCoolBox, a new product of Mondi features a thermo insulation packaging solution to keep fresh foods and produce cold without having any external sources for cooling of items. This has the capacity to keep produce below 7 degrees for about 24 hours of duration.

Category growth is expected to be fueled by the increasing awareness and environmental concerns related to the use of plastic packaging. The utilization of corrugated boards in varied industries like food beverages, shipping, healthcare, e-commerce, and consumer goods is a key factor driving the growth trend in this category. The rising demand for an innovative corrugated board is attributed to its advantageous features, including high graphics boxes, thermo-insulating packaging, and e-commerce packaging solutions.

Corrugated Board Sourcing Intelligence Highlights

- There are many small and major competitors operating in various countries, creating a fragmented market for corrugated boards globally. Competition is intense amongst the competitors as they try to take the lead by continuous RD to develop new technologies, make strategic alliances, and have mergers and acquisitions to increase their consumer base and enhance customer service.

- The suppliers of raw materials in this category such as Kraft paper, corn starch, and steel wires have increased over time, reducing the supplier’s bargaining power to some extent

- Kraft Paper, labor, and cornstarch used for making glue form the most significant cost component in the category. The overall cost also depends on the type of flute used such as A, B, C, E, F, and other types

List of Key Suppliers

- DS Smith

- Smurfit Kappa

- WestRock Company

- Mondi

- Packaging Corporation of America

- Stora Enso

- International Paper

- Georgia-Pacific

- Oji Holdings Corporation

- Port Townsend Paper Company

Browse through Grand View Research’s collection of procurement intelligence studies:

- Facilities Management Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Methanol Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Corrugated Board Procurement Intelligence Report Scope

- Corrugated Board Category Growth Rate: CAGR of 6.8% from 2023 to 2030

- Pricing Growth Outlook: 20% - 25% (Annually)

- Pricing Models: Cost plus pricing model, and market-based pricing model

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: By type, operating capability, quality measures, technology, certifications, regulatory compliance, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Explore Horizon, the world's most expansive Market Research Database Brief about Pipeline by Grand View Research:

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions